US

US

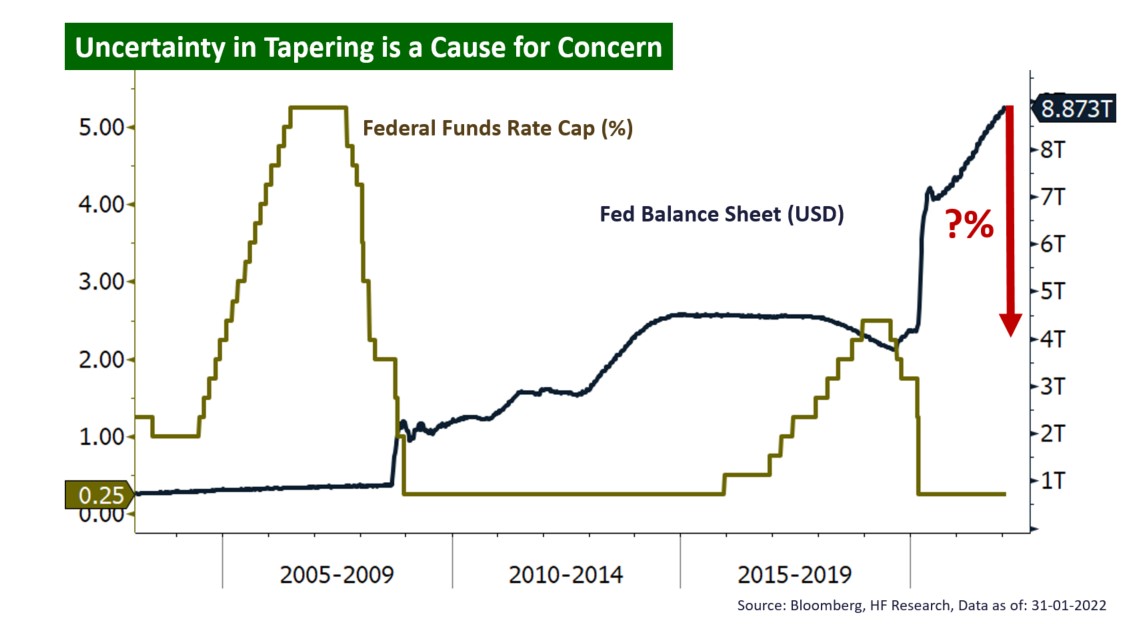

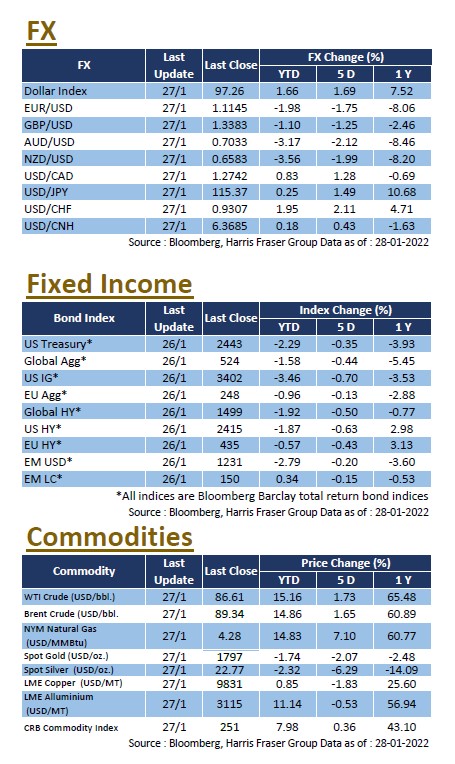

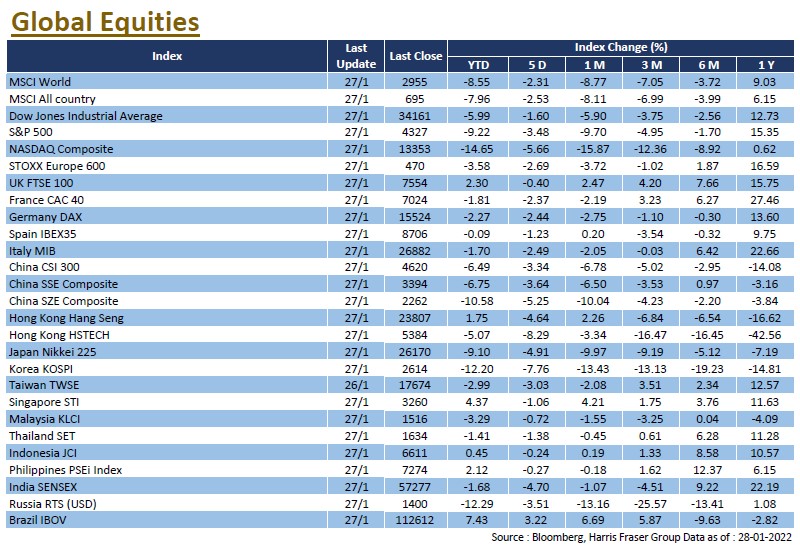

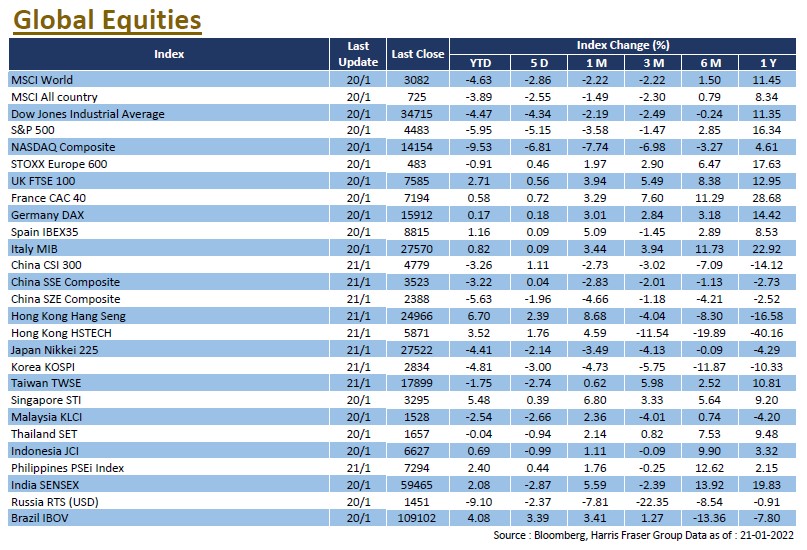

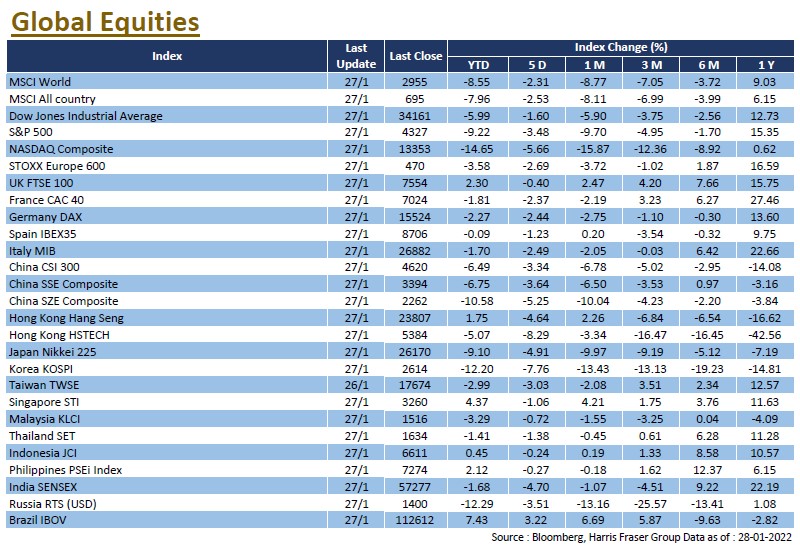

In the first meeting of the year, the Federal Reserve further reinforced the idea of faster interest rate hikes and tapering, suggesting that an interest rate hike at the March meeting is almost certainly going to happen. Together with the rising tensions between Russia and Ukraine, global stock markets including the US further slipped, with the Dow, S&P 500 and NASDAQ down by 5.99%, 9.22%, and 14.65% respectively over the 18 trading days since the beginning of the year. Despite the volatility in the US market, the Federal Reserve delivered a hawkish statement instead, saying that interest rates would hike soon, and tapering would follow. Chairman Jerome Powell also said that the US is now facing a different economic expansion compared to the last tightening, sparking speculation that the pace of tightening would be more aggressive this time around.

Tensions over the Ukraine situation are also worrying markets. The Ukrainian government estimates that more than 100,000 Russian troops have been deployed. Whereas the White House said 8,500 US troops are ready to aid NATO, called for the evacuation of US Nationals from Ukraine, and suggested sanctions against Putin himself. Despite Russia's repeated denials of its plans to invade Ukraine, tensions have escalated.

As for the fundamentals, although the IMF has lowered its growth forecast for the US economy, the estimated 2.6% growth in 2023 is still higher than the long-term average of 1.9%. US GDP growth for 2021 of 6.9% QoQ was well ahead of the 5.5% market estimate. In addition, Q4 earnings were strong, with 78% of the 159 reporting companies posting earnings beats, key players such as Microsoft, Apple and Tesla also reported solid results. Next week, the ISM manufacturing and services indices will be released, along with key data including non-farm payrolls.

Europe

Europe

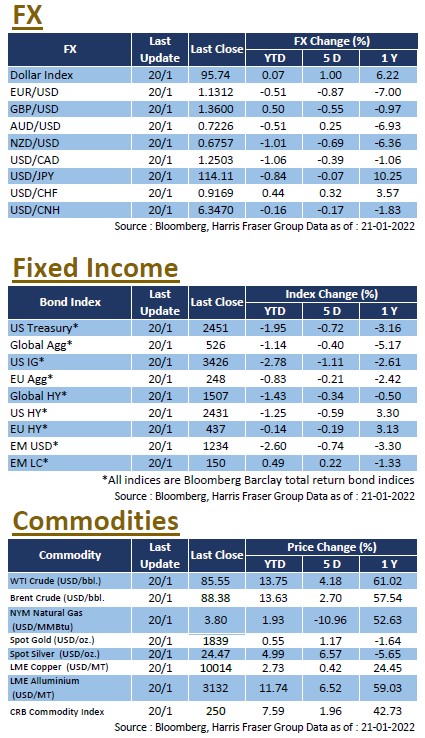

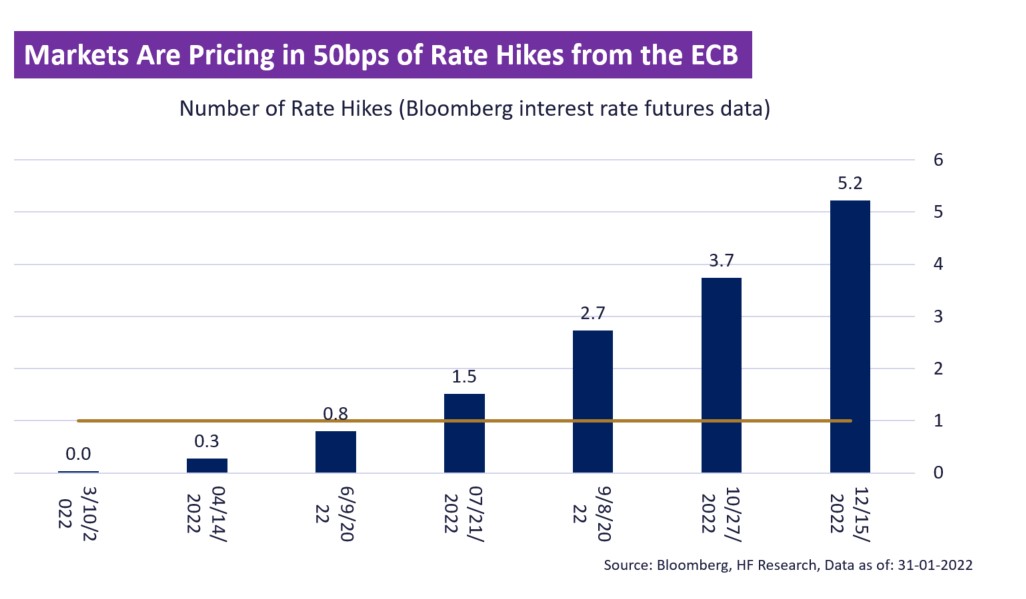

Affected by the neighbouring Ukraine situation, and the poor global market sentiment, European equities struggled to perform, with the STOXX 600 index down 2.69% over the past five days ending Thursday, while the German and French indices lost 2.44% and 2.37% respectively over the same period. The German government lowered its economic growth forecast to 3.6% this year in the face of a number of headwinds including the epidemic, inflation, and the geopolitical tensions. ECB's chief economist Philip Lane said in an interview that the ECB would tighten its monetary policy if inflation remained above target. Next week, the Eurozone will release its 2021 Q4 GDP and CPI data for January.

China

China

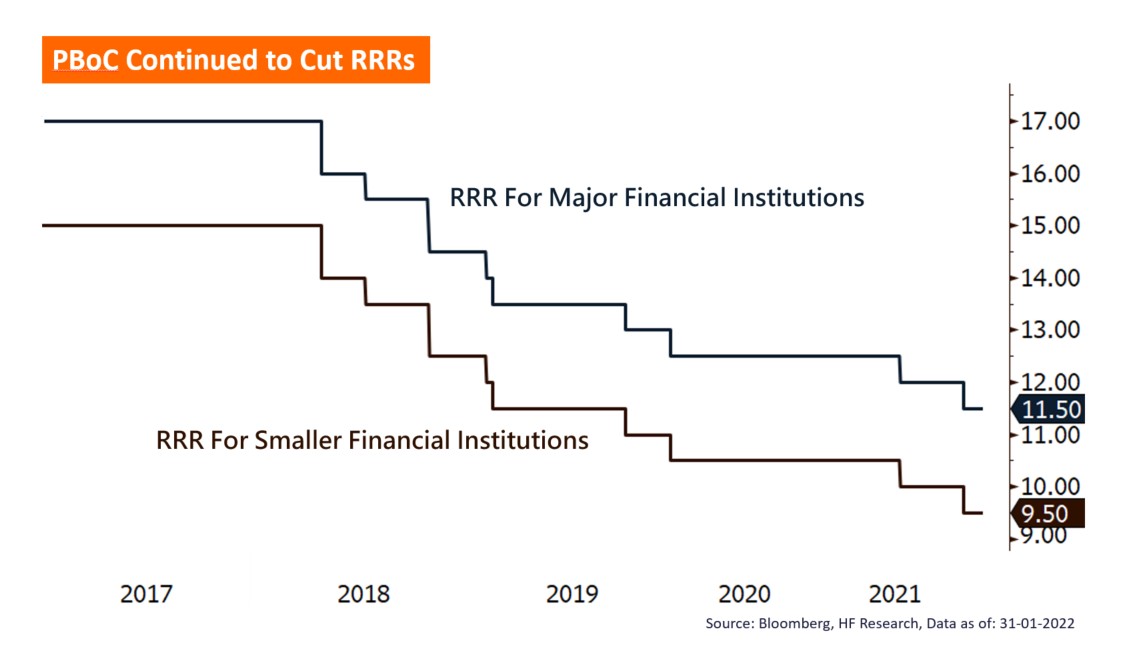

Hong Kong stocks almost wiped out all the YTD gains in just one week, as the HSI fell 5.67% for the week, trimming the YTD returns to just 0.65%; China A-shares remained soft, with the CSI 300 Index down 4.51% for the week, extending its YTD losses to 7.62%, almost reaching the bear market territory of over 20% down from its 2021 February high. China's 2021 GDP grew better than expected at 8.1%, but the economy remains under pressure as retail sales growth slowed markedly in December, and the problems of the real estate sector persist. China's Premier Li Keqiang said that macro policies need to be stepped up, and growth stabilisation will take a greater priority, but he insisted that there would be no excess stimulus. Earlier, the People's Bank of China lowered the one-year and five-year LPR rates to help the economy. The market will still be watching to see if China will further loosen its policies.

US

US Europe

Europe China

China