US

US

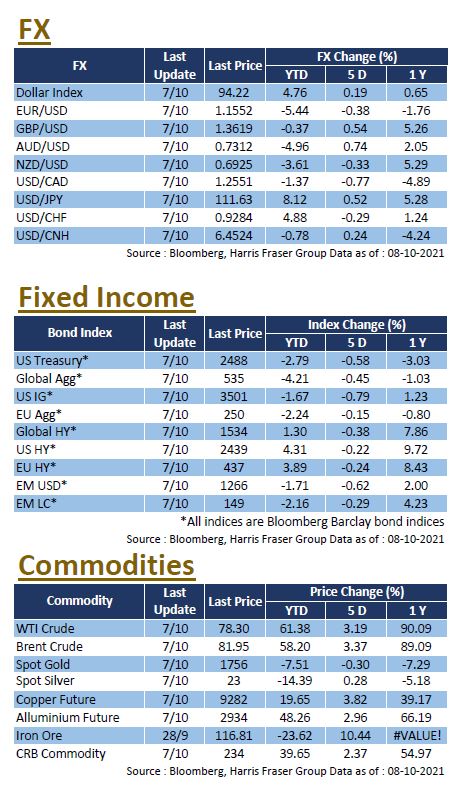

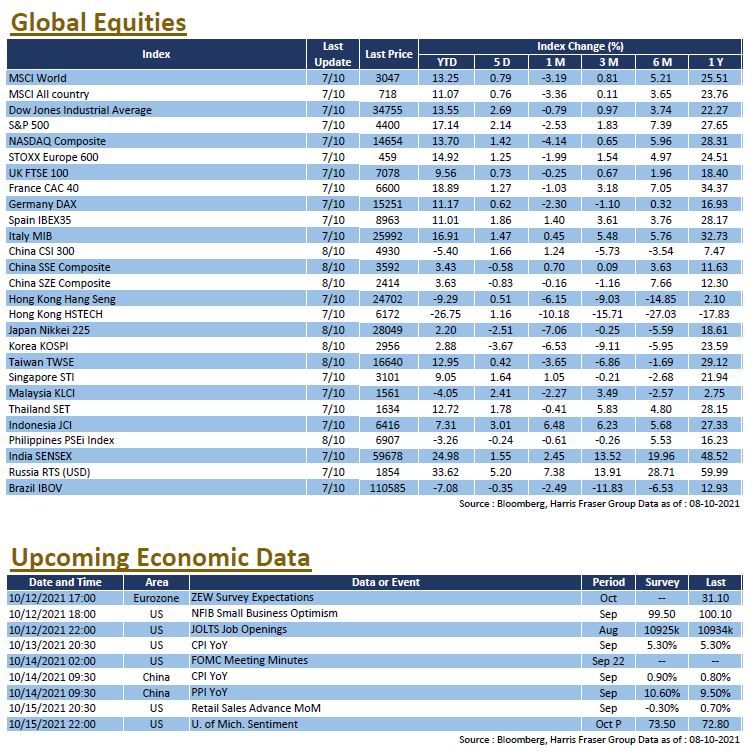

The US Senate reached a bipartisan agreement to extend the debt ceiling and the market expects the House to approve the bill. The news was positive and US stocks reversed their short term weakness, in the past 5 days ending Thursday, the Dow, S&P and NASDAQ rose by 2.69%, 2.14% and 1.42% respectively. On the US debt ceiling issue, Senate Republican Leader Mitch McConnell originally declared that he would not work with the Democrats. However, McConnell later proposed the short-term extension of the debt ceiling, which was passed by the Senate. According to the agreement, the US debt ceiling will be raised by US$480 billion, which should be sufficient to meet all payments until 3 December this year, lifting the US debt ceiling crisis for the time being.

Global energy shortages sent energy prices to multi-year highs, with natural gas futures surging by 60% over a two-day period. At the end, Russian President Vladimir Putin, a major natural gas supplier to Europe, said he could help stabilise the global energy market, prompting a fall in natural gas prices. While countries are working to address their energy crisis, OPEC+ announced that it will maintain a 400,000 barrel per day increase in crude oil production in November, which falls short of market expectations; together with the US Department of Energy statement that there are no plans to release strategic oil reserves, sent WTI crude futures to a seven-year high of almost US$80 per barrel.

With energy prices high, the market is wary of inflation risks in the US, plus the faster-than-expected expansion of the service sector in September, indicating strong demand, there is high conviction that the Fed will announce a taper in bond purchases in November. The 10-year yield on US Treasuries rose to nearly 1.6%, the highest since mid-June, reflecting rising inflation expectations and the Fed's expected tapering, as funds flowed out of US Treasuries. Next week, the US will release the minutes of its September interest rate meeting and important data such as the September CPI.

Europe

Europe

European equities mirrored the global market recovery, with UK, French and German equities rising between 0.73% and 1.27% over the past five days ending Thursday. According to the minutes of the European Central Bank (ECB) meeting in September, members discussed a larger reduction in the scale of asset purchases, and there were suggestions that the market may be preparing for the end of the pandemic support programme. It was also reported that the ECB was looking at introducing a new bond-buying programme to replace the PEPP, which expires in March next year, to avoid market turbulence that could affect the economic recovery. Next week, the ZEW Economic Sentiment Index for October will be released.

China

China

Asian stock market sentiment improved, with the Shanghai and Shenzhen stock markets ending in the green after the National Day holiday, the CSI 300 Index rose 1.31% in a single day, and the combined turnover of the two stock exchanges exceeded one trillion RMB again. While Hong Kong equities narrowed their gains on Friday, the market rose for two days in a row, reversing the recent weakness, the HSI rose 1.07% for the week and the Hang Seng Tech Index also rose 1.72% over the same period. During the National Day holidays, the market was concerned about the liquidity of mainland property companies. Following Evergrande's missed bond interest payment, another property company, Fantasia, also failed to pay the principal on its maturing notes, which weighed on the Chinese offshore bond market, driving the Bloomberg Barclays China Dollar Bond Index yield up to 16.9%. Next week, China will release CPI and PPI data for September.

US

US Europe

Europe China

China