US

US

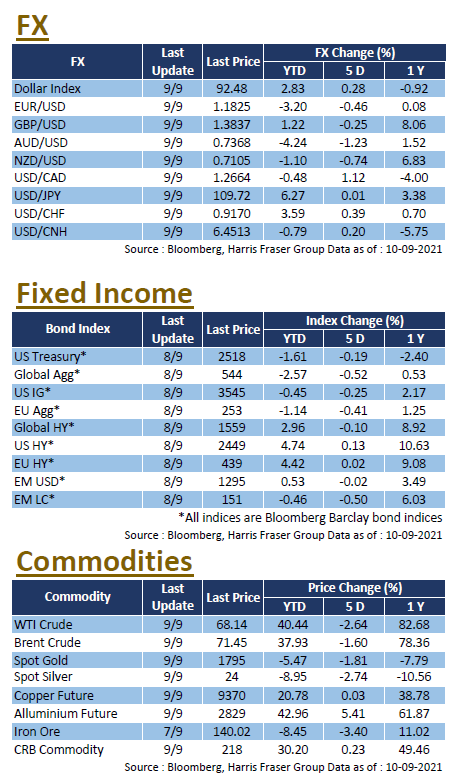

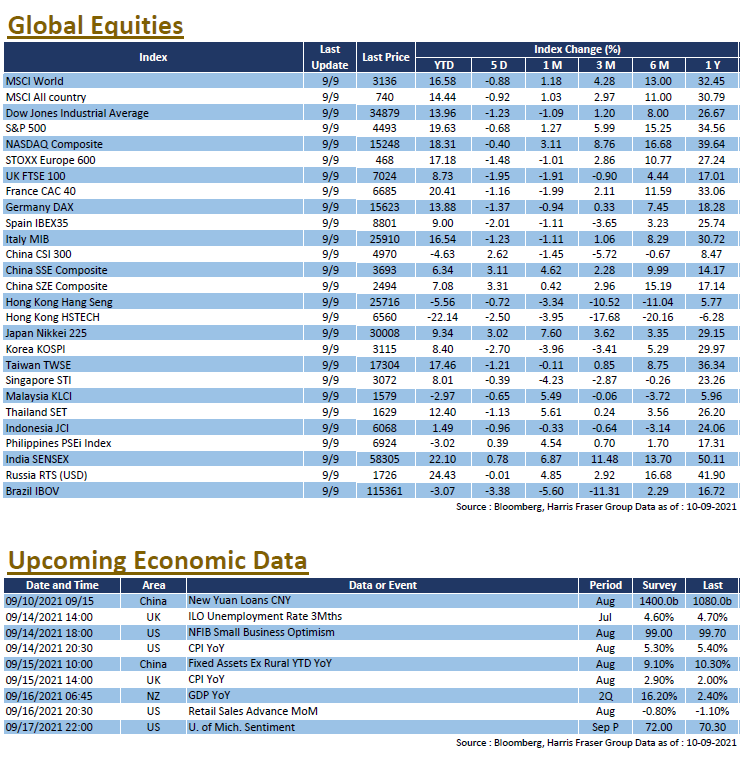

The US economy showed signs of slowing down and investors were concerned about the Federal Reserve's plans on tapering its bond-buying programme, US stocks consolidated near all-time highs, with the three indices retreating between 0.40% and 1.23% over the past five days ending Thursday. The latest Federal Reserve Beige Book showed that the US economy grew at a slightly slower pace in July-August this year, and that companies are still worried about supply-side issues; employment data also fell short of expectations, as the 235,000 non-farm jobs added in August was well below market expectations of 728,000. In the face of negative factors such as the prevalence of the Delta variant, the slowing global recovery, and global central banks' gradual exit from accommodative policies, prominent Wall Street players such as Goldman Sachs, Morgan Stanley, and Citibank all warned that US stocks may be at risk of a correction.

Another worrying factor is the US debt ceiling issue. US Treasury Secretary Janet Yellen said that the temporary measures taken to prevent the debt ceiling from being exceeded may be fully exhausted by October this year. She added that if the debt ceiling is not raised in time, it could pose a risk to the financial system. Next week, the US will release CPI for August, retail sales for August, and the University of Michigan Market Sentiment Index for September

Europe

Europe

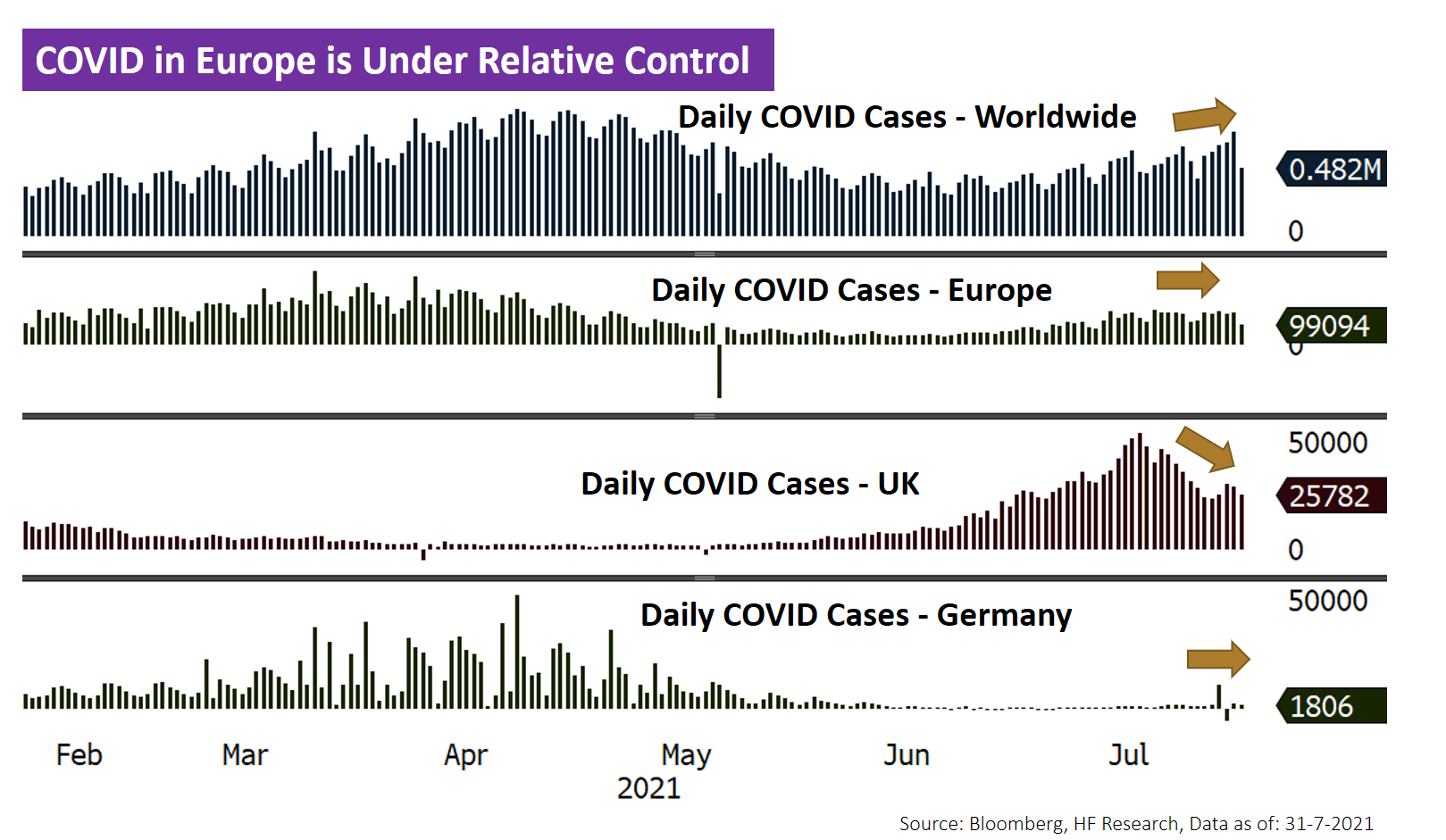

European stocks retreated on the eve of the European Central Bank (ECB) meeting, weighing on the market over the past five days ending Thursday. The UK, French, and German equities falling between 1.16% and 1.95% over the period. The ECB kept interest rates unchanged after Thursday's meeting, but said it would moderate the pace of purchases under its emergency pandemic purchase programme (PEPP), but reiterated that the €1.85 trillion programme would stay in place until at least March next year, and will be extended if necessary. The German Bundestag election is scheduled to take place on 26 September, Chancellor Angela Merkel made a high-profile statement, supporting of her party's candidate and CDU leader Armin Laschett and criticising the rivals from SPD. However, Forsa polls showed that CDU support had fallen to a record low of 19%, raising concerns in the market. Next week, the UK will release the unemployment rate for July and CPI figures for August.

China

China

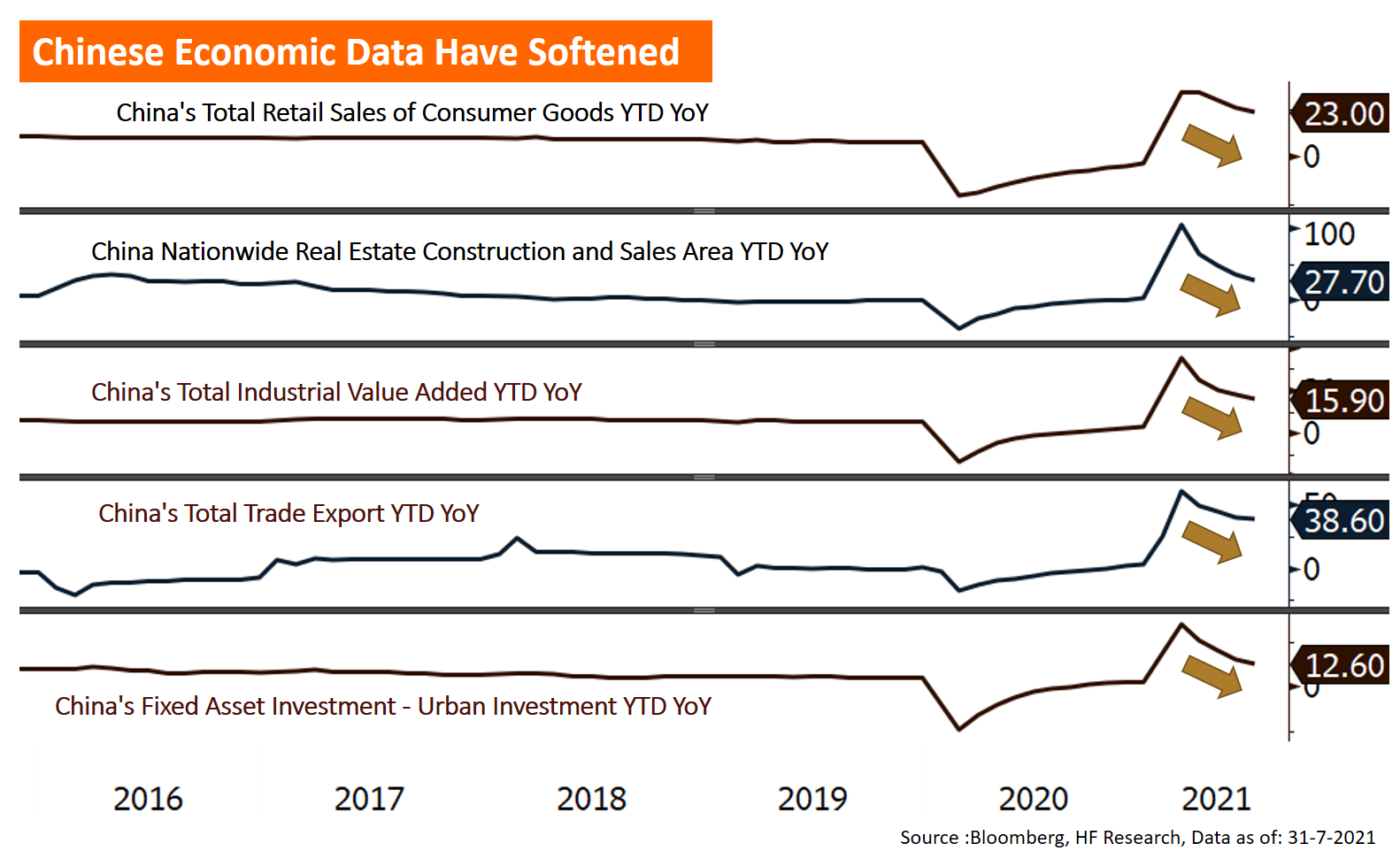

It was reported that the head of state of China and the US spoke on Friday, easing market tensions. The CSI 300 Index rose 0.88% that day, extending the weekly gain to 3.52%; the HSI also rose on Friday, reversing its earlier loss and posting a 1.17% gain for the week. China's export data for August beat market expectations in both US dollar and Renminbi terms, while Chinese CPI growth moderated to 0.8% YoY in August, against an uptick in PPI to 9.5% over the same period. On the other hand, the negative news about Evergrande continued, with Moody's and Fitch downgrading the company's credit rating, putting pressure on both debt and equity prices. It was reported that the mainland regulators had agreed to renegotiate the debt repayment arrangements between Evergrande and financial institutions. Next week, China will release data on fixed investment, industrial production, and retail sales.

US

US Europe

Europe China

China