U.S.

U.S.

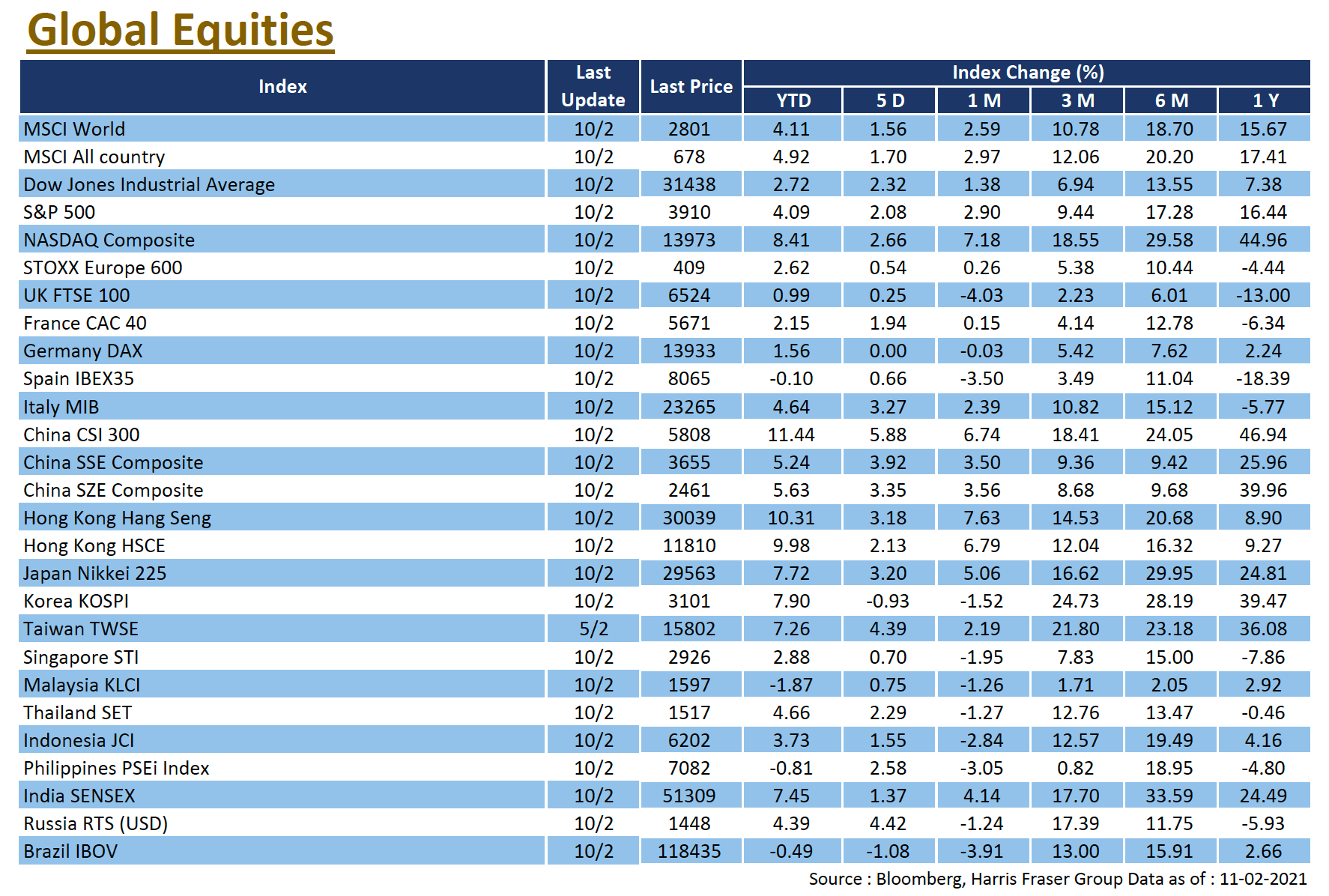

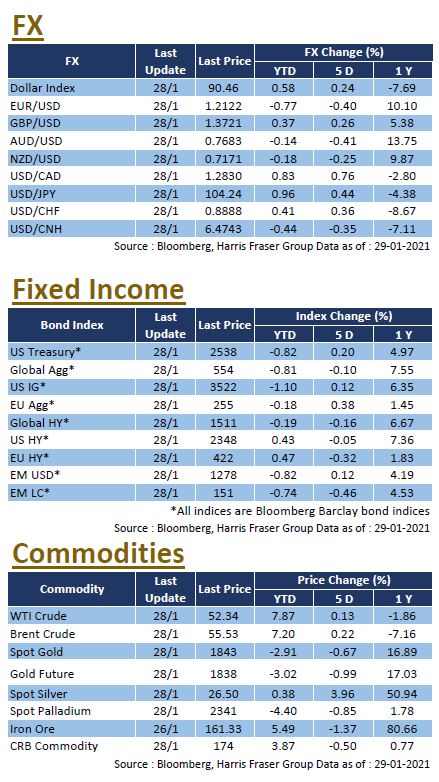

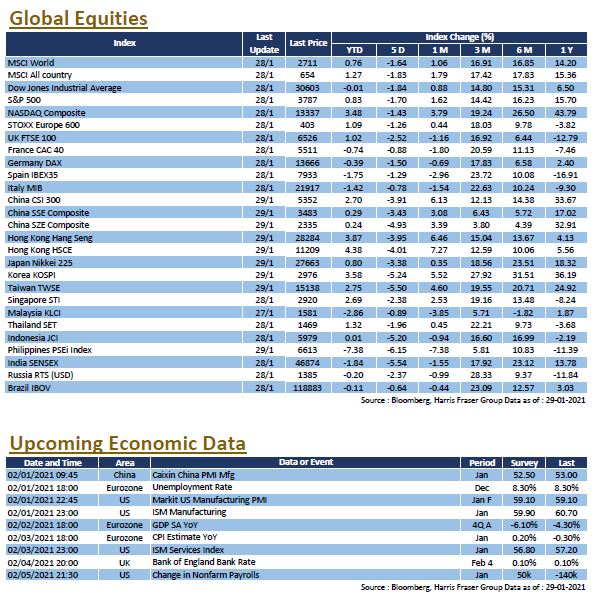

The IMF raised its outlook for global economic growth this year, but the slowdown in US GDP growth in the fourth quarter, coupled with concerns that the GameStop long/short battle could trigger massive sell-off by funds, caused the US stock market to slip, with the three major equity indexes down between 1.43% and 1.84% over the past five days ending Thursday. The market's focus centered around the GameStop long-short debacle, as the news of retail investors' successful defense against short-selling hedge funds shocked the world, and the frenzied rally in the stocks in concern continued unabated even though several brokerages, including Robinhood, restricted subscribers from opening positions for the stocks in concern, the whole incident have raised concern from the US government and the SEC.

The International Monetary Fund (IMF) raised its global growth outlook, but its economists said they were concerned that the slow pace of vaccinations would weigh on the global economic recovery. In terms of data, the US GDP growth slowed to 4% YoY in Q4, which was a surprise to the market. However, more than 80% of the 171 reporting S&P 500 constituent companies up to date have outperformed market expectations, indicating that the overall corporate landscape remains healthy.

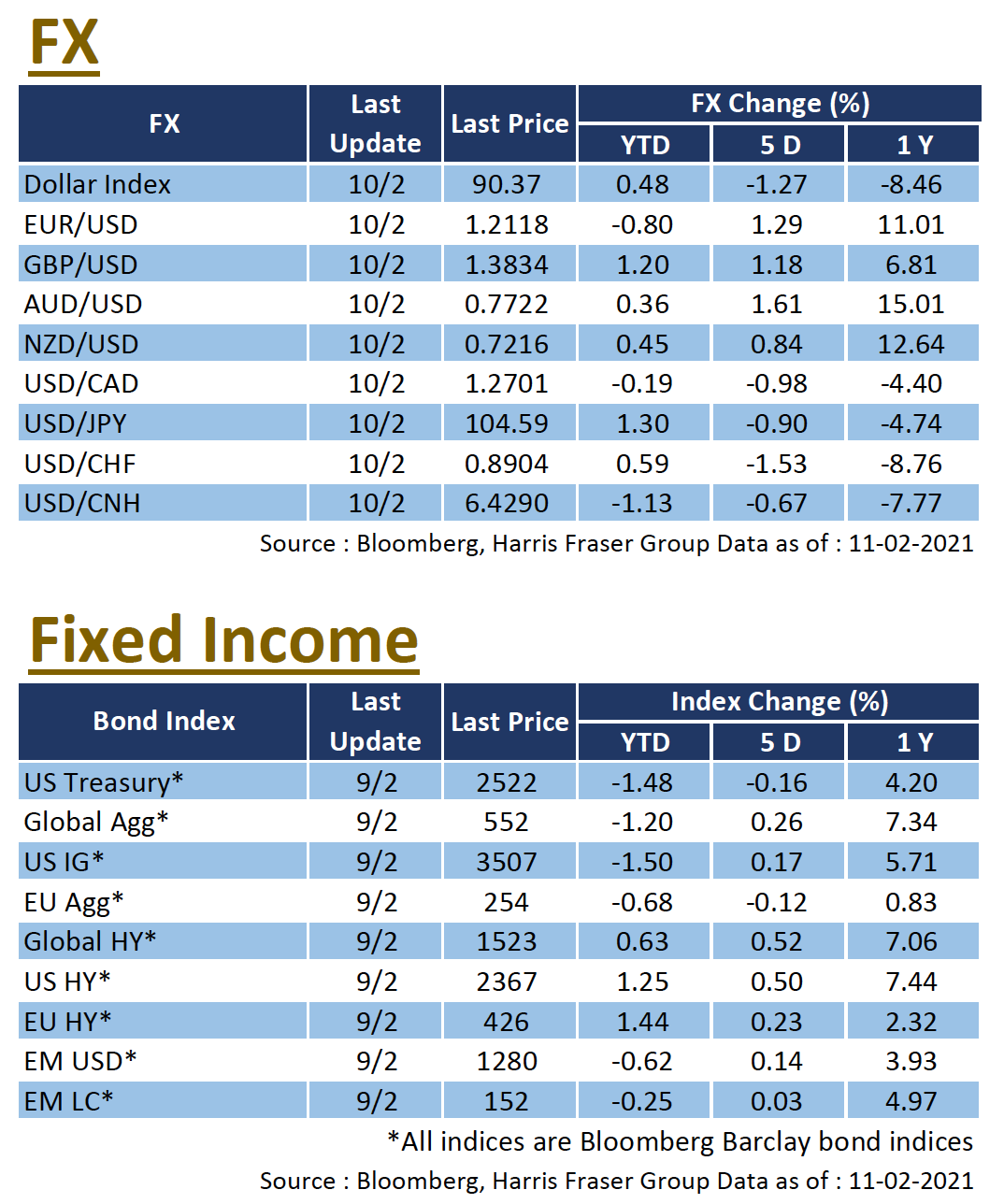

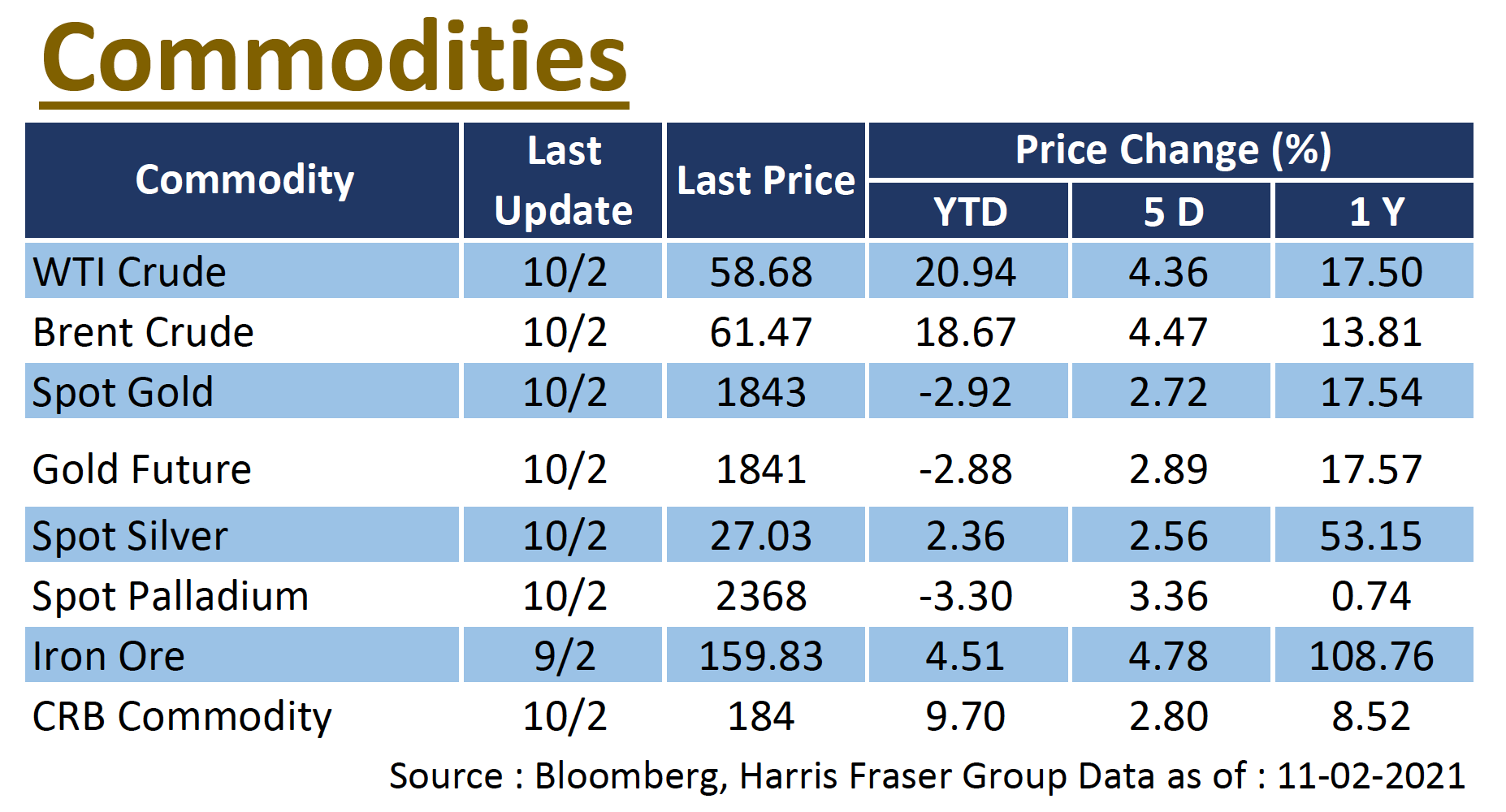

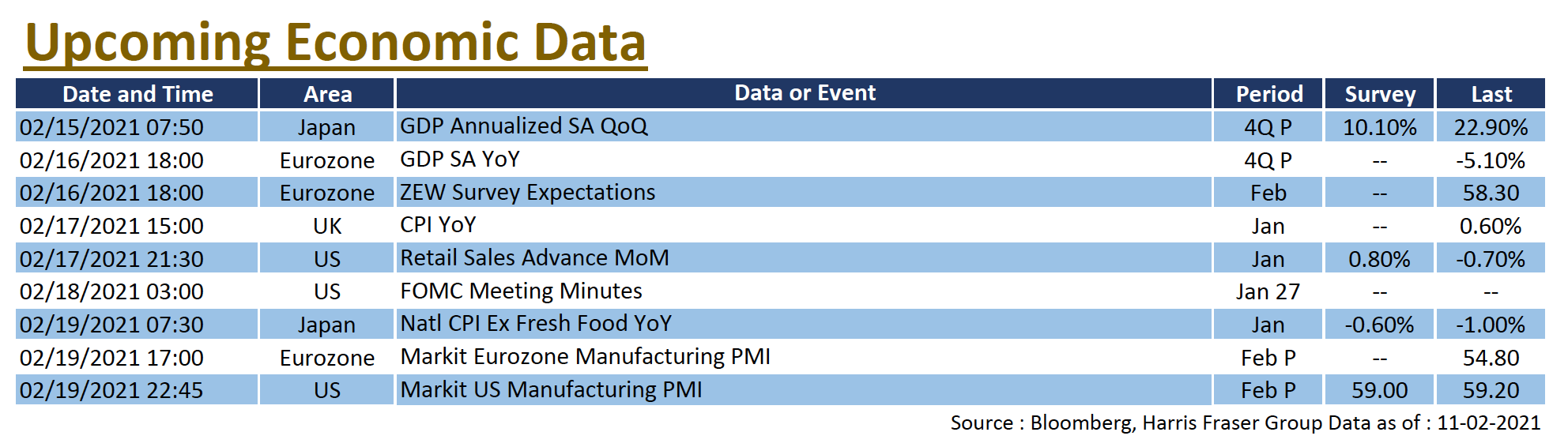

On the policy front, US President Joe Biden remains open to making adjustments to the US$1.9 trillion stimulus package, market expects the relief package to be approved within one to two months. The US Federal Reserve also kept its easing policy unchanged after the interest rate meeting, with Chairman Jerome Powell saying that given the signs of a slowdown in economic recovery, the Administration would commit to the current level of asset purchases for a ‘period of time’. Job market data for January and the ISM manufacturing and services indexes will be released next week.

Europe

Europe

European stocks were soft due to global market volatility, with UK, French, and German equity indexes were down 1.44% - 2.82% over the past 5 days ending Thursday. Eurozone inflation data for December were in line with market expectations, but the YoY change remains in negative territory. ECB Governing Council member Olli Rehn said the central bank would utilise necessary means to boost the inflation rate, and the Bank remains concerned about the appreciation of the Euro. Next week, the Eurozone will release data on 2020 Q4 GDP, December unemployment, and January CPI figures.

China

China

As China’s aggregate financing hits 1.7 trillion, overnight SHIBOR rate rose to over 3%. The upcoming IPO of Kuaishou also froze over 1 trillion in the market, sending the HIBOR up. As market liquidity runs low, investment sentiment deteriorated. Hong Kong and Chinese stock markets lost momentum, with the Hang Seng Index (HSI) reversing its trend after hitting the 30,000 mark, falling below its 20-day average after 4 consecutive days of losses. For Chinese economic data, all eyes are on the January Caixin China Manufacturing Index releasing next week.

US

US Europe

Europe China

China