Weekly Insight October 30

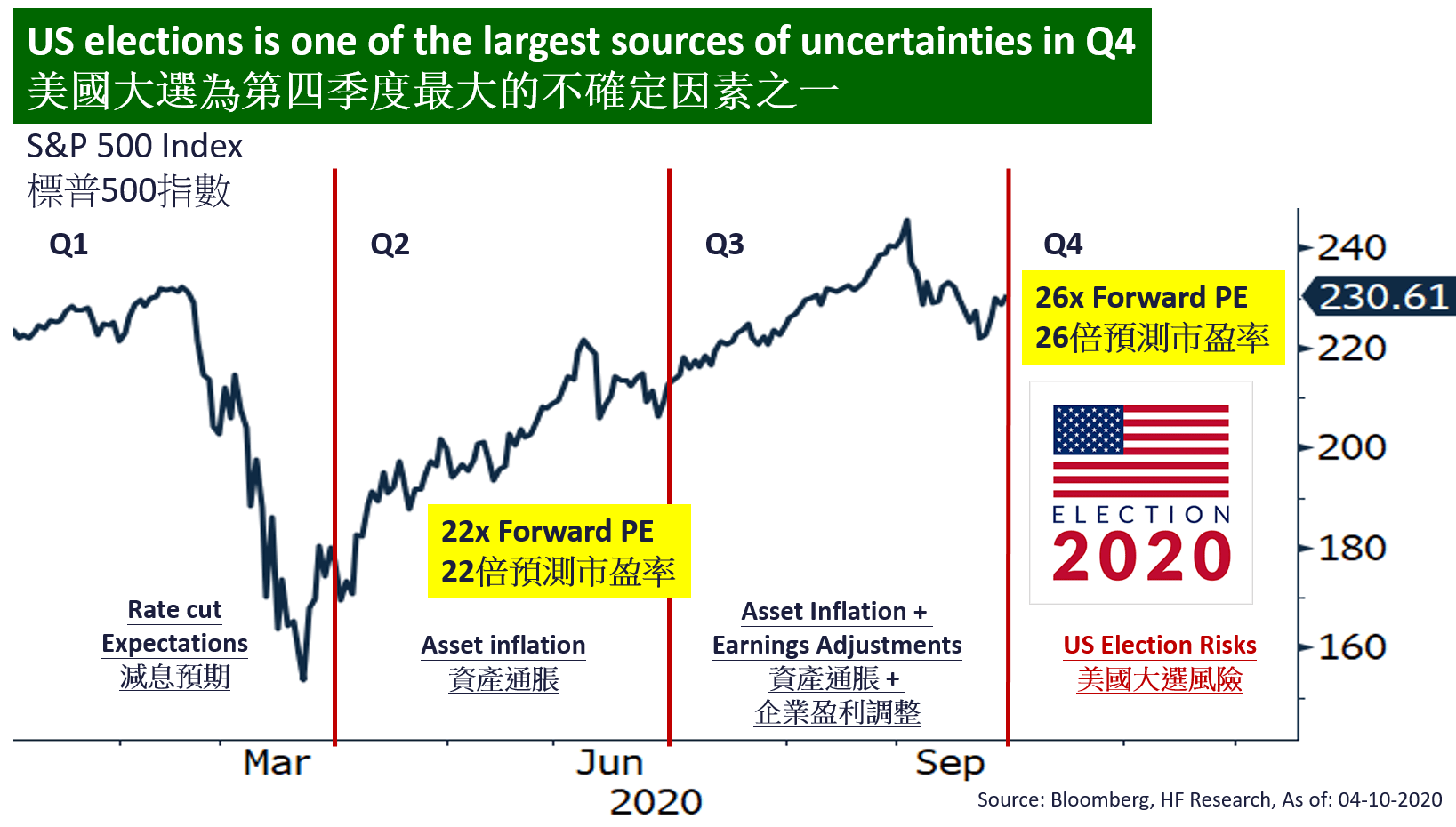

US

US

With new covid cases in many European countries hitting record highs, France and Germany both rolled out emergency lockdowns, raising fears of the epidemic crippling economic recovery. This resulted in sharp drop in both US and European markets, the S&P 500 index in particular posted its biggest single-day drop since June 2020. The outbreak in the US is also concerning, with daily cases hitting record highs in the Midwest. With less than four days until the election, polls showed Biden maintaining his lead, but markets are still focused on key swing states. As for the earnings season, more than half of the companies in the S&P 500 index have already reported, with 84% of them beating market expectations; in particular the FAAG+M, top 5 companies in the market by market capitalization, reported better than expected quarterly earnings, alongside with a record breaking Q3 US GDP growth of 33% QoQ annualised, beating expectations, drove market recovery on Thursday. Next week, the US will release the Markit Manufacturing PMI, ISM Manufacturing Index, and other relevant employment data, the Federal Reserve will also hold an interest rate meeting.

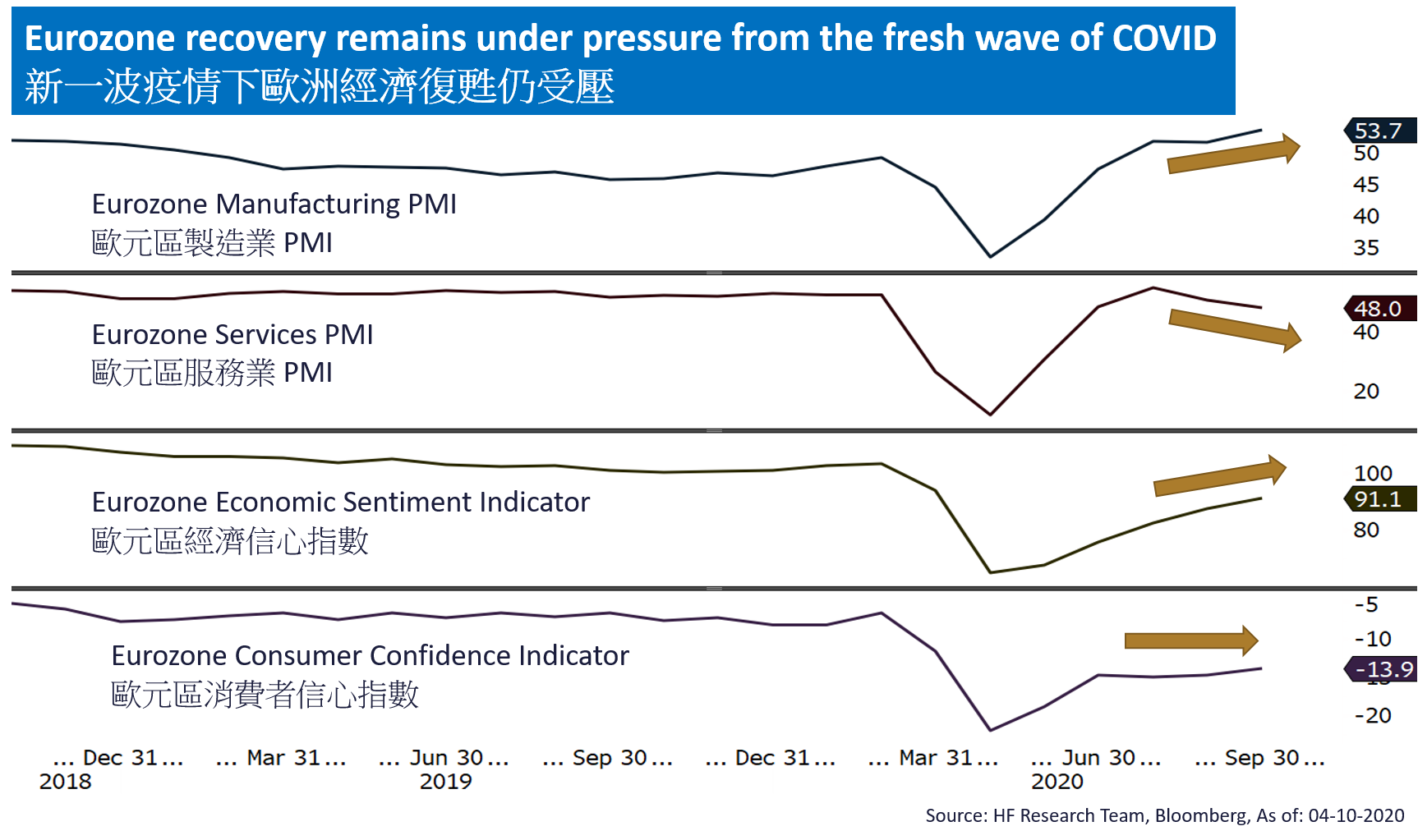

EUROPE

EUROPE

With the covid epidemic surging in Europe, French President Emmanuel Macron announced on Wednesday that the whole country would be in lockdown again from Friday onwards, and it would last until at least early December this year. European equities crashed in response, German, French, and UK equity indexes fell 8.28%, 6.92%, and 4.75% respectively over the past 5 days ending Thursday. The ECB kept interest rates and its QE plan unchanged after the interest rate meeting, and ECB President Christine Lagarde said the economy was losing momentum faster than expected. The Bank of England will hold an interest rate meeting next week, markets expect the Bank to keep rates unchanged, but should see an increase in monthly asset purchases to £845 billion.

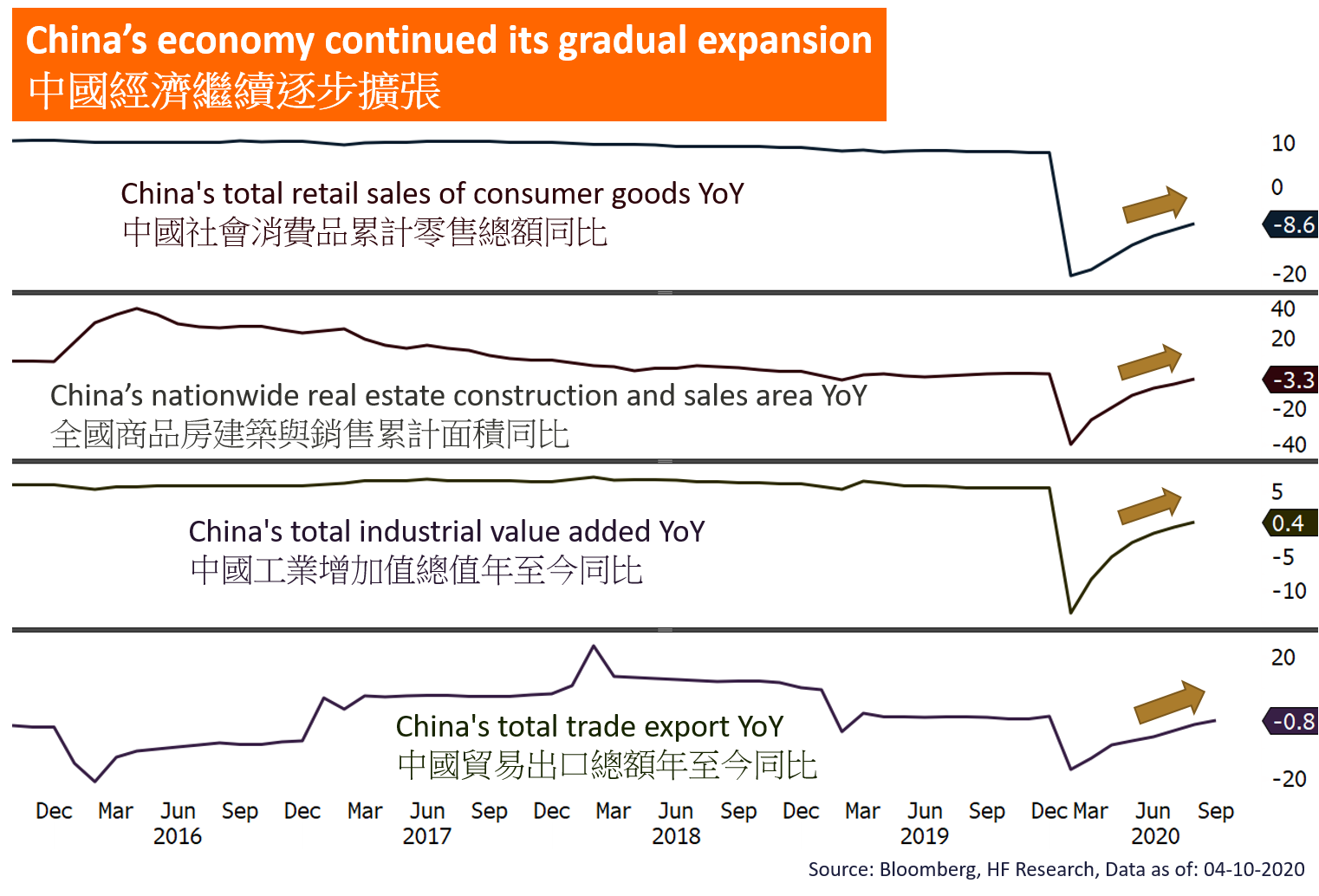

CHINA

CHINA

Hong Kong equities trailed the sharp fall of global markets on Friday afternoon, but the HSI still managed to close above 24,000, logging in a 2.74% fall over the week. Chinese markets fared better, with the CSI 300 index only slightly slipping 0.49% over the same period. China announced its "14th Five-Year Plan", key targets include high quality development and transforming into a technological superpower, but the GDP growth target was nowhere to be found. On the other hand, Ant Group's IPO will raise US$34.5 billion, which will be the world's largest IPO ever recorded. Next week, China will release the Caixin Manufacturing PMI