With the effects of covid gradually receding in their respective localities, emerging markets saw a decent comeback as fundamentals continue to improve. Over the month of October, MSCI Emerging Markets Index rose 1.98%.

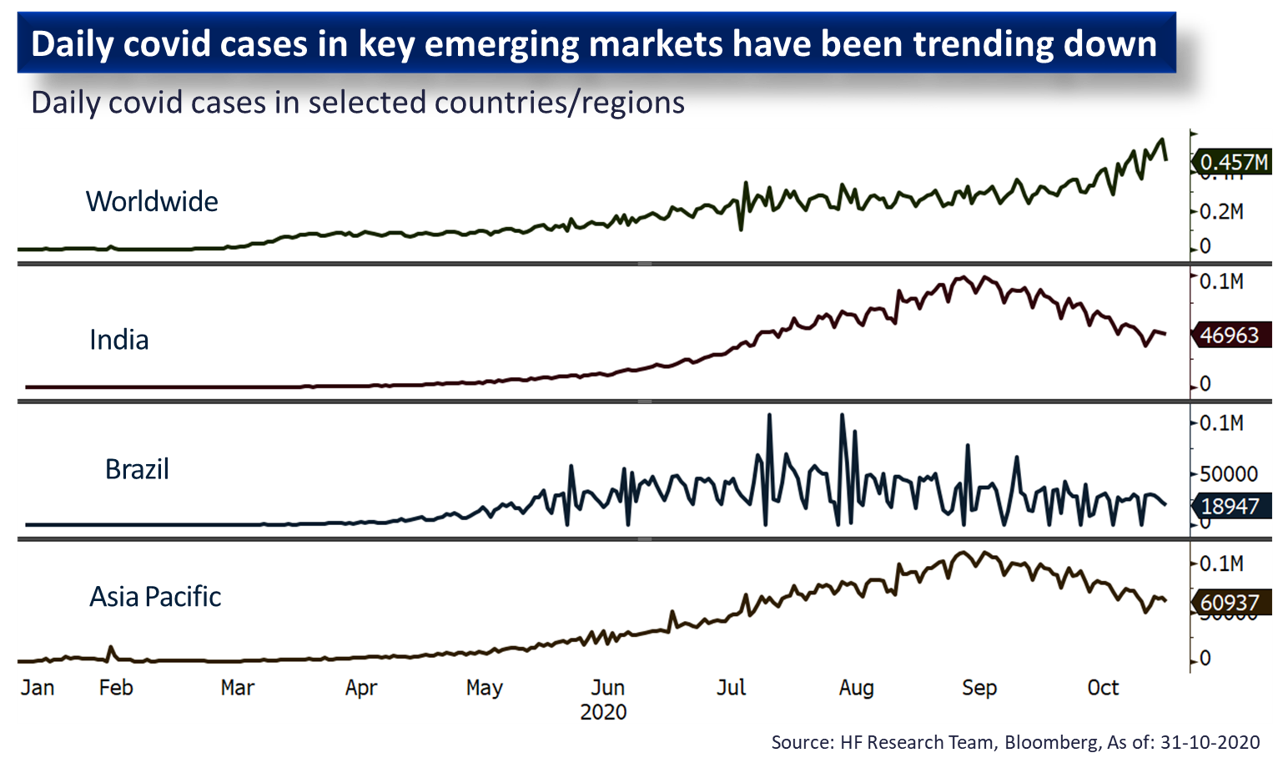

In most of the key emerging market economies such as India, Brazil, South Africa, and numerous Southeast Asian countries, the covid epidemic is losing steam with new daily cases falling. This provides further boost to market confidence, concurrent with the solid improvement in economic fundamentals, Brazil and India PMIs in particular have hit new highs in over a decade. With gradual improvement in the local economy and anticipating global demand recovering, we anticipate EM equity performance to follow.

As one of the largest concerns in form of US elections are going to be settled over the coming month, the level of uncertainty should gradually ebb out with the roadmap for the 4 upcoming years mapped out. At the moment, it seems we would likely see a split Congress, suggesting a more or less status quo in terms of policy direction, which should be positive for emerging market performance. However conservative investors could consider to remain on the sidelines until the smoke clears, as the current closely contested elections would likely result in recounts and court cases, which could still drive volatility in the market.

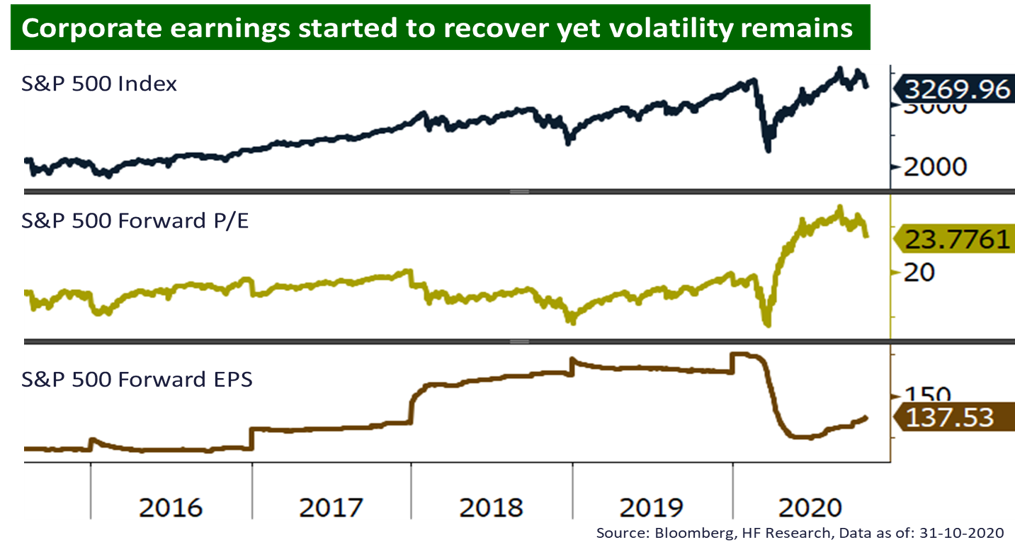

US

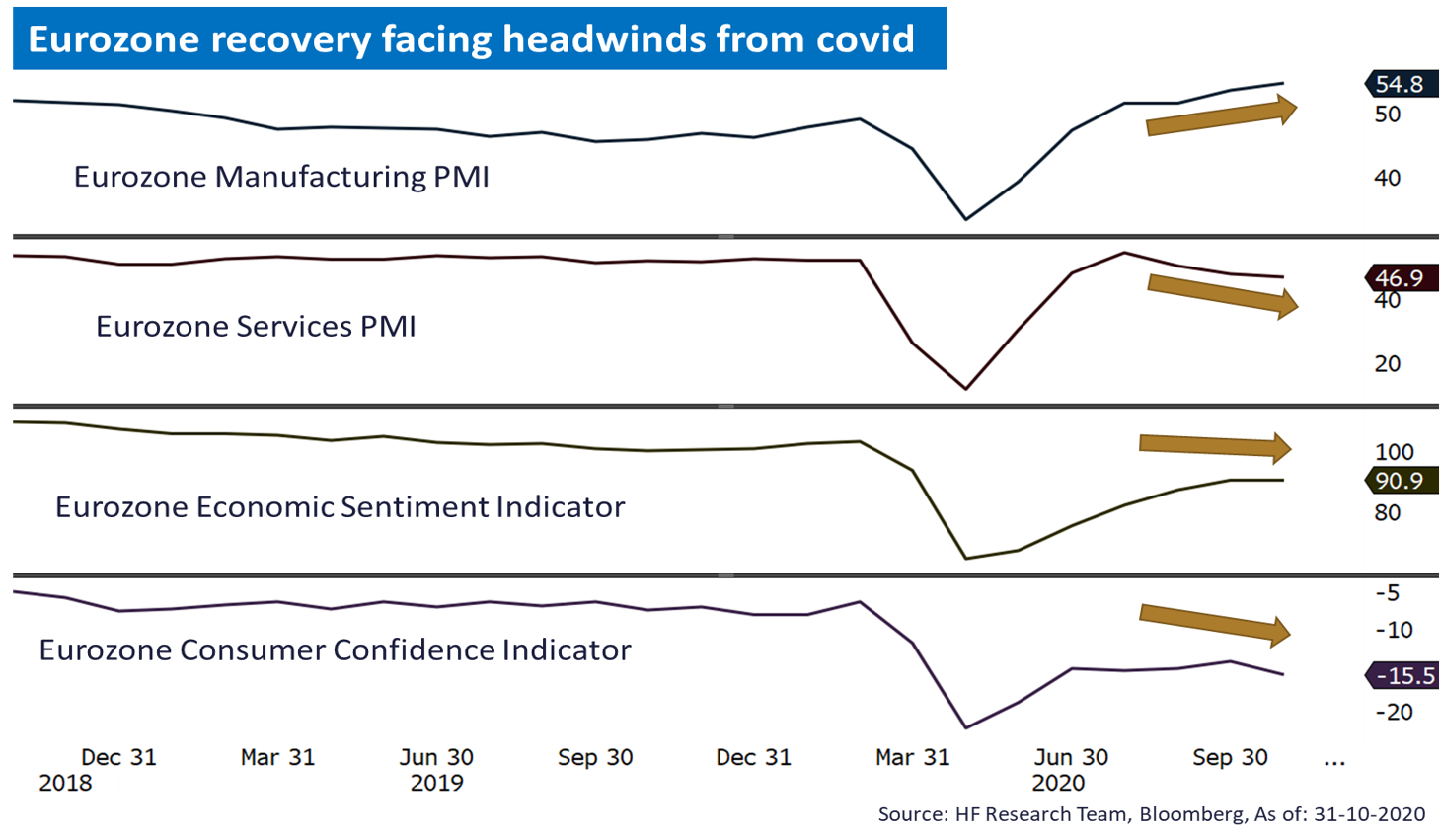

US EUROPE

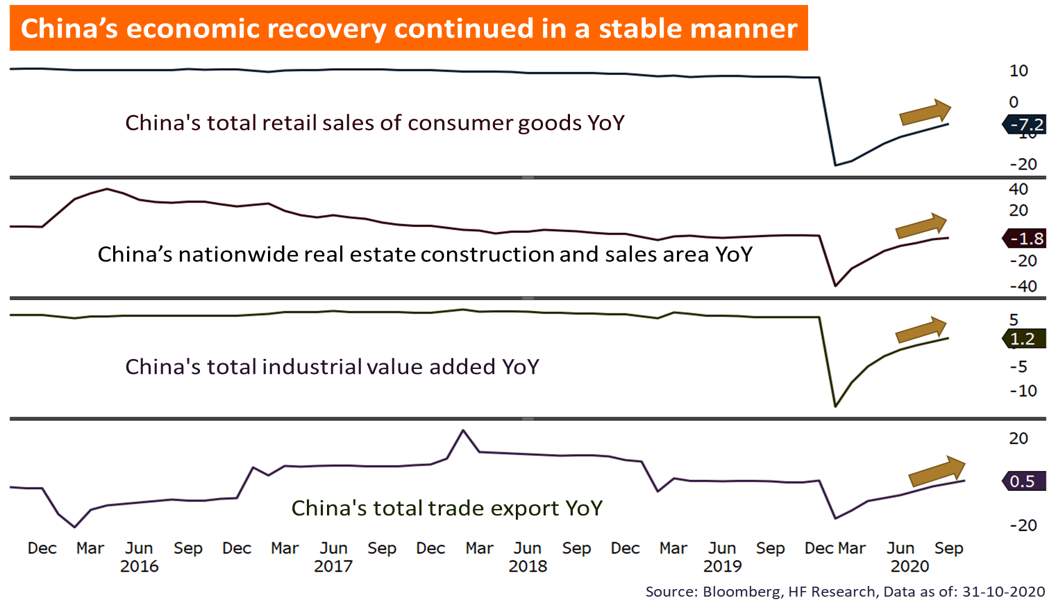

EUROPE CHINA

CHINA