Property Listing

Aspen

Nestling in Canary Wharf and alongside the glittering Thames, Aspen is poised to be one of the tallest and most striking residences in the Capital.

Designed by Pilbrow & Partners, this distinctive addition to the London skyline makes not only a stunning architectural statement but also brings a new community to the area. Aspen is the jewel in the crown of Consort Place, a fresh destination with cafés, bars, activity spaces, education, health centre, restaurant and the international Dorsett hotel.

The residences are the cornerstone of a vibrant pocket neighbourhood, that will be somewhere to meet, relax, work, study or just enjoy throughout the year and at any time of day.

Nearby Places of Interest

-

Transport

-

DLR Heron Quays10

-

Canary Wharf Station11

-

-

Lifestyle

-

Museum of London4

-

The Space5

-

-

Shopping

-

Asda Isle of Dogs Superstore3

-

Billingsgate market7 mins drive

-

Inspections

Contact us to arrange an inspection.

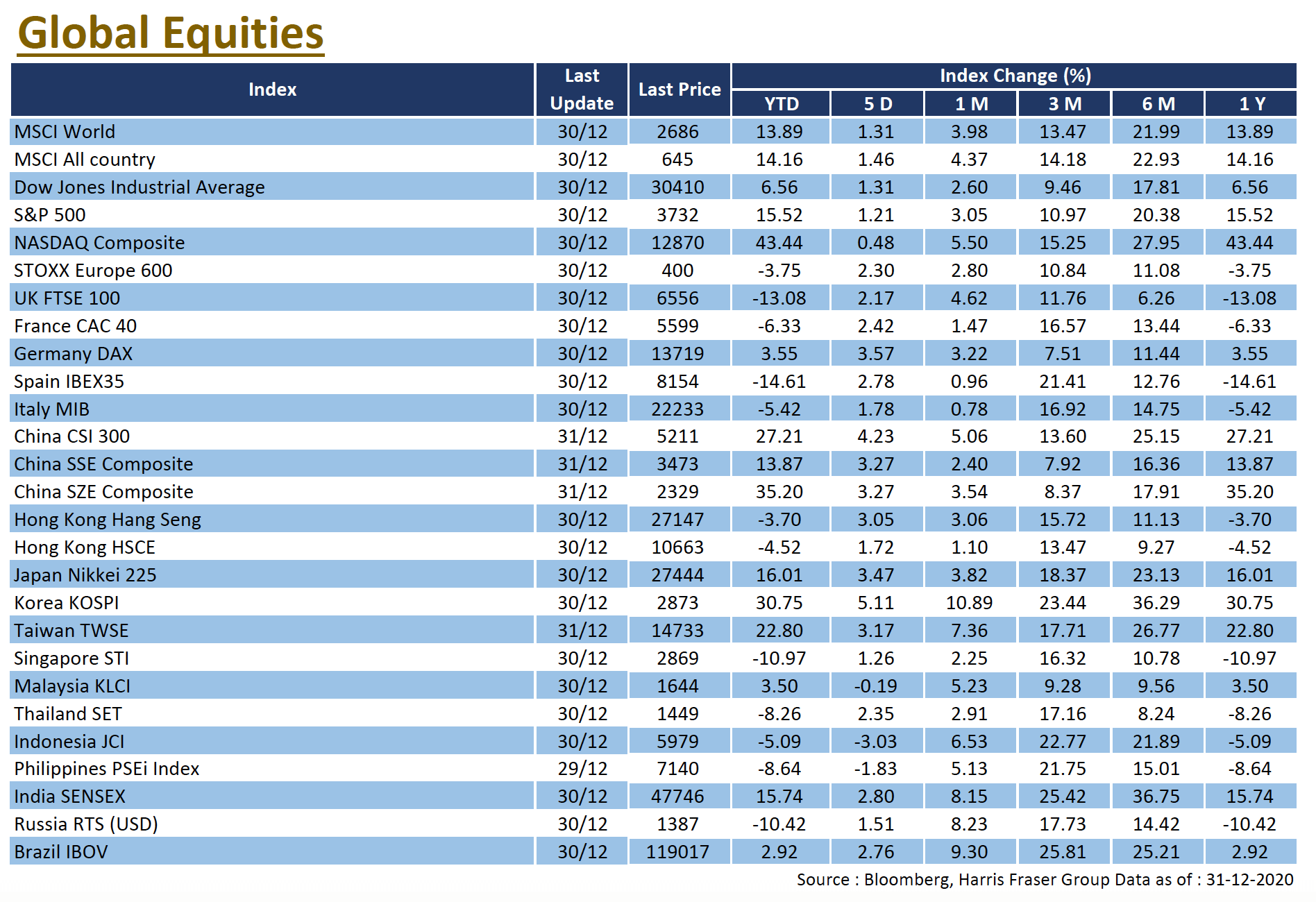

US

US Europe

Europe China

China