Canada Immigration Seminar: Diversified Paths for Financial Talents

12 May 2021

12 May 2021  19:00 - 20:00

19:00 - 20:00 Portion 1, 12/F, The Center, 99 Queen’s Road Central, Hong Kong

Portion 1, 12/F, The Center, 99 Queen’s Road Central, Hong Kong

Canada Immigration Seminar for Financial Talents | Apply Now

12 May 2021

12 May 2021  19:00 - 20:00

19:00 - 20:00 Portion 1, 12/F, The Center, 99 Queen’s Road Central, Hong Kong

Portion 1, 12/F, The Center, 99 Queen’s Road Central, Hong Kong

Canada Immigration Seminar for Financial Talents | Apply Now

16 April 2021

16 April 2021  19:00 - 20:00

19:00 - 20:00 香港中環皇后大道中99號中環中心12樓1室

香港中環皇后大道中99號中環中心12樓1室加拿大生活舒適,擁有完善的基建及優質的教育水平,社會福利更堪稱世界第一!近年,加拿大放寬移民政策,絕對是港人移民的理想國度!

對於有意以商業移民加國的港人,傳統省提名商業移民申請門檻要求甚高。而且大多商業移民方案都要求申請人擁有一定程度的營商及高級管理經驗,由申請到永居獲批可能要花費數年時間,實在令不少人卻步。

如果想快速移民加拿大,但沒有合資格的營商高管經驗,是否沒有機會?今次晉裕移民專家將會和大家分享如何以初創簽證一步到位,直接獲取加拿大永居身份解決傳統商業移民帶來的煩腦。

為加速推動疫情後的經濟復蘇,初創簽證的申請所需時間更加大大縮短了─由以往19個月減至最快12個月。

24 March 2021

24 March 2021  19:00 - 20:00

19:00 - 20:00 香港中環皇后大道中99號中環中心12樓1室

香港中環皇后大道中99號中環中心12樓1室大部份人都覺得移民加拿大一定要大灑金錢,其中氣候宜人的溫哥華, 以及作為加拿大經濟重心的多倫多更深受港人熱愛。可是面對著極高的收分門檻,很多人想申請但不知如何入手。

今次【加拿大投資及商業移民小型分享會】,晉裕移民專家為你介紹多個加拿大的商業移民方案,分析各省的申請要求,和你剖析如何以港幣100萬成功透過商業移民計劃移民加拿大並於當地做老闆。一個分享會讓你掌握最新最正確的加拿大移民資訊,幫你節省大量資料蒐集時間,為你解答各種移民加拿大的問題。

Weekly Insight March 12

US

USUS President Joe Biden signed the US$1.9 trillion stimulus bill on Thursday, pushing the S&P 500 to a new record high in the footsteps of the Dow, and fund flows lifted technology stocks higher, as the three major equity indexes rose between 4.53% and 5.31% over the past 5 days ending Thursday. Earlier, the OECD forecasted that the global economic output would grow by 5.6% YoY, with the US growth rate doubling from the previous forecast to 6.5%. Indeed, recent economic data is encouraging, with the number of initial jobless claims in the US at its lowest level since November 2020, while the core CPI rose at a lower YoY and MoM rate than expected in February, easing concerns about faster inflation and sending US stocks further up after the stimulus package was passed by Congress. Next week, retail sales data and the Conference Board Leading Economic Index will be released, and the Fed will hold the March interest rate meeting, where policy rates are expected to remain unchanged.

Europe

EuropeStocks in the UK, France, and Germany rose further as the ECB pledged to accelerate asset purchases, which sent the three major European Indexes up between 1.29% and 3.65% over the past 5 days ending Thursday. The ECB announced that it would keep its main refinancing rate unchanged at zero and the overall size of the PEPP unchanged at €1.85 trillion, but pledged to accelerate the pace of bond purchases in the coming months to curb the rise in bond yields, which was positive for market sentiment. In addition, the ECB expects Eurozone GDP to grow by 4% this year, which is higher than the forecast made in December last year, and expects the average inflation rate to rise to 1.5% this year, which is also higher than earlier estimates. Next week, the Bank of England will hold a meeting on interest rates, while Germany will release its ZEW survey expectations.

China

ChinaChina's national ‘Two sessions’ concluded with Premier Li Keqiang announcing that the growth target for this year was set at over 6%, with the intention of avoiding major swings in the economy. Despite a rebound in the market during the last two days of the National People's Congress, the CSI 300 Index fell by 2.9% throughout the two sessions, posting a loss of 2.21% for the week. As the US dollar strengthened, both the onshore and offshore RMB shed their YTD gains. Hong Kong stocks weakened on Friday, dragging the Hang Seng Index down 1.23% for the week, as it was reported that Tencent was facing a widespread regulatory overhaul on fintech and trading in China. The focus of the market was on Baidu, which is in the process of IPO, and BiliBili, which is likely to be the next in line. Next week, China will release a series of data on fixed investment, industrial production, and retail sales.

We host business events to bring people together – we encourage knowledge sharing, information sharing and business connections.

|

The UK education is internationally renowned for its high quality. According to the QS World University Rankings 2021, UK universities occupied four of the top 10 spots. Furthermore, UK education focuses on developing students' critical thinking, analytical, and leadership skills, which will give your children an edge in the workplace after studying in the UK.

Renowned Universities

|

Australian education values diversity, promotes multiculturalism and respects individual ideas. Several Australian cities have been rated as one of the world's most liveable cities, making it a great place for students to live and study. Australian universities are internationally recognised, with 7 ranked among the top 100 in the QS World University Rankings 2021.

Renowned Universities

|

The quality of education in the United States is among the highest in the world, which is the aspiration of many parents - sending their children to one of the world's top universities. Moreover, US education offers great flexibility and diversity. In addition to traditional disicplines such as information technology, economics and business administration, students can also pursue specialised disciplines such as energy science and aerospace technology. Hence, by studying in the USA, students not only acquire further knowledge in the classroom, but can also broaden their horizons.

Renowned Universities

|

Canada has a North American education system with high quality education, and the degrees obtained are widely recognised by businesses, governments, and academia worldwide. Canadian students can apply for a PGWP (work visa) valid for up to three years after graduation, enabling them to obtain permanent residence in Canada through various means after graduation.

Renowned Universities

Through our smart online system, our team of education experts will help your child explore their inner potential and career interests, tailoring their time abroad to their needs

Our experienced foreign correspondents will handle the application documents, explore your child's outstanding attributes, and assist with the writing and translating letters of recommendation and CVs. Our team of professionals will follow up with you throughout the entire process of reviewing and proofreading your application documents, and we are committed to ensuring that you receive a formal confirmation of acceptance.

Our team of professionals will follow up with you throughout the process, providing guidance on visa documents and application procedures, and reminding you of key matters to be aware of when applying for a visa

Pre-departure seminars are arranged by our overseas team to explain the immigration information and process in detail, so that our clients can have a wonderful experience while studying abroad

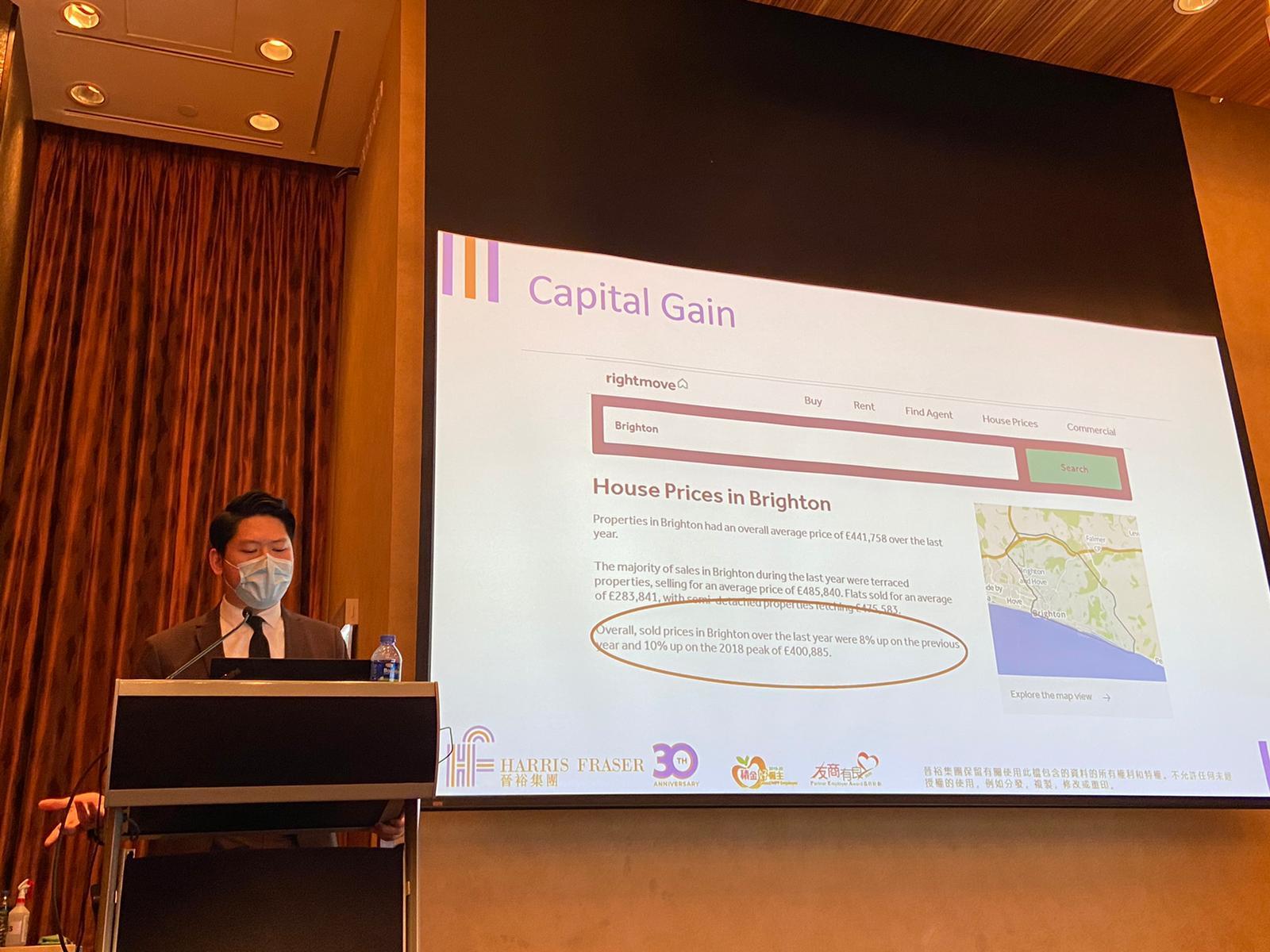

Harris Fraser hosted the first overseas property exhibition in Hyatt Regency Hotel, Tsim Sha Tsui.

Brighton Marina brings a new meaning to waterside living, with 2 beautiful blocks, creating a total of 195 superb new homes in an outstanding south coast location.

As one of the most exciting developments in the history of this vibrant city, it presents a rare opportunity to experience marina life amidst all the advantages of Brighton’s rich heritage.

Brighton Marina is sold by Harris Fraser exclusively with price per sq ft. starting from 5,500 HKD. Please contact our professional consultant to know more details

Weekly Insight March 5

US

USContinuing the recent trend, US treasury yields went up again on Thursday, climbing as high as 1.57%. In turn, equity markets reacted to the spike with yet another correction, the S&P 500 and the Dow recorded losses of over 1.5% over the past 5 days ending Thursday, while the NASDAQ saw a larger correction of over 3%, bringing the YTD performance into negative territory once again. Fed chair Jerome Powell earlier mentioned that the inflation is still far from the Fed target level, and the lack of full employment in the US necessitates the loose monetary policy in the near future. As a result of his remarks, yields shot up, causing spot gold to briefly fall below USD 1,690 per oz, while the Dollar index rose 0.83% over the past 5 days ending Thursday. As for the fiscal side of things, the Senate is expected to pass the stimulus bill soon, which could boost the somewhat struggling economy. In other news, OPEC+ decided to keep the current production cuts intact after the meeting on Thursday, Saudi Arabia also promised to keep her voluntary 1 million bpd cut in place. Crude prices jumped as a result, WTI futures rose over the USD 64/barrel mark. Next week, fresh data on CPI, Michigan Consumer Sentiment, and jobless claims will be in focus, possibly giving investors a better picture on the US economy.

Europe

EuropeEuropean stocks performed better this week as sentiment in the region seems to be insulated from the surge in US Treasury yields. Individual equity indexes was mixed bag, German equities led the way with a 1.28% gain over the past 5 days ending Thursday, while the UK FTSE slightly lost 0.02% over the same period. Traditionally, the steepening of the yield curve actually hints at an improving economy, cyclicals such as European financials could likely benefit from the trend. Epidemic wise, vaccination progress in the Eurozone still lags behind other developed countries such as the UK and the US, investors could follow that closely if this could potentially undermine future economic recovery. As for the economy, manufacturing data in the region remain strong, but the weak retail sales and services PMI figures hints at potential weakness. Next week, the ECB will hold another interest rate meeting. Considering the situation of the current economy, market expects no changes to the loose monetary policies. Europe will also release data on industrial production, German CPI, and Eurozone GDP.

China

ChinaThe US equity market correction continue to have ripple effects across the globe, the selloff in the more expensive tech stocks extended to Chinese and Hong Kong markets. We saw more profit taking in the new economy sector, the overall market however saw relatively limited correction. Over the week, the CSI 300 were down more than 1%, the Hang Seng Index edged slightly higher, while the Hang Seng Tech Index lost more than 3%. The national ‘Two Sessions’ have commenced on Thursday, the largest takeaways up till now is the target economic growth of 6% this year, which is close to our estimates at the beginning of the year; and carbon reduction shall be a national policy direction, considering the targets of reaching peak carbon by 2030 and carbon neutrality by 2060, his should continue to benefit relevant sectors, with electric vehicles and clean energy sectors being the largest likely beneficiaries. Next week, China will announce the latest medium-term lending facility (MLF) rates, and release figures for money market M2, CPI, and PPI.

Harris Fraser Group is awarded the ``Caring Company'' in 2020/21.

In the 2020-21 "Caring Company" program established by The Hong Kong Council of Social Service, Harris Fraser Group is awarded the recognition for the company's commitment to the community, employees and the environment in the past. The "Caring Company" recognition program was established by The Hong Kong Council of Social Service. The purpose of the program is to build a cohesive society by promoting strategic partnerships among business and social service partners and inspiring corporate social responsibility through caring for the community, employees and the environment.

Entering its 30th anniversary, Harris Fraser Group will continue to devote in corporate social responsibility and contribute to the society as before.

Weekly Insight February 26

US

USLong dated US bonds saw a heavy sell-off, with the US 10-year bond yield rising above 1.61% during the day. The market is worried about the possibility of an overheated economy and a sharp rise in inflation, which could possibly lead to the Fed tightening. US stocks fell sharply, with pressure on high valuation technology stocks, the NASDAQ index fell 5.38% over the past 5 days ending Thursday, while the S&P 500 and the Dow fell 2.16% and 0.29% respectively over the same period. US Federal Reserve Chairman Jerome Powell said there was no need to worry about inflation and the economy overheating, reiterating that the current economy still needs monetary easing. Other Fed officials also said publicly that the rise in US bond yields was a sign of market optimism about the economic outlook, stressing that there is no plan to tighten monetary policy at the moment. On the economic front, US 2020 Q4 GDP was revised to a 4.1% growth YoY, slightly below market expectations of 4.2%, while the core personal consumption expenditure (PCE) price index rose by 1.4% QoQ over the same period, in line with expectations. Next week, the ISM manufacturing and services indexes, employment data, and the latest Fed Beige Book will be released.

Europe

EuropeAgainst the backdrop of a correction in global equities, European equities fared better, with the UK and French equities gaining 0.53% and 0.57% over the past 5 days ending Thursday, while German equities edged down 0.05% over the same period. In view of the recent rise in yields on long-term government bonds, ECB President Christine Lagarde said the authorities are closely monitoring the trend in interest rates to determine whether the current financial environment is appropriate for the economy in the face of the epidemic. Bank of France Governor Mr François Villeroy de Galhau, also a member of the ECB Governing Council, said that the Eurozone economy faces no risk of overheating nor of rising inflation. Next week, the Eurozone will announce the unemployment rate for January and the Consumer Price Index (CPI) for February, which is expected to accelerate to 1.1% YoY.

China

ChinaThe rise in US long end bond yields triggered a market correction in global equities. Mainland China also tightened up market capital, which saw net withdrawals for the third consecutive week, putting pressure on Hong Kong and Chinese stocks. The CSI 300 Index fell 7.65% over the week, whilst the Hang Seng Index fell over 5%. Emerging market currencies and equity markets came under pressure as there are concerns over rising US bond yields leading to capital outflows from emerging markets, with the USD/CNH briefly touching the 6.5 level. The People's Bank of China conducted a RMB20 billion 7-day reverse repo operation on Friday, but the market still recorded a net withdrawal of RMB20 billion for the week. Next week, China will release the Caixin Manufacturing and Services Purchasing Managers' Index for February. The market will be watching the Two Sessions closely, which is scheduled for 5 March.