United States

United States

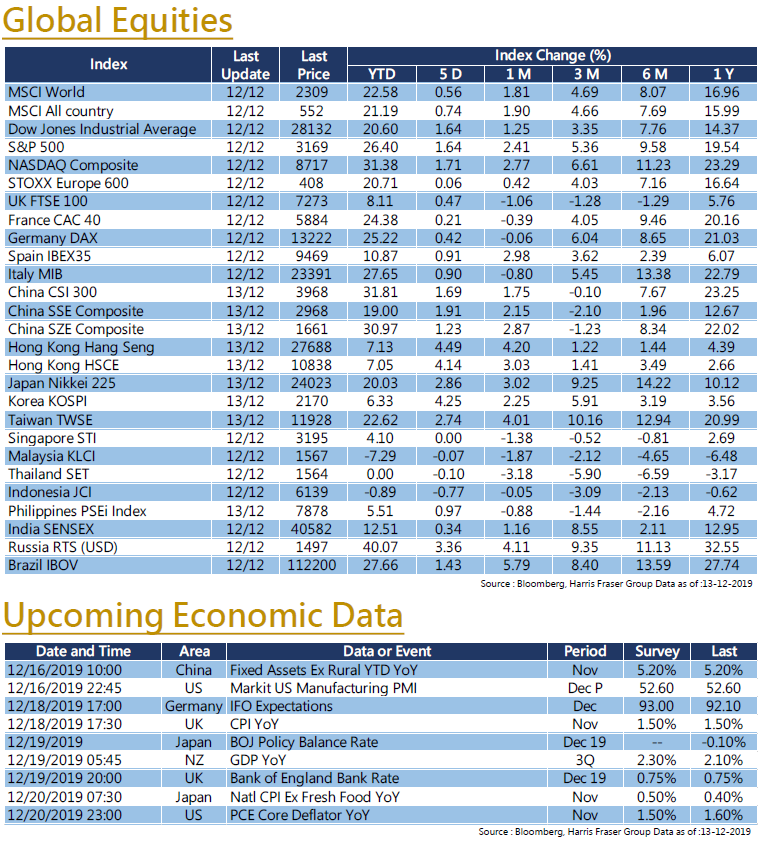

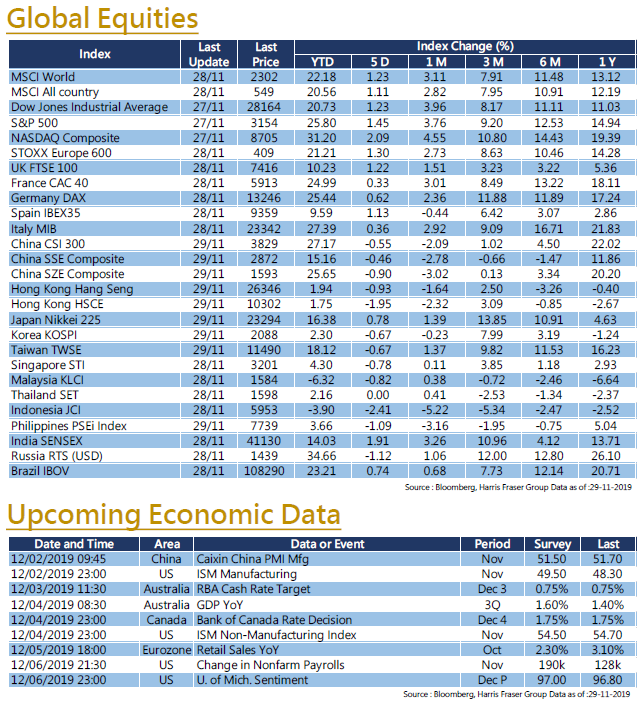

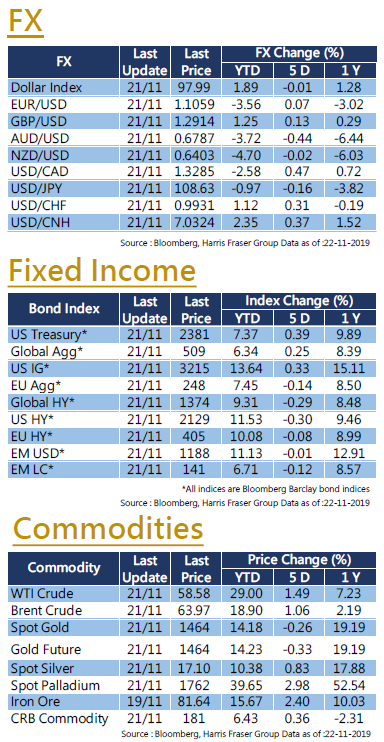

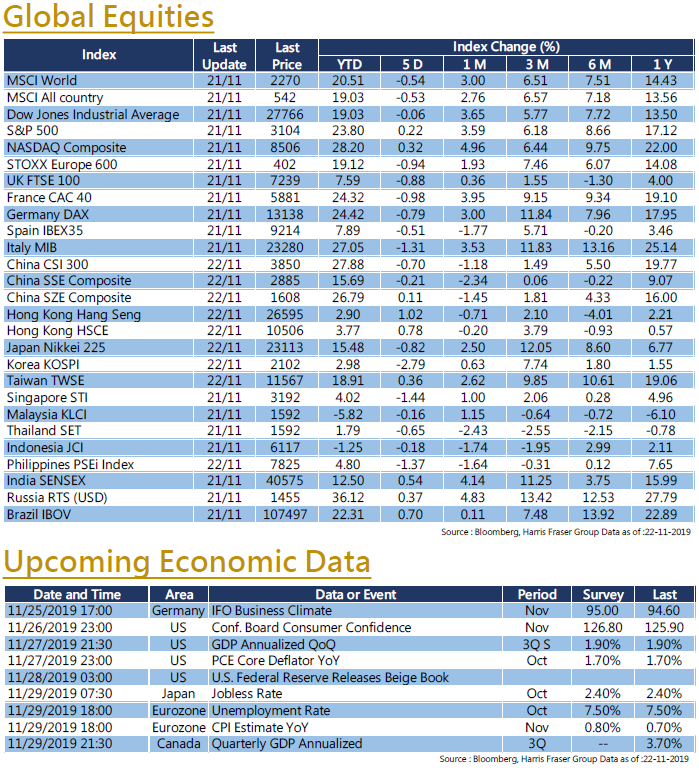

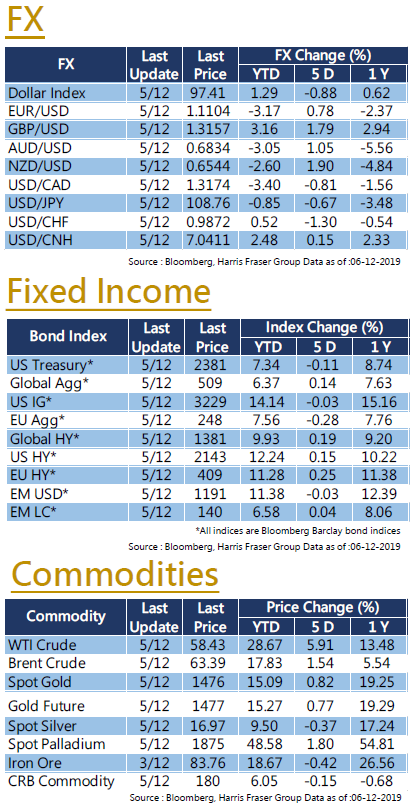

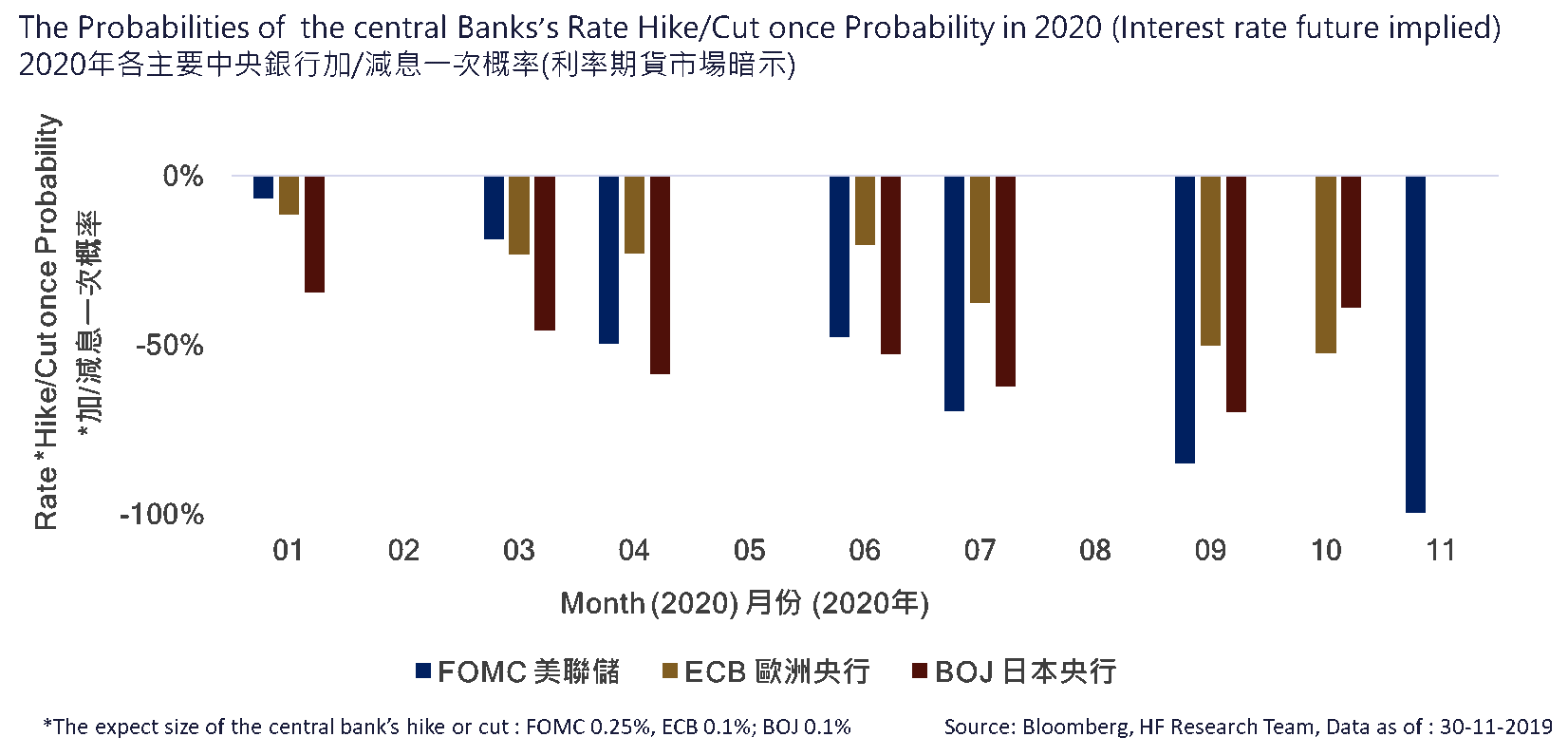

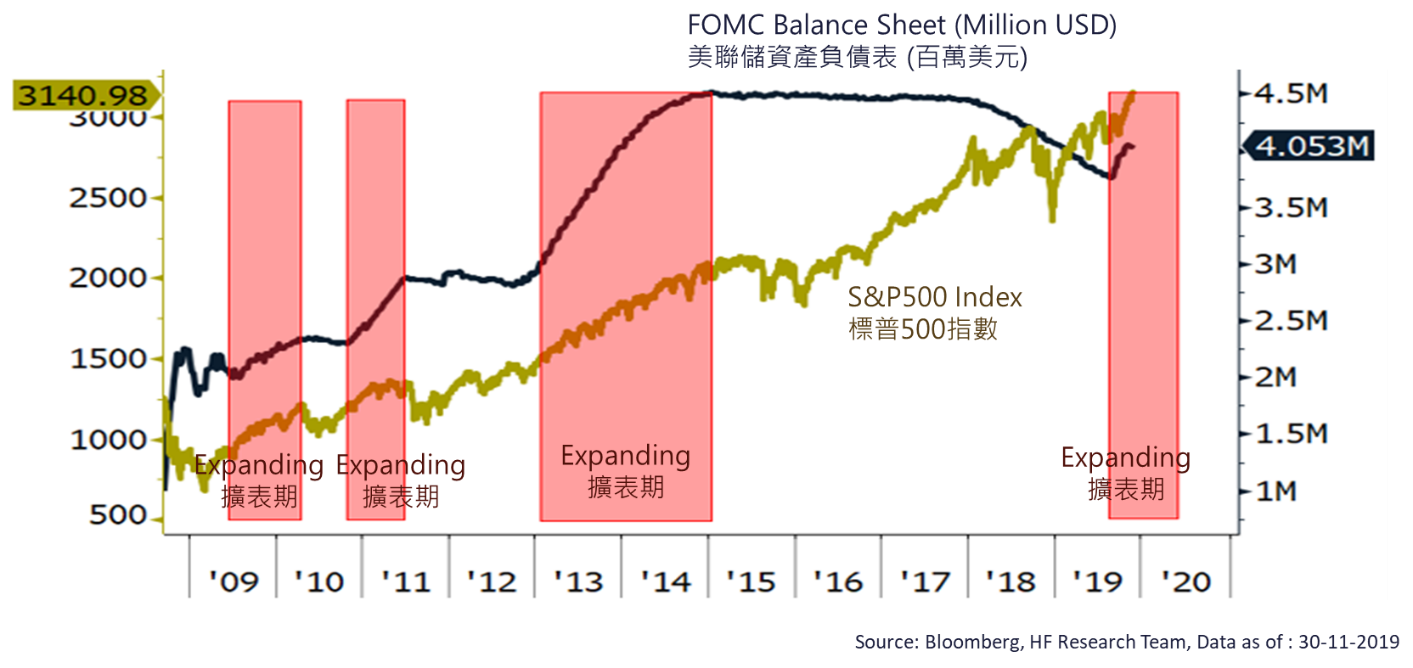

Global stock markets showed signs of weakening. Earlier in the week, Trump pointed out that there is no deadline for the Sino-US agreement, implying that the agreement with China might only be signed as late as November 2020. This incident worried the markets that the United States might proceed with the new tariffs on Chinese goods as scheduled on 15th December, killing the last glimmer of hope on a tariff delay. Affected by this, the S&P 500 fell earlier this week, recording the largest single day drop in nearly eight weeks. Over the past 5 days ending Thursday, the three major US stock indexes fell 1.15% - 1.73%. In addition to trade concerns, economic data also weighed on US equities. Data showed that the US ISM manufacturing index contracted for the fourth consecutive month in November, while the ISM non-manufacturing index also fell below the previous value and market expectations during the same period, implying slowdown in both aspects of the economy. Next week, the United States will announce the November retail sales and consumer price index, the market expects that both data show positive results. In addition, the US Federal Reserve will also hold the interest rate meetings, which markets expect rates to remain unchanged..

Europe

Europe

While global stock markets dipped, the drop was further magnified in Europe. French and German stocks fell 1.9% and 1.4%, respectively; UK stocks went further down, falling 3.8%. In the UK, as polls in the UK showed that the Conservative Party still maintained the lead, the Pound rose sharply to the 1.3150 level. In addition, UK Prime Minister Boris Johnson also announced his plan for the first 100 days of his tenure, including plans to ‘complete’ Brexit before January 31, providing support to the Pound. In France, there was a general strike, mainly due to dissatisfaction over the government's revision of the retirement system. The European Central Bank (ECB) will hold its last 2019 interest rate discussion next week, the market expects interest rates to be kept unchanged.

China

China

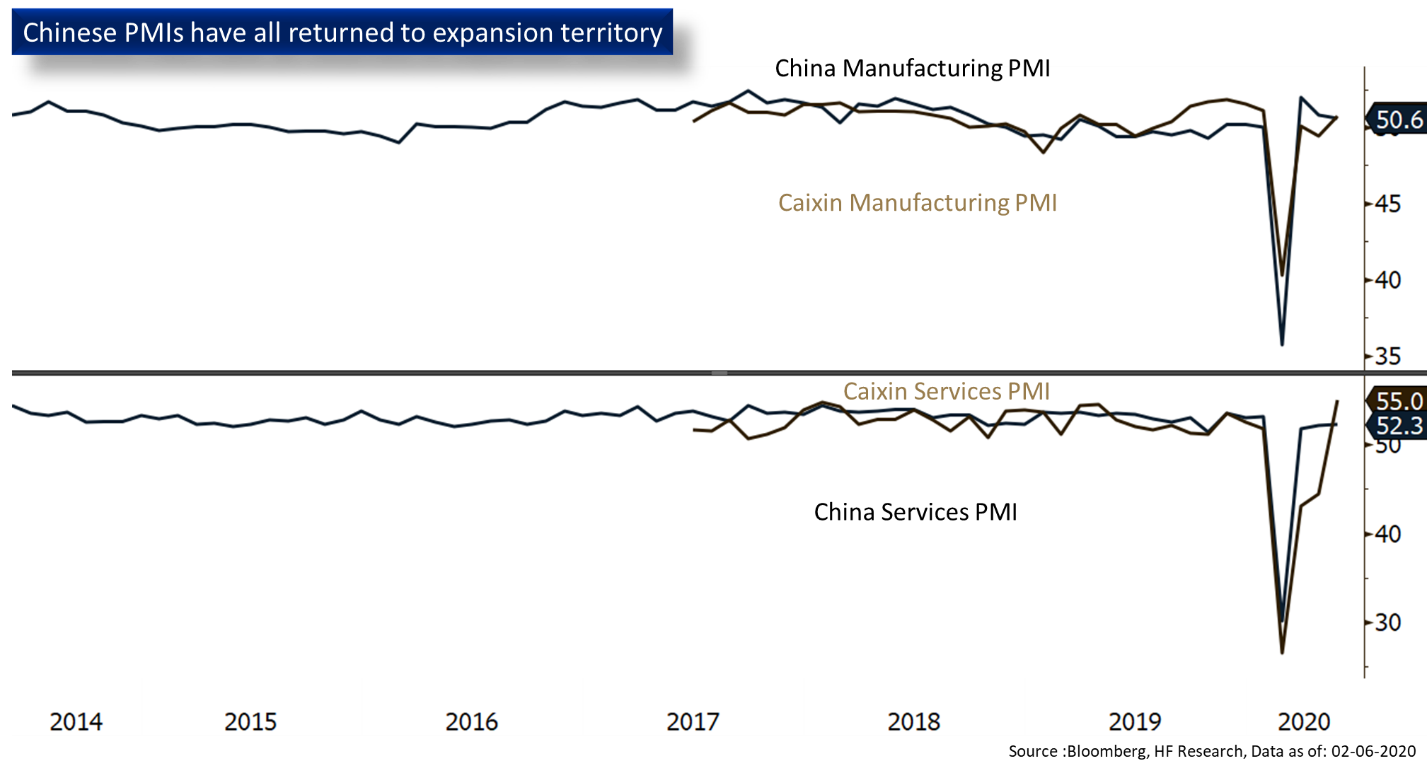

China and Hong Kong stock markets performed well. Despite the worsening global market sentiment at the beginning of the week, it was reported that the Chinese side maintained close communication with the US and the stock market rebounded. The mainland stock market outperformed HK markets, CSI 300 index nearly 2% this week, while the Hang Seng Index rose 0.6%. In the absence of a clear breakthrough in trade negotiations, data showed that the Sino-US trade volume further declined in October, and the US merchandise import quota from China also hit a three-year low. China will release CPI data next week, and the market expects the figure to further increase to 4.3% YoY.

- Recent activities include : Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019, Attended iFAST’s annual symposium 2019 in Berlin Germany

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”, “iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)

United States

United States  Europe

Europe China

China