United States

United States

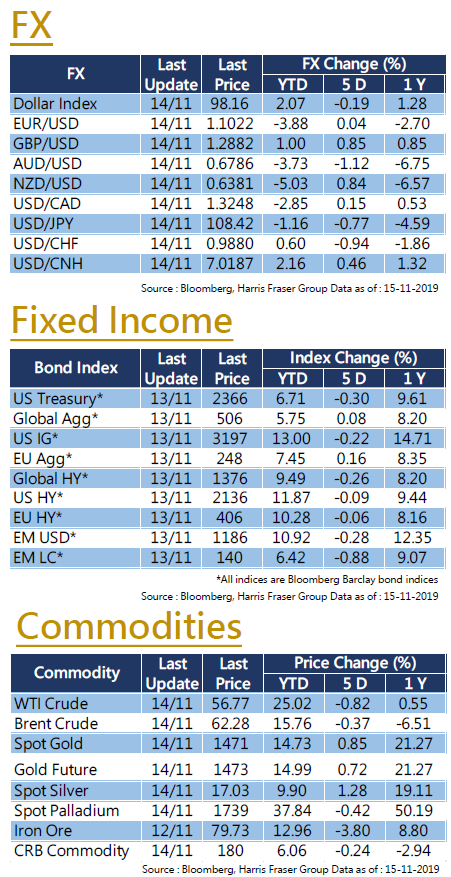

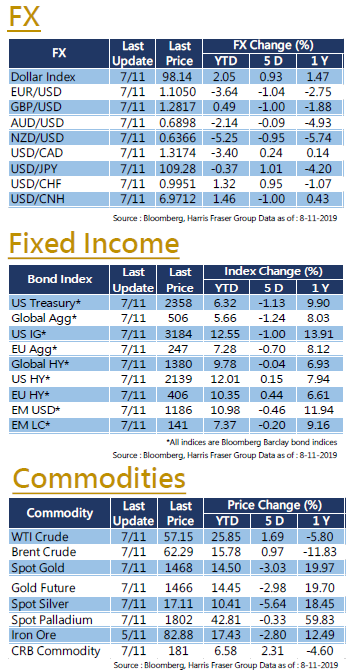

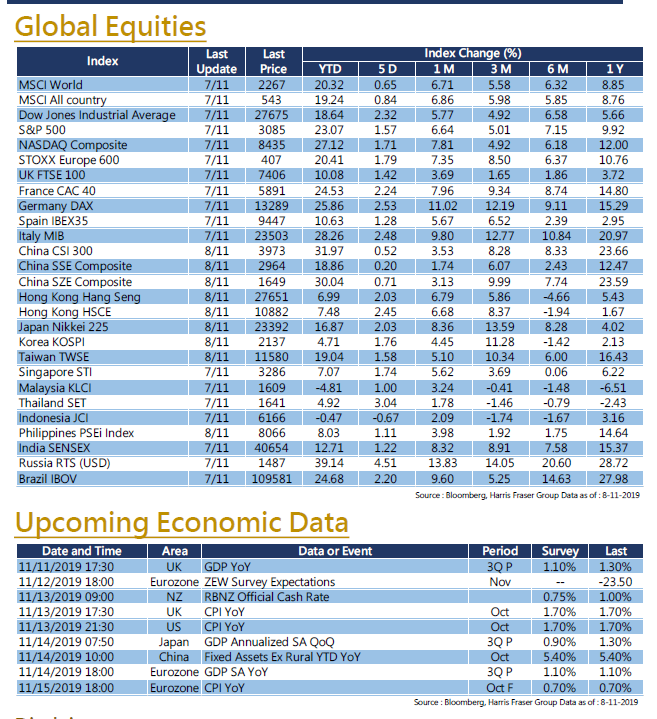

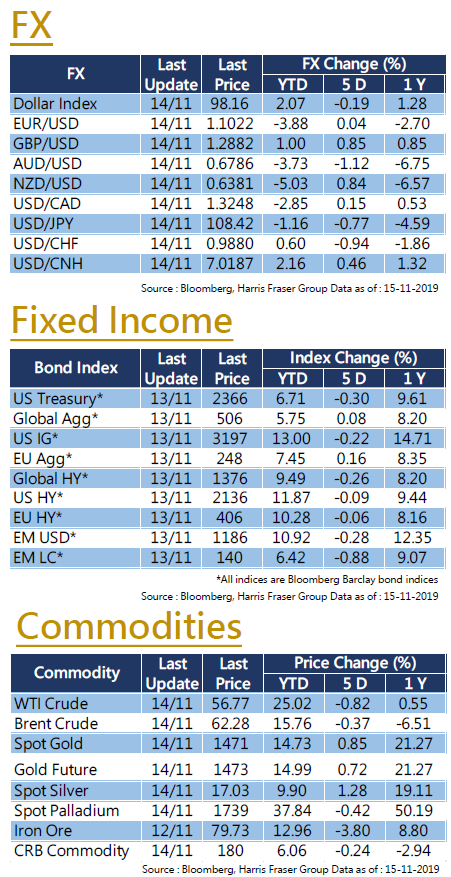

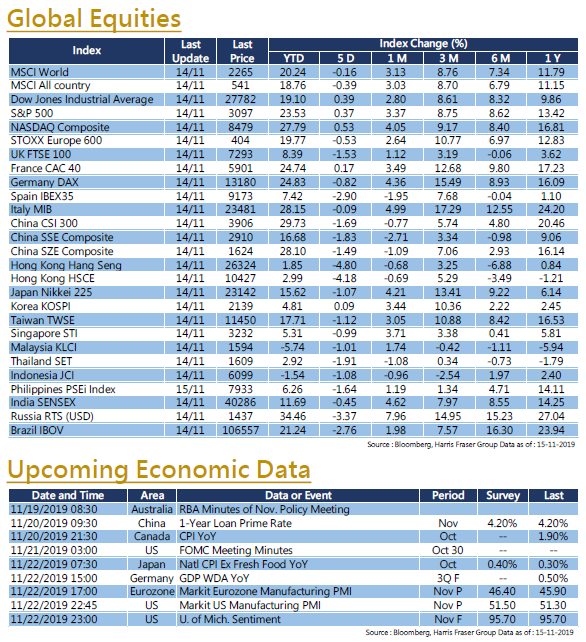

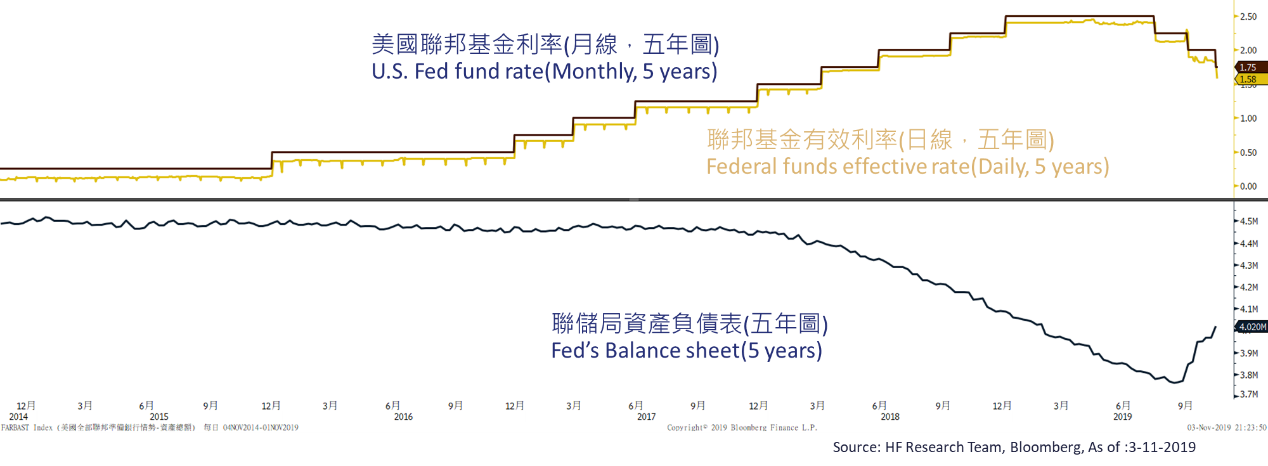

The US stock rally slowed down, as there were doubts on whether China and the United States could reach any agreement as outlined earlier. Over the past 5 days ending Thursday, the three major US stock indexes rose 0.3% - 0.6%. The obstacles in the procurement of agricultural products remains the main issue, which has halted Sino-US trade negotiations. During the week, the US Federal Reserve Chairman Jerome Powell delivered a speech. He claimed that the current monetary policy is appropriate, but the risks are still worthy of attention, while the pressure on the repo market is already under control. The US CPI in October released this week increased slightly to 1.8% YoY, but core inflation fell, as the annual growth rate fell to 2.3%. Next week, there will be data on the US manufacturing PMI and market sentiment. In addition, the Fed will also release the October meeting minutes, which may shed more light on the future monetary policy.

Europe

Europe

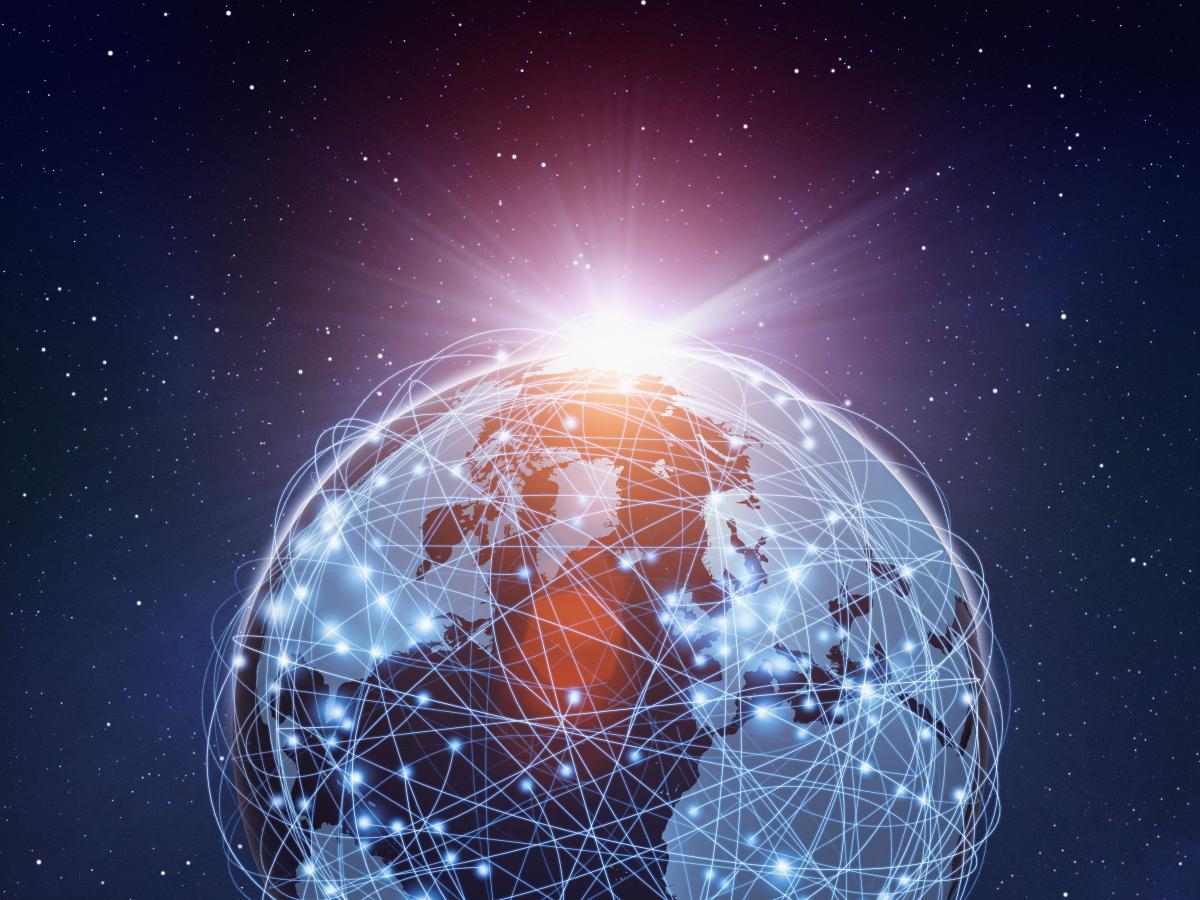

The European market performance was in line with the global markets. Over the past 5 days ending Thursday, the UK FTSE 100 and German DAX fell 1.53% and 0.82% respectively, while the French CAC rose by 0.17%. In the UK, the latest survey showed that the UK Prime Minister Boris Johnson’s Conservative Party is still leading the Labour Party in polls, but falls short of a majority. The UK's third-quarter GDP and October CPI rose by only 1% and 1.5% respectively, which was slightly worse than expected, the MoM retail sales also recorded an unexpected drop in October, but as the dust settles after the general election in December, we believe that the overall economy outlook will be brighter. Moving on to Continental Europe, Germany's Q3 GDP grew by 0.1% QoQ, which surpassed expectations and also narrowly escaped a technical recession. The Eurozone's Q3 GDP grew by 0.2% QoQ, in line with expectations but growth remains sluggish. More European economic data will be released next week, including Germany's Q3 final GDP and October PPI, as well as the various PMIs in Germany and France.

China

China

Due to external factors and the disagreements over the trade agreement, Hong Kong stocks performed poorly this week. Over the past 5 days ending Thursday, the Hang Seng Index has fallen 4.8%. The Chinese equities also felt the impact, major stock indices have fallen by 1.49%-1.83% over the period. China released a number of economic data this week, where industrial production, fixed asset investment, and retail sales in October all missed market expectations. However, China's unemployment rate fell to 5.1% and improved. As for trade war matters, it is reported that the Sino-US trade negotiations are currently in a stalemate. The key lies in whether the US agrees to cancel all tariffs under the first-phase trade agreement, or to only cancel the tariffs coming into effect on 15th December; the Chinese on the other hand remained hesitant over the actual figures of agricultural purchases. In addition to paying attention to the trade war development next week, the People's Bank of China will announce the loan prime rate (LPR), and Hong Kong will also announce the unemployment rate in October.

- Recent activities include : Attended iFAST’s annual symposium 2019 in Berlin Germany, visit Mason Privatbank Liechtenstein office in Liechtenstein, joined The Private Wealth Asia Forum in Hong Kong.

- Media include : SCMP、imoney、AAStocks、TVB、HKEJ、MingPao、HKET、Metro Broadcast、Commercial Radio Hong Kong etc (including but not limited to the above)

- Publishing on newspapers, magazines and online sections : “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos collaborated by Mason Securities limited and Harris Fraser Group.

United States

United States Europe

Europe China

China