Harris Fraser Group Limited released the latest “Hong Kong Property Market Outlook” (“Outlook”), an in-depth study on the property market trends from 2019 to 2022. The Outlook anticipated property demands in Hong Kong to continue outstripping supply, and the property market to remain in an uptrend. However, as the demand-supply imbalance subsides, the growth in property prices is expected to soften in the next four years. The Outlook also noted that, as Hong Kong faces demographic changes, purchasing power for smaller units or flats targeting first-time homebuyers (e.g. studio flats or one-bedroom apartments) would decline, and become less lucrative compared with medium or large units, such as two-bedroom or three-bedroom apartments.

Property Price Increase Moderates

Trade-up Properties Become Top Investment Choice

The Outlook focused on the private residential market, with the goal of determining the direction of the Hong Kong property market. In addition, it aimed to ascertain the type of private homes with the highest investment returns in the current market environment. The Outlook forecast that during the period from 2019 to 2022, the property market supply-demand imbalance would ease, with an equilibrium in sight. Nevertheless, since the overall demand exceeds supply, the property market will maintain a steady uptrend.

Although overall demand outpaces supply, demand growth will moderate due to changes in the supply-demand ratio. Demand for private properties can be further broken down into (i) rigid demand (such as homeownership due to marriage and starting a family), and (ii) elastic demand (such as a switch from non-private housing to private flats). From 2019 to 2022, supply of new private residential properties is estimated to surpass rigid demand. The surplus supply will be absorbed by the elastic demand, slowing down the upward growth. Since elastic demand is responsive to price changes, the property market is likely to experience volatility.

The Outlook observed that, by estimation based on the area of government land sale and the number of private residential properties in construction, supply of new private residential homes is expected to significantly decrease from 2023 onwards. Coupled with the objective of long-term land supply, the ratio of public to private housing will be tilted from 6:4 to 7:3, further decreasing the supply of private residential properties. It is expected to bring support to the long-term upward momentum of the property market.

Steven Wong, author of the Outlook and HFG Investment Analyst, said, “According to our analysis, first-time homebuyers of suitable age have buttressed the demand for flats targeting them for the last 14 years. Under the present conditions, the demand for first-purchase flats prevalent in the past will shift to demand for trade-up properties. The investment value of the trade-up properties is relatively higher in response to the demand for these type of properties. As the upward momentum of the property market slows, investors can turn their attention to medium to large trade-up properties, such as two-bedroom or three-bedroom apartments, and increase their wealth through replacing their flats for one with a higher value.”

Refinance Property Investment in Anticipation of Interest Rate Cuts Cycle

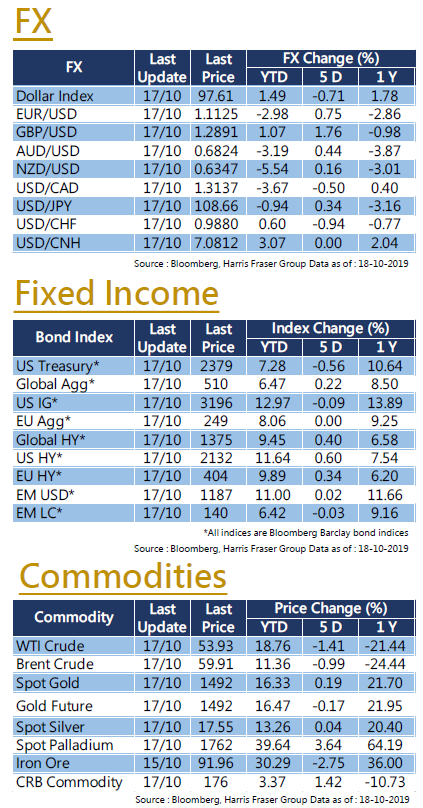

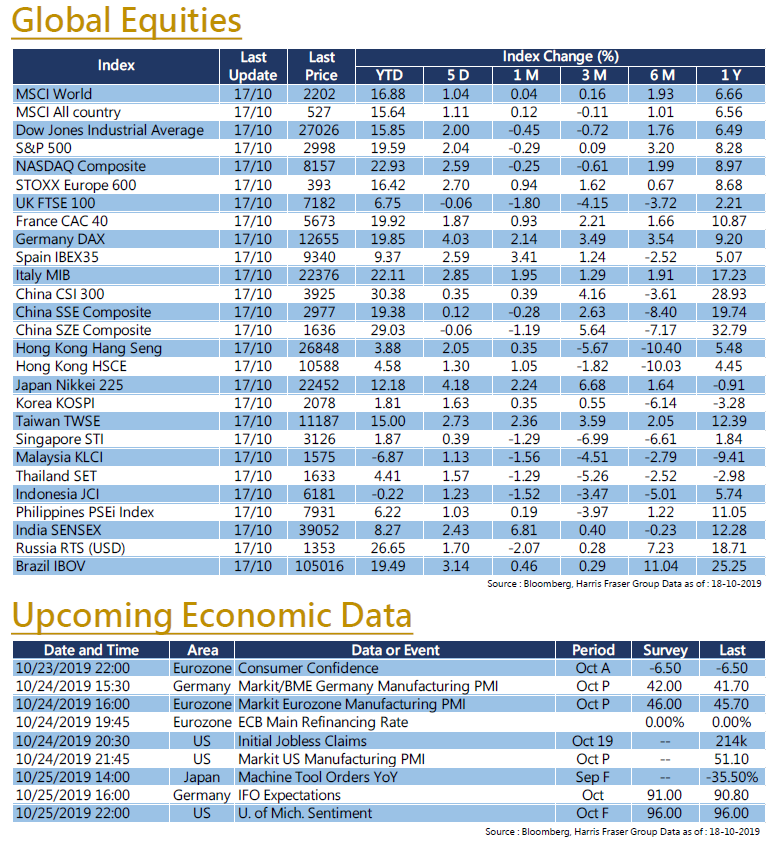

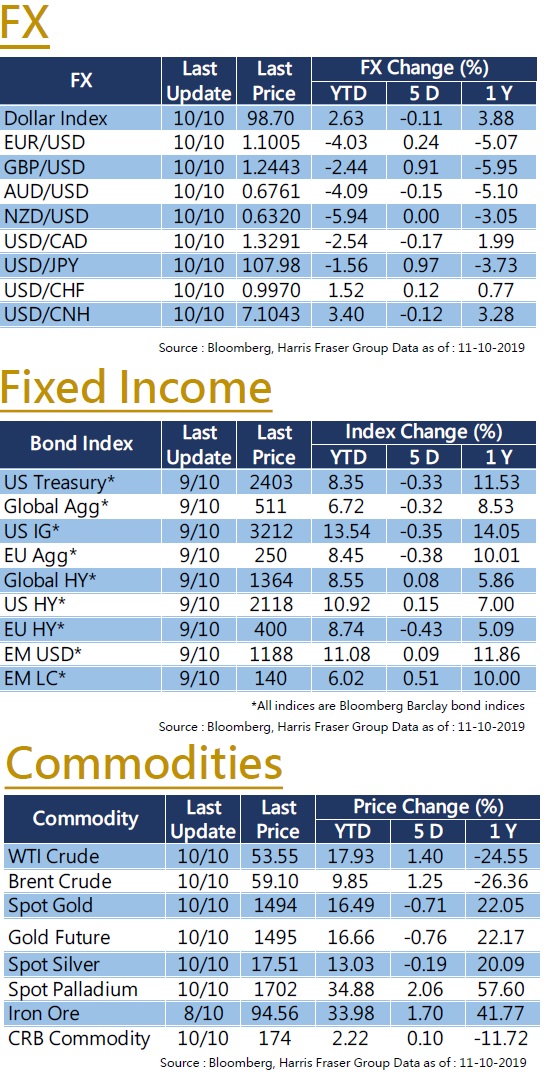

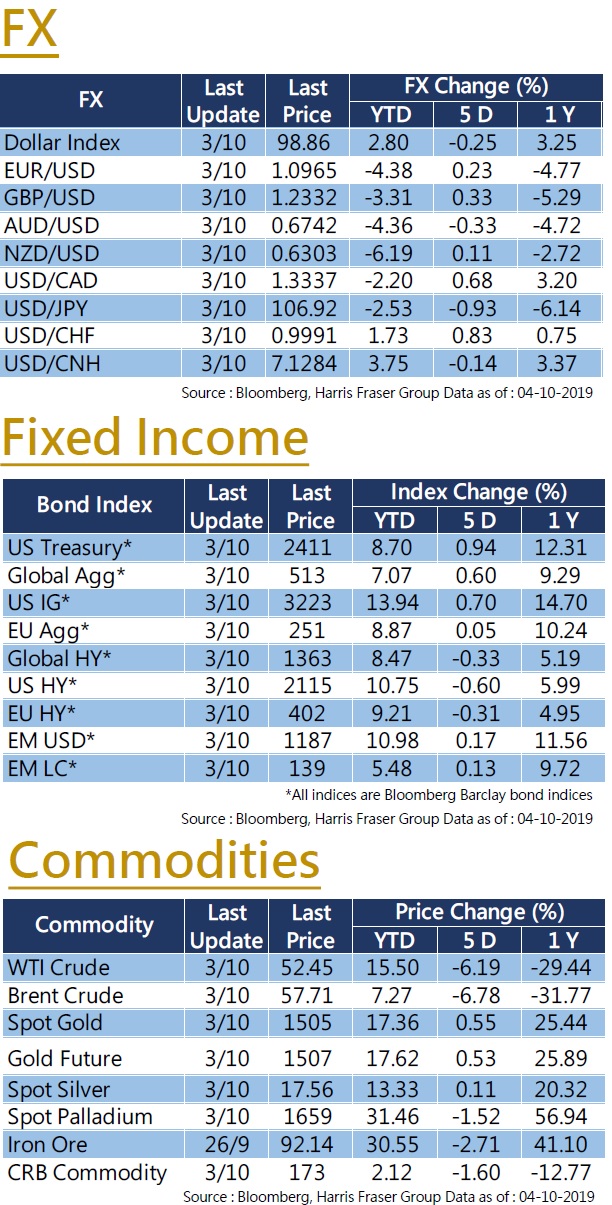

Apart from investing in a replacement property, another viable option is to take advantage of the current low interest rate environment and create wealth through remortgage and property refinancing. Investing in higher-return assets so as to capture the interest rate differential between those and the property refinancing can generate additional “passive income”. Investors can choose interest-generating products of relatively stable prices, such as bonds, bond funds, REITs and high-interest stocks. Among these assets, bonds and bond funds are the most popular, owing to their steady interest payments and comparatively lower price volatility than stocks. These are preferred choices as the interests generated can be used to offset the property refinancing interests.

Cyrus Chan, Investment Strategist at HFG Research Department said, “Higher global property prices in recent years and the low interest rate environment are expected to continue. As a result, proceeds from the remortgage increase and interest expenses decrease, boosting the effectiveness of the interest arbitrage maneuver. Property refinancing, like magic, can reveal usually unseen capital for the investor. Whether used for investment or replacement property, it can create opportunities for wealth creation.”

Cyrus pointed out that with the current reference mortgage rate of 2.625% in Hong Kong, the monthly contribution was only $16,869 with the $4.2 million mortgages amortised over 30 years. If the $4.2 million mortgage amount is used for investment and the average annual return on investment can reach 6%, the average monthly return on investment of $21,000 is sufficient to cover the mortgage installment. Moreover, the mortgage installment is partially returned to the principal, meaning the actual net return will be even larger. The estimated monthly passive income can reach more than 10,000 Hong Kong dollars.

Cyrus continued that there are a lot of investment tools on the market, but he believes that straight bonds and bond funds are more ideal for refinancing investment, because of more stable dividend and price stability characteristics. If the investment amount is more than HK$4 million, one of the options is to consider diversifying the portfolio into straight bond and bond funds. Conversely, if the amount is below 4 million, investing in 1-2 regionally diversified bond funds can be considered. Cyrus said that the average annual dividend payout ratio or total return can reach more than 6% for many straight bonds and bond funds in the market. And the income return can cover the mortgage contributions in a low interest rate environment, thus achieving passive income generation.

In addition, Cyrus did not forget to draw attention to the risks of this mortgage refinancing investment operation, including the mortgage loan interest rate increase, interest income risk, handling fee and liquidity risk; also risks related to the principal and mortgage, including market risk, non-guaranteed or default risk, changes in mortgage ratio risk and inflation risks.

For the market outlook, Cyrus expected that two major worldwide trends will continue, including the slowdown in global economic growth and the low interest rate environment. Under the trend of slowdown in global economic growth, Cyrus believes that the performance of Investment Grade bonds may outperform High-Yield bonds. It may be more desirable for investors to use investment-Grade bonds as a carrying asset. In addition, Cyrus expected that the global low interest rate environment will persist, which will support the refinancing investment environment. Moreover, if the interest rate is further lowered, the bond price will increase and the refinancing investment will produce double benefit in both income and capital.

The Research and Investment Team

Steven Wong is the Investment Analyst at Harris Fraser. He has rich experience in asset allocation, investment management and credit analysis, exceling in combining macroeconomic analysis and technical analysis to determine the optimal asset allocation strategy. Currently he is responsible for macroeconomic analysis, investment strategy development as well as discretionary portfolio management. He actively shares his investment ideas and commentaries in public and he has his own columns in different media including Sing Tao Daily, ET Net and Capital Weekly. Prior to joining Harris Fraser, he was a corporate banker and managed loan accounts of listed companies from the Greater China region. He has experience in M&A loans, project financing and cross-border financing. The loan size that he has dealt with was more than 10 billion Hong Kong dollars.

Cyrus Chan, CFA, currently works as Investment Strategist at Harris Fraser. He advises and manages portfolio for the group's clients. In addition, by doing thorough market research on global economy and investment markets, he also produces investment research reports. He actively shares his investment ideas and commentaries in public, publishing on newspapers, magazines and online sections including ET Net, OrangeNews, Sing Tao Investment Weekly and Headlines News. In addition to the columns, he is also active in multimedia channels, participating in the online videos collaborated by Mason Securities Limited and Harris Fraser Group. Prior to joining the Group, he worked in a number of international banking and financial institutions including HSBC, BOC Hong Kong and Taifook Securities (currently known as Haitong International Securities). He holds a bachelor degree in business administration. Cyrus is a Chartered Financial Analyst® (CFA) charterholder.