加籍港人申請按揭須知網上分享會

09 March 2022

09 March 2022  18:30

18:30 Zoom 線上會議

Zoom 線上會議加拿大銀行駐香港代表為你解答

加籍港人申請按揭須知網上分享會

名額有限 請立即登記

Apply Now

09 March 2022

09 March 2022  18:30

18:30 Zoom 線上會議

Zoom 線上會議名額有限 請立即登記

Weekly Insight February 25

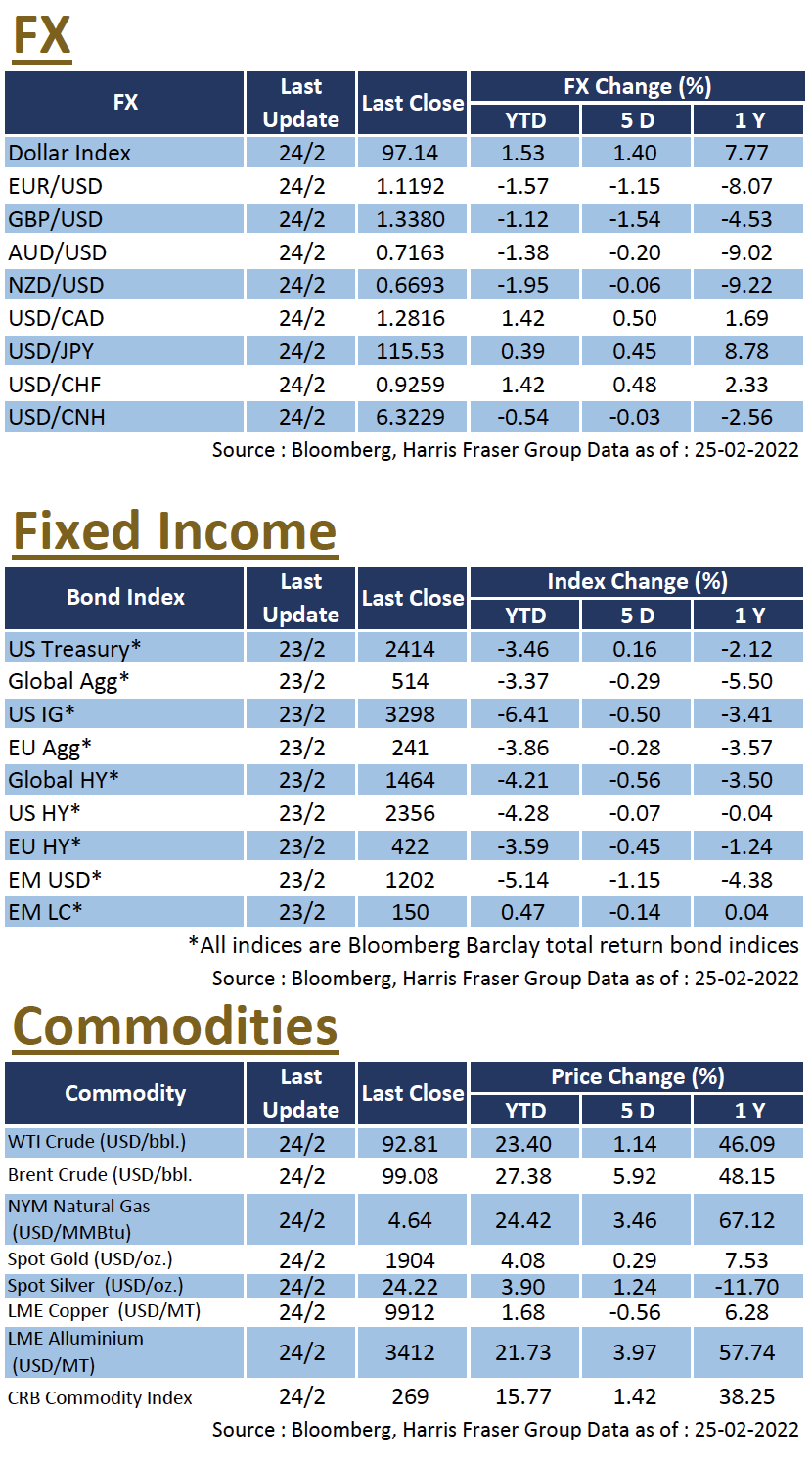

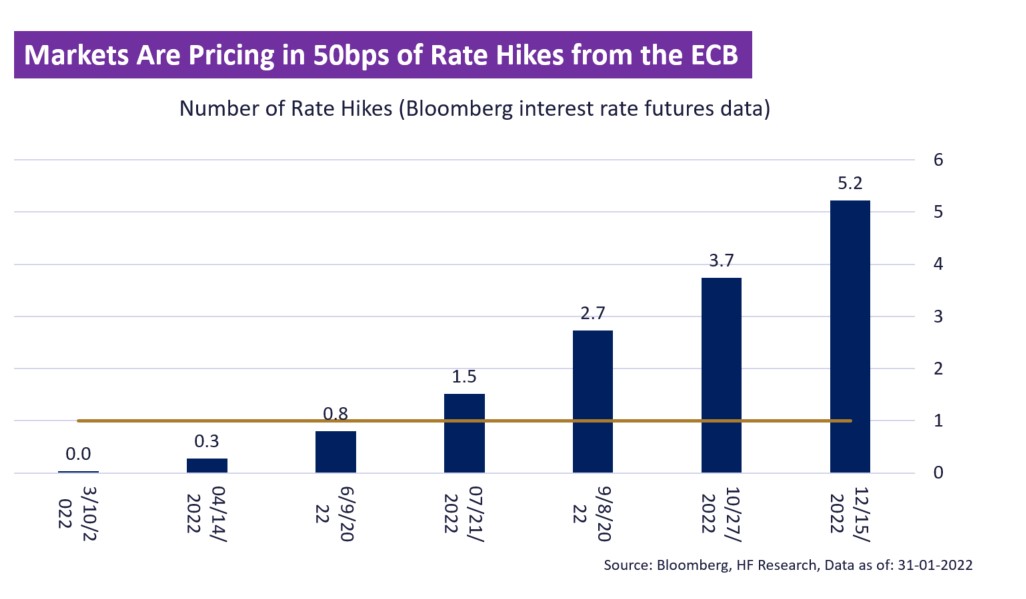

US

USTensions in Ukraine escalated, and it was later reported that Russia began military operation in Ukraine, impacting the global investment market, Asian equities fell across the board on Thursday; the S&P 500 was down 2.62% at one point, the NASDAQ down 3.45% and the Dow down 859 points, after which the three major indices rebounded later in the session. Still, the three indices were still down between 4.16% and 4.90% over the past 5 days ending Thursday.

After Russian President Vladimir Putin recognised the independence of the two regions of eastern Ukraine and dispatched "peacekeepers" to those regions, he then authorised a special military operation to the Donbass region. The Ukrainian capital, Kiev, was hit by a series of missile attacks on military facilities, with the Ukrainian army claiming that its forces had shot down Russian jets and helicopters, which Russia denied. Russians also denied attacking Ukrainian towns, stressing that they only targeted military facilities and air defence systems. In response to the incident, a number of Western countries, including the US, imposed a new round of sanctions on Russia.

As for the interest rate policy, some Fed officials acknowledged the risks associated with the war between Russia and Ukraine, but also stressed the need to address high inflation, with Fed Governor Michelle Bowman expressing support for a rate hike in March, and not ruling out the possibility of a 50 basis point hike. The next Fed meeting will be held on 16-17 March, while the US will release data including ISM manufacturing index, non-farm payrolls, and the Fed Beige Book next week.

Europe

EuropeOn Thursday, reports that Russia had officially authorised a special military operation against Ukraine, coupled with the announcement of increased sanctions against Russia, led to an intraday fall of over 50% in the RTS index, before narrowing its loss to 38.3% at market close. Apart from Russia, major European stock markets in proximity to Ukraine were also affected, the DAX, CAC, and FTSE 100 indices also lost between 3.83% and 3.96% over the day. As the geopolitical situation in Eastern Europe escalated, some ECB officials said that the pace of the exit of its stimulus measures might be slowed down, while Bank of England Governor Andrew Bailey said that the planned tapering might be suspended during the market turmoil. Next week, the Eurozone will release the Consumer Price Index (CPI) for February.

China

ChinaHong Kong equities fell sharply this week and wiped out the gains made so far this year, with the Hang Seng Index down 6.41% for the week and down 2.69% YTD, while the CSI 300 Index fell 1.67% for the week and extended its YTD losses to 7.43%. Recently, the focus has been on the situation in Ukraine, sending the price of commodities such as gold and oil up, and the market is mostly speculating on sectors that benefit from the rising gold and oil prices, related sectors are performing well, the market will continue to pay attention to the situation in Ukraine. Next week, China will release the Official and Caixin Manufacturing PMI data.

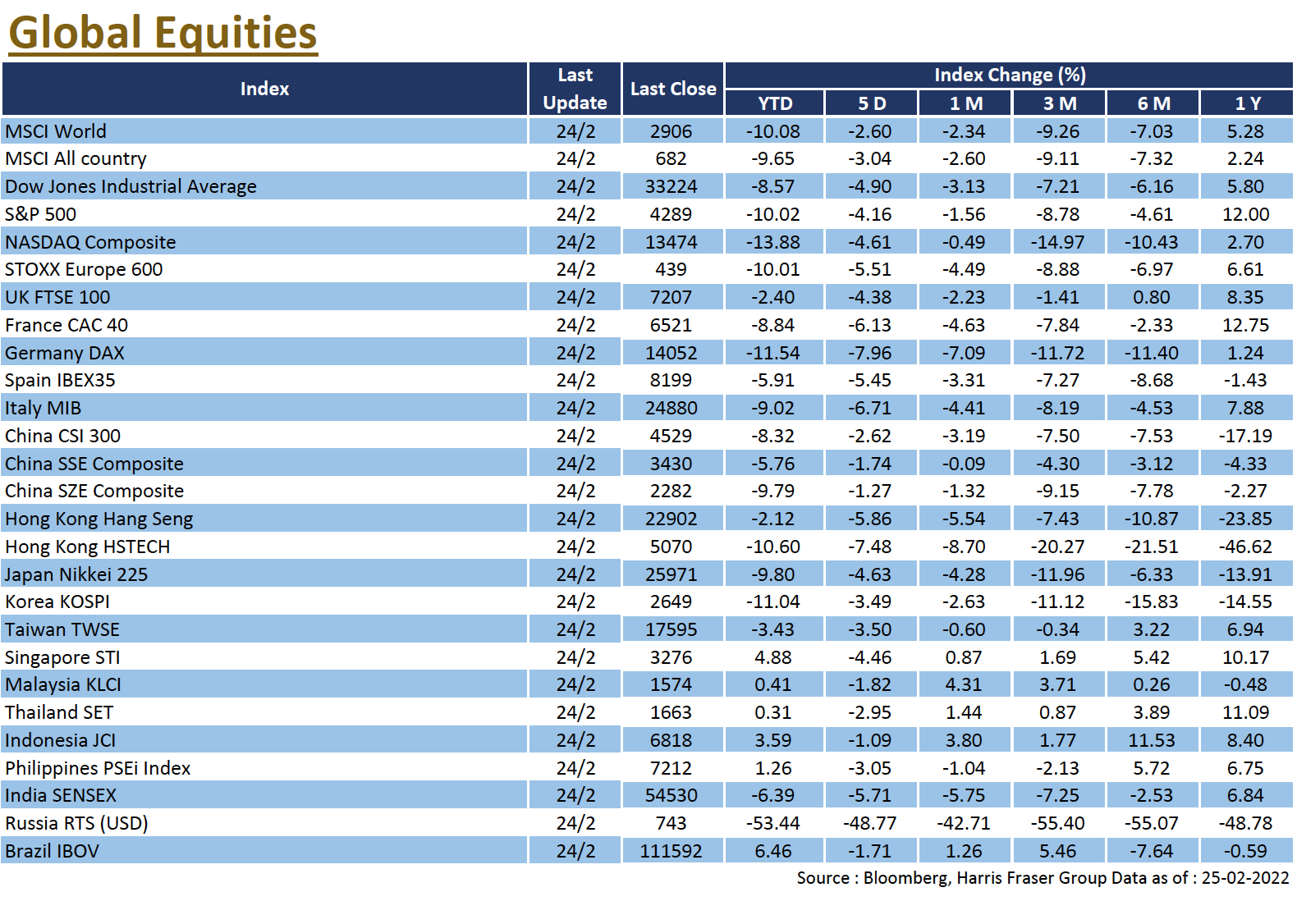

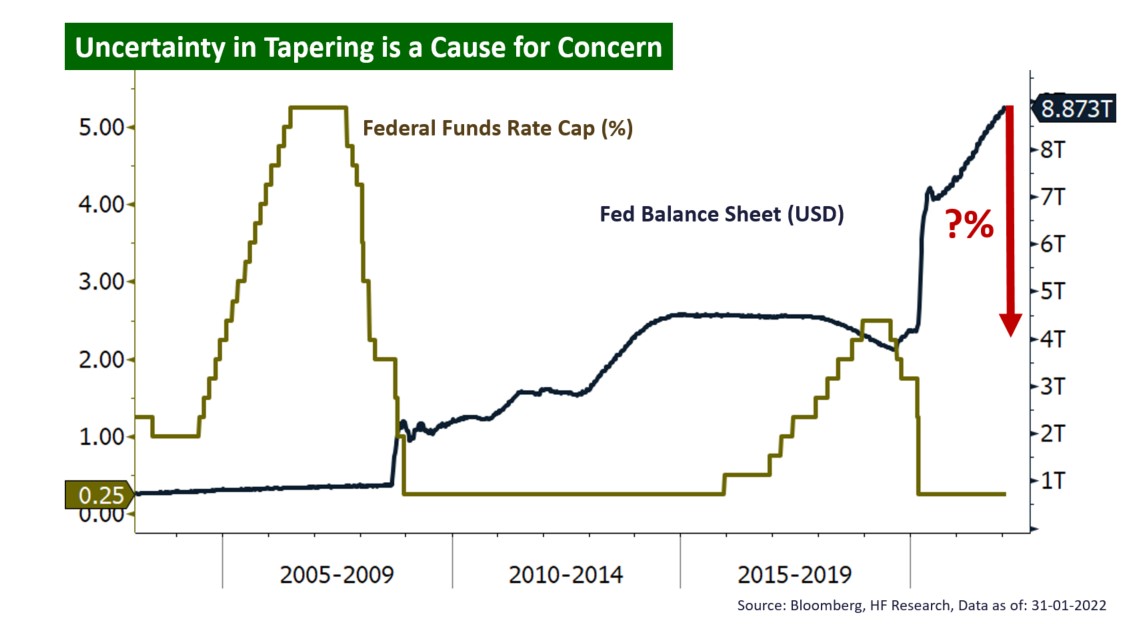

Inflationary pressures remain, together with both forms of monetary tightening (rate hikes & tapering) threatening fixed income market performance.

Over the month of January, the Bloomberg Barclays Global Aggregate, US Investment Grades, US High Yields, and Emerging Markets US Dollar Bonds down 2.05%, 3.37%, 2.73%, and 2.63% respectively.

Inflation in both Europe and the US continue to set record highs in recent years. Henceforth, in order to reign in the runaway inflation, Fed president Jerome Powell mentioned that tapering could start within the year, which would put more pressure on asset prices due to the reducing liquidity. As for the ECB, they have seemingly shifted their stance on the inflation outlook and monetary policy. Concerned about the high inflation, the ECB announced a reduction of asset purchases over the year. The turnaround was unexpected and puts pressure onto the bond market.

The elevated inflation was one of the main reasons for the tightening policy, which was caused by a myriad of factors. The ongoing energy crisis, supply and demand imbalance in general, and the lingering supply chain problems further adds fuel to the fire. With continued tightening expected, fixed income as an asset class this year is expected to underperform. If one still has to invest in fixed income, we will continue to propose prioritising high yields for their shorter duration and higher carry. We see Asian bonds in particular as a unique investment opportunity, as the loosening monetary in the region could lift the market in 2022.

The Japanese equity market performed in line with global markets, concerns over global monetary policy tightening and higher geopolitical tensions all contributed to the weaker market sentiment. Over the month of January, the Nikkei 225 lost 6.22% (6.18% in US$ terms), while the TOPIX also ended 4.84% lower (4.80% in US$ terms).

COVID showed no signs of easing in the country, as daily infected figures continue to climb, despite a flurry of countermeasures dedicated to limit the spread. As of late, the government have finally started to shift its position on the pandemic restrictions, announcing reopening its borders, which could hopefully relief some of the pressure on badly hit sectors of travel, hospitality, and services in general. This could mark the start of the transition from a low tolerance policy to the coexistence one, which should also help lift the corporate earnings forecast in the market.

That said, economy itself remains relatively weak, leading indicators are still mixed at best, confidence indices are less positive. However, the key item of inflation in Japan is still far lower than the global average. This could give the market an edge as the central bank is expected to keep the loose monetary policy unchanged, which prevents a significant valuation compression. These should keep the market afloat despite the weaker fundamentals. We stay neutral on the market for the whole year.

Emerging market equities were actually one of the few better performing geographies across global markets. Although fundamentals were still relatively weaker, there is bounce back on the back on low valuations, and the fact that monetary tightening has already been priced in. Over the month of January, MSCI emerging markets index slightly lost 1.93%.

Some EM markets rebounded, the Brazilian market in particular had a good run in January, which was helped by the large amount of capital inflows, the low valuation, positive political outlook, and strong commodities prices. However, this situation is not expected to stay for an extended period, as factors such as inflows and cheap valuations will fade out in the medium term. For the 2022 outlook, we would still need to focus on the more fundamental aspects of the market.

At the moment, we are still cautious on EM as a whole, as we see no change in the pain points that we have always highlighted. While the pandemic is seemingly more serious in the developed economies figure wise, their higher vaccination rates allow them to keep economic activities relatively unaffected. Moreover, higher inflation, rising interest rates with a stronger dollar puts pressure on EM equities. Henceforth, we remain neutral on the EM outlook for the full year, and the only stay selectively positive on specific markets, namely China and southern Asian markets, as they are helped by the controlled pandemic situation, less inflationary pressures, and a stronger economic outlook.

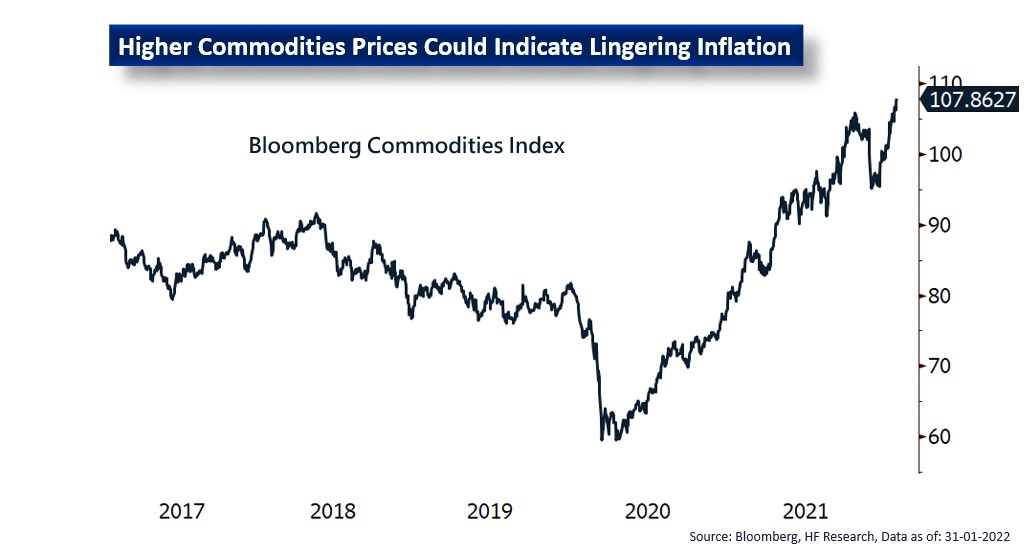

Global equity markets overall started off the year with a weak January, European markets were also affected. With the energy crisis exacerbated by worries over the Ukrainian situation, inflation spiked, COVID outbreak continued, and monetary policy tightening is seemingly on the way. In January, the European STOXX 600 index fell 3.88% (5.29% in US$ terms).

Pandemic remains a hot topic, as the Omicron variant swept through the region, bringing cases far above previous waves. However, we expect a limited impact to the economy compared to previous outbreaks, as government restrictions and lockdowns are less stringent. That said, even though the economic growth is expected to stay decently in line with early projections, the fast-spreading virus still reduced the workforce available, adding further pressure to the strained supply chain. This is also one of the contributing reasons why the inflation level is high.

The latest CPI print in Europe was a whopping 5.1%, representing a problem for the central bank. ECB President Christine Largarde was surprisingly hawkish, announcing tapering of asset purchases, and even refused to rule out a rate hike before the end of the year. Markets have started pricing in faster tightening, with the ECB widely expected to increase rates by 50bps within the year. The sharp turn from the ECB could bring forth more downside pressure in the equity market even as corporate earnings and economic conditions improve. With the high levels of volatility in the market due to uncertainties, before market conditions stabilise, we would opt for a wait-and-see approach in the meantime before actually entering the market.

Weekly Insight February 18

US

USWith prospects of a faster rate hike from the Fed, and the situation in Ukraine heating up, equities fell sharply, with the S&P 500 back below its 200-day average, and the three major US indices down between 2.64% and 3.31% over the past five days ending Thursday. Initially, Russia had signalled a partial withdrawal of its troops, which at one point spurred a rally in global equities. Later, the US and NATO said that Russian presence on the Ukrainian border was increasing instead, and US President Joe Biden warned that there was a ‘very high probability’ that the Russians would launch an attack on Ukraine within a few days, which led to a shift in market sentiment again, sending safe-haven assets such as gold above US$1,900 per ounce at one point.

On the interest rate front, the US Federal Reserve released the minutes of its January interest rate meeting, with officials agreeing that interest rates should be raised as soon as possible, and the Fed should remain vigilant about high inflation, some members further agreed that the current situation warrants the start of tapering later in the year. Current interest rate futures data suggest a 50 basis point hike in March and a total of 100 basis points before we move into the second half of the year. On the economic front, the US Producer Price Index (PPI) in January were higher than expected, following the earlier surprise in Consumer Price Index (CPI), reflecting that inflation in upstream raw materials remained worse than expected. Next week, the US will release important data including the Markit Manufacturing PMI and the Consumer Confidence Index for February.

Europe

EuropeEuropean stocks followed external markets as the geopolitical tensions in Ukraine intensified, with the UK, French, and German equities falling between 1.44% and 2.18% over the past 5 days ending Thursday. Markets were focused on the ECB's monetary policy position for the year, as ECB President Christine Lagarde expressed her concerns about inflation earlier, and then said she would act at ‘the right time’ and would not rush to exit the Eurozone’s current simulative measures. In addition, the International Monetary Fund (IMF) has said that the supply chain problems in the Eurozone may continue until 2023. Next week, the Eurozone will release data including the Markit Manufacturing PMI for February.

China

ChinaHong Kong stocks were under pressure partly due to the situation in Ukraine, ending the week with a 2.32% drop, while China A-shares recovered modestly, with the CSI 300 Index rising 1.08% over the week. Against the backdrop of surging inflation in Europe and the US, China's January Consumer Price Index (CPI) slowed to 0.9% YoY, down from 1.5% YoY in December, while the PPI also moderated. On the other hand, there were further regulatory guidelines from Chinese authorities, with the National Development and Reform Commission urging takeaway platforms to lower their service charges, pressuring shares of a number of takeaway platform companies. Next week, China will announce the 1-year and 5-year LPR rates.

While the Chinese equity market itself was less affected by the external market conditions, policy uncertainty and epidemic situation helped drive expectations of a weaker economic growth. Over the month of January, the Shanghai Composite and CSI 300 Index lost 7.65% (7.72% in US$ terms) and 7.62% (7.70% in US$ terms), while the Hang Seng Index was one of the only few major equity markets that managed to post a positive return, ending the month 1.73% (1.73% in US$ terms) higher.

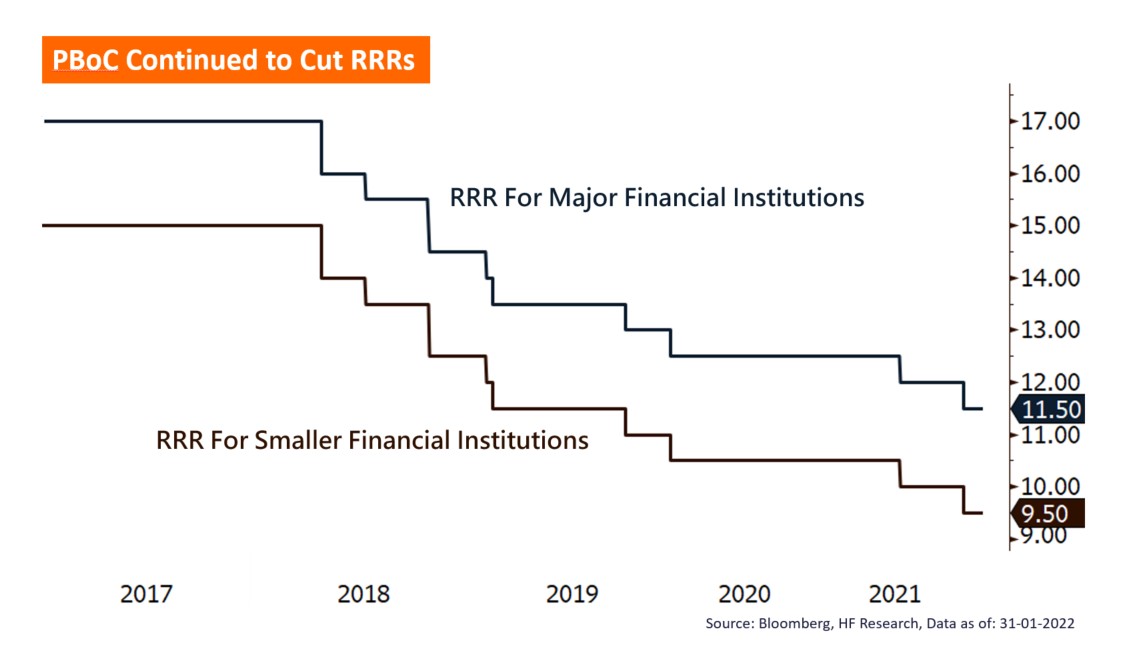

Ever since the strong initial rebound in 2020, the economy growth has been slipping, with various sectors hit by the ongoing regulatory upheaval as reflected by the corresponding indicators. As a result, equity performance has underperformed global equities. While this situation might not completely resolve by itself in the short term, considering the shifts in the message from the authorities in China, with the emphasis put on increasing the economic stability, we could be looking at a gradual loosening in terms of both fiscal and monetary policies.

The battered real estate sector should see pressures alleviating with the loosening policies, this could also help support sectors that we are bullish on, including the technology sectors with compressed valuations, and the carbon neutral sectors. However, as China continues to adopt a zero-tolerance policy against COVID, we would avoid the relevant sectors that are more affected by the curbs on travel and services. Overall, we are positive on China for the year, as the country is likely going for a contrarian fiscal and monetary policy.

US markets bore the brunt of the correction over the month of January. Although Omicron had a relatively limited impact on the economy, the elevated inflation levels pressured the Fed to adopt more monetary tightening. US equity markets were under pressure, the Dow, S&P 500, and the NASDAQ fell 3.32%, 5.26%, and 8.98%.

Omicron continue to dominate the epidemic landscape, but the high infection figures are not deemed to be a problem, as government lockdowns and restrictions were not in place, which should help support the economy. Fundamentally, US equities are still relatively strong, although economic sentiment indicators have slightly receded, corporate earnings are still strong, with a majority of reporting S&P 500 constituents reported earnings beats; the forward EPS of US equities are still being revised up. Henceforth, the key of the equity market outlook lies in non-fundamental factors.

The biggest headwind came in form of the elevated inflation. The US CPI hit a 40 year high, raising concerns over faster monetary tightening. According to the US Fed, tapering of its balance sheet would happen this year, and rate hikes would start after asset purchases reach zero. This is a significant shift, which could mean a change in the post-pandemic ‘new normal’. If the current expectations were to materialise, the US equity market could see further downside via valuation compression. Although we expect the full year performance could be in the low single digits, we would opt to stay on the side-lines in the short-term given the uncertainties present.

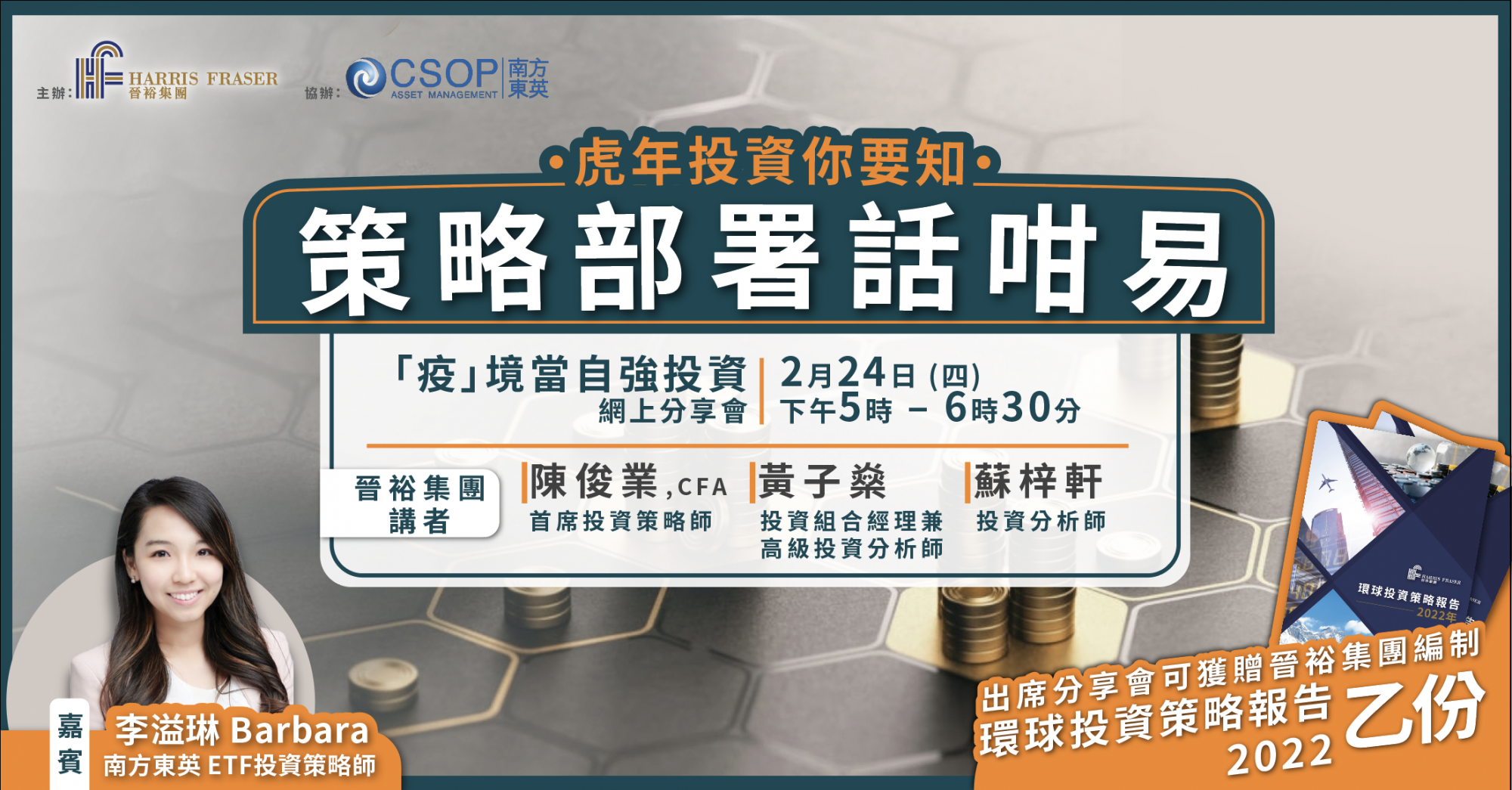

24 February 2022

24 February 2022  16:30 - 18:30

16:30 - 18:30 Zoom 線上會議

Zoom 線上會議名額有限 請立即登記