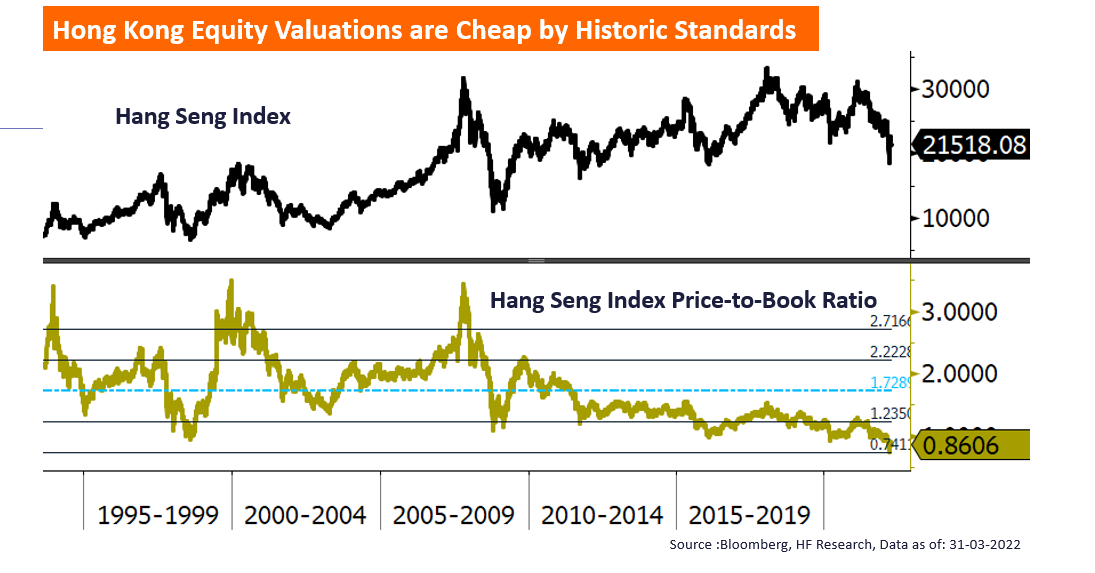

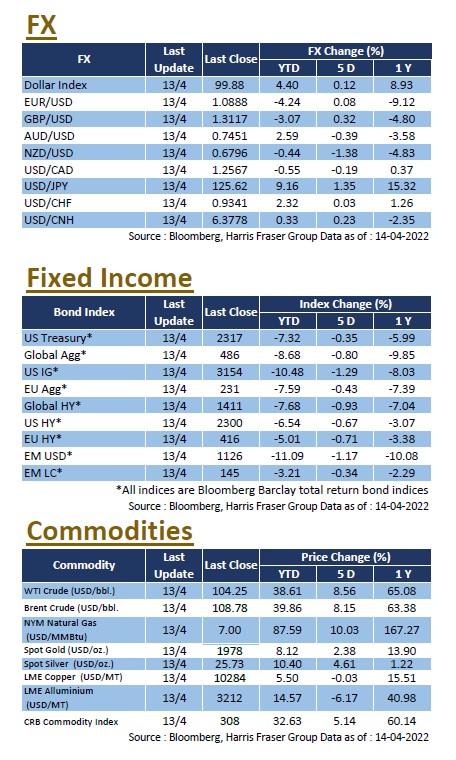

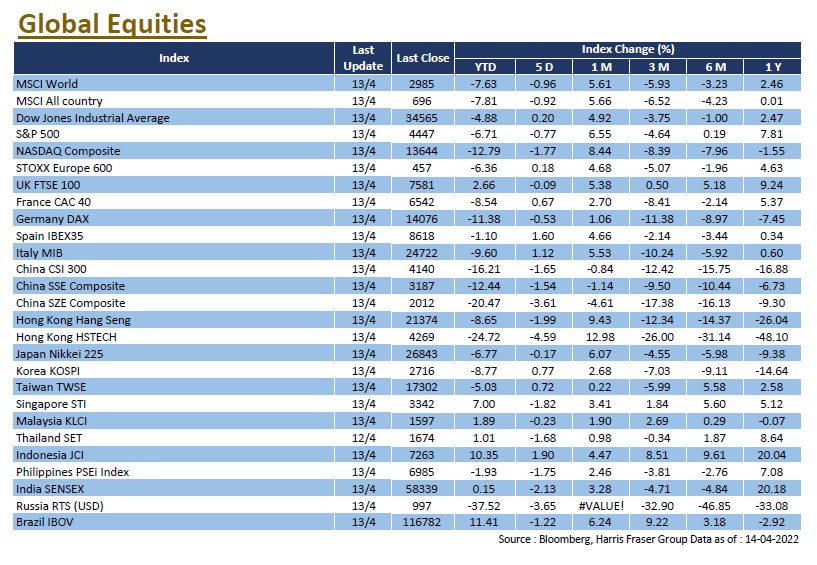

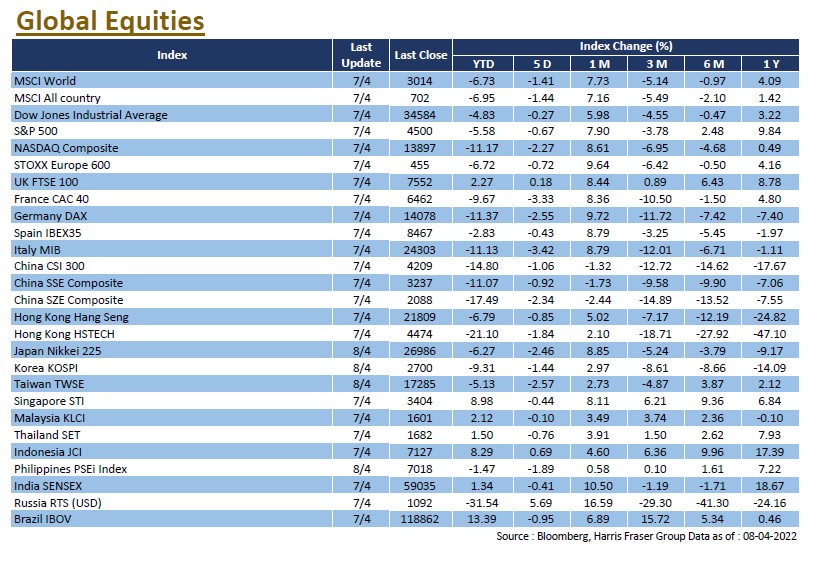

Southern Asian market did decent with the FTSE ASEAN 40 index gaining 1.93%, but the overall environment remains challenging. Overall, global uncertainties over the economy and geopolitics remain, EM equities continued to suffer with Chinese equities leading the fall, MSCI emerging markets index lost 2.52% over the month of March.

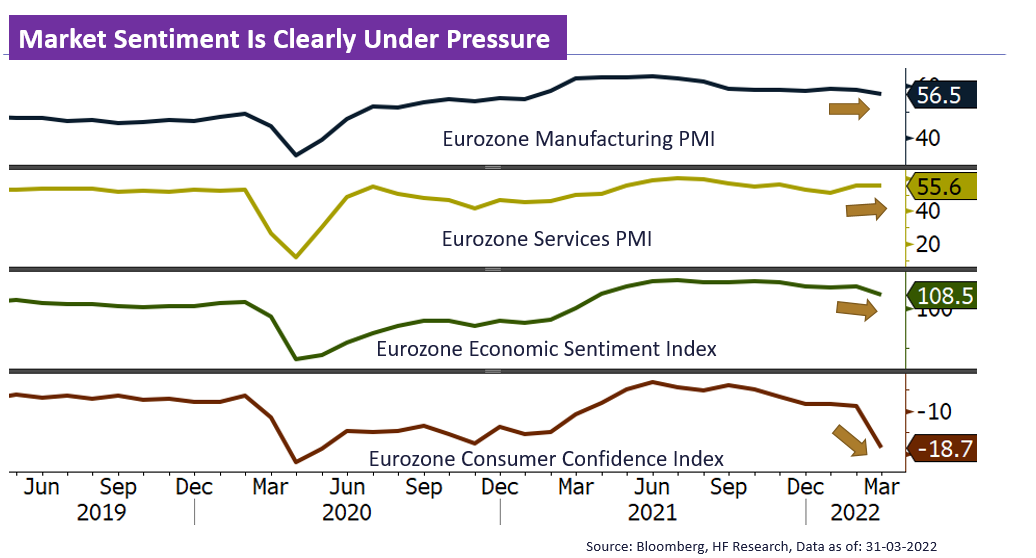

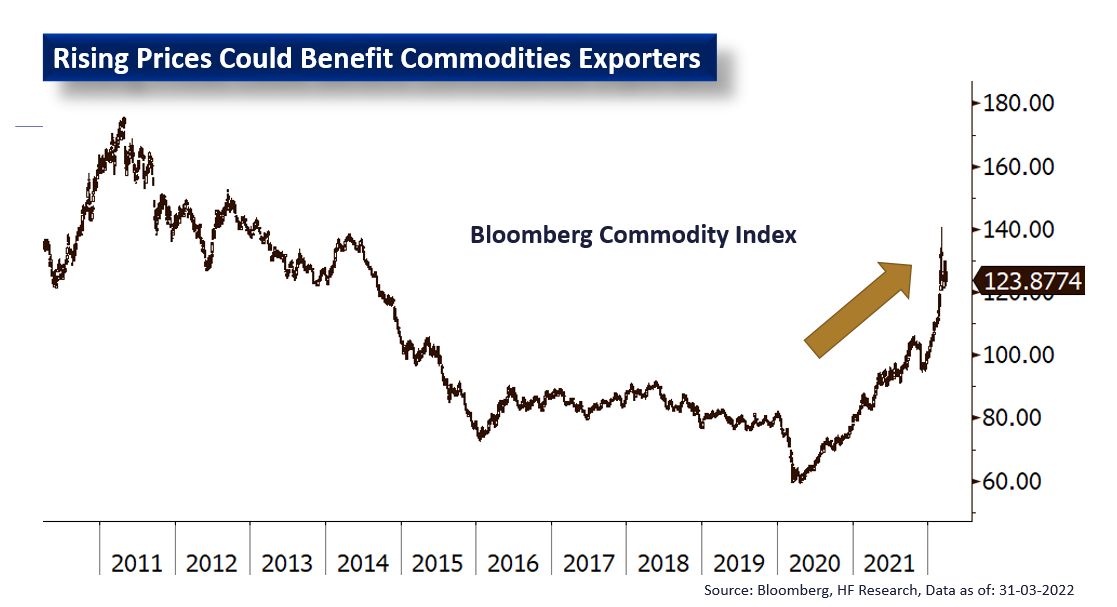

The situation in Ukraine remains troubling, but further escalation of the current situation seems to be an unlikely event. Henceforth, the direct risks arising from the Ukraine uncertainty should have been well priced into the current market. However, the lingering side effects due to the conflict, including the supply shortage on several key commodities, would likely fuel the high inflation for the time being, posing as a problem to the global economy. We do note that exporting countries could somewhat benefit from the higher commodities prices, but imported inflation remains a problem for many.

Global central banks have raised interest rates and tightened their monetary policy, EM central banks were no exception. While rate hikes could potentially help rein in inflation, they also deal damage to the physical economy, making it a two-edged sword. We still find emerging markets to be less attractive as an investment option, as negative factors such as the weaker economy, capital outflows back to DMs, and the stronger Dollar remain in place for the time being. Henceforth, we remain conservative on EM in the short term, while modestly optimistic on China and Southeast Asian markets over the longer investment horizon.

US

US Europe

Europe China

China