US

US

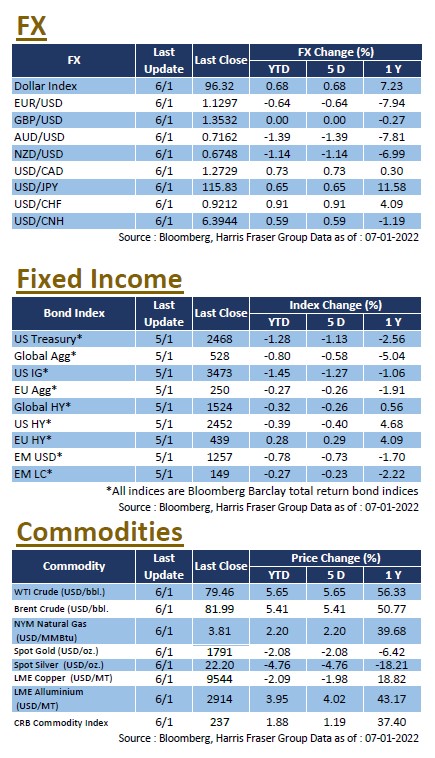

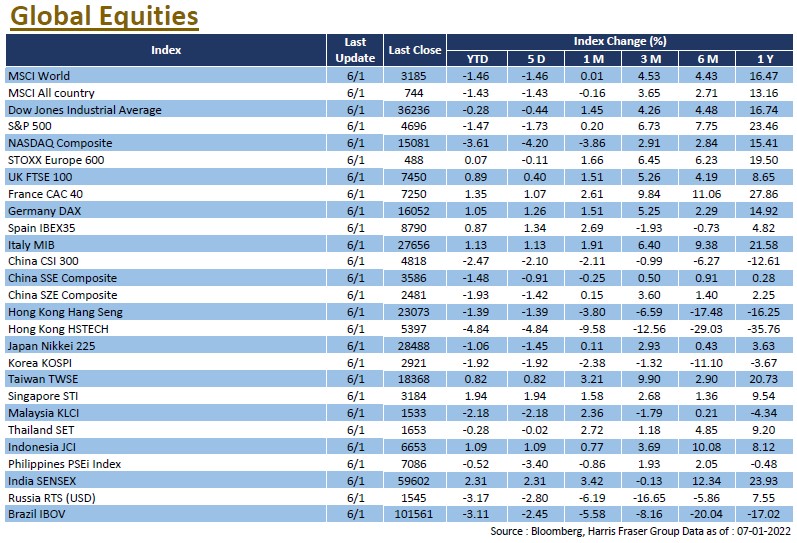

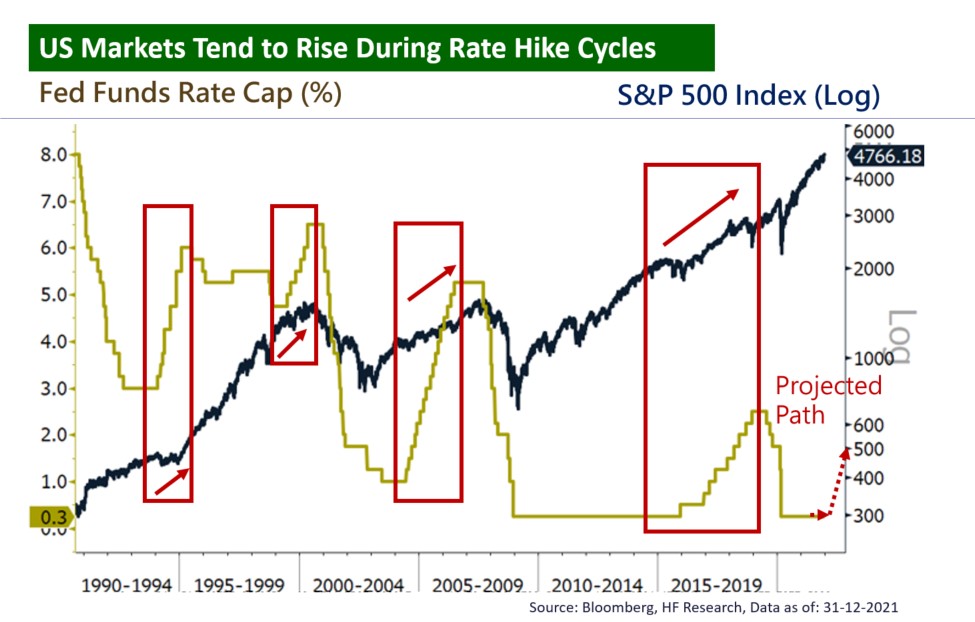

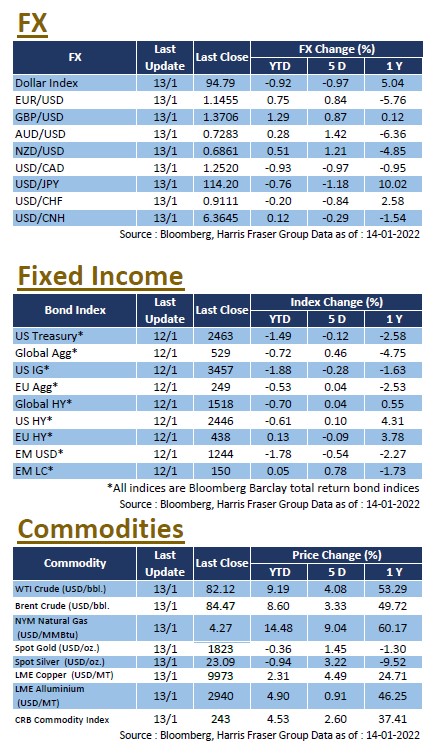

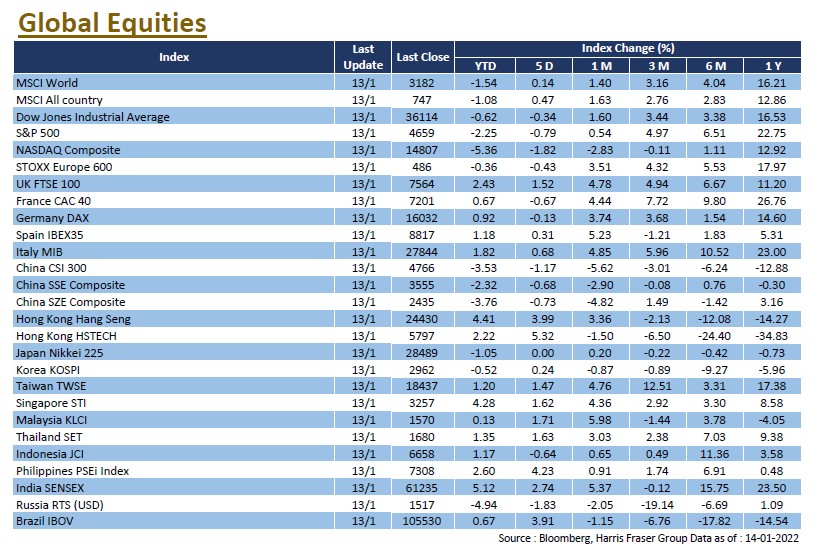

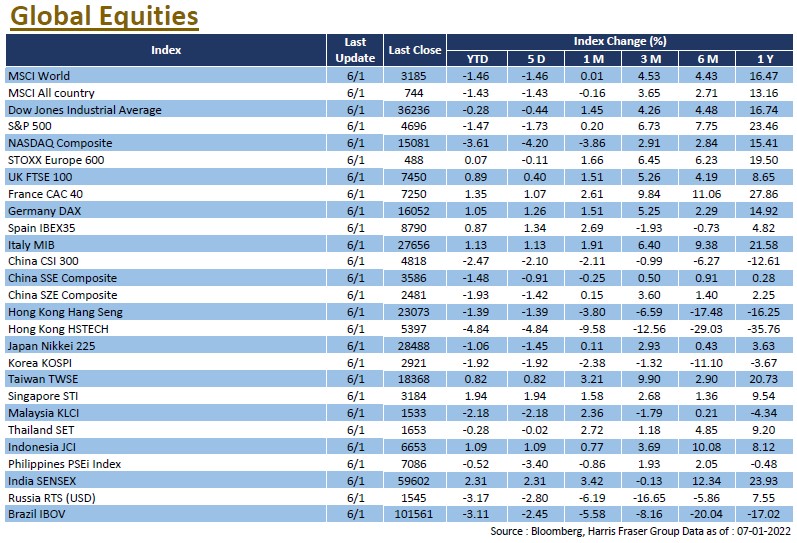

Global equities got off to a poor start in the New Year, the US market fell in line, the S&P 500 was down 1.47% over the 5 days ending Thursday, the Dow shed 0.44%, and the technology-heavy NASDAQ lost 4.2%. The decline in the US market was attributed to signals from the US Federal Reserve to speed up the “tapering" process. The released Fed December minutes indicated that interest rates may be raised earlier than expected, and subsequent tapering of the balance sheet is considered. Later, St. Louis Fed President Bullard said the Fed could start raising interest rates as early as March, and then it could start trimming its balance sheet. According to Bloomberg interest rate futures data, the probability of a rate hike in March rose to nearly 80%, and the market is worried that the accelerated pace of rate hikes may put pressure on the economy. The VIX index, a reflection of market fears, rose to 21.06.

On the economic front, the number of initial jobless claims rose in the US, but was still close to a record low; while the number of US ADP jobs added in December was the highest in seven months. Nonetheless, the ISM Manufacturing and Services indices were 58.7 and 62.0 respectively in December, both lower than the previous reading and missed market expectations, reflecting weakening economic activity. Next week, Hearings on the re-election of US Federal Reserve Chairman Jerome Powell are scheduled for 11 January, while hearings on the nomination of Lael Brainard as Vice Chairman will also be held on 13 January. In addition, the US will release CPI, retail sales, University of Michigan market sentiment data, and the Fed will publish the latest Beige book.

Europe

Europe

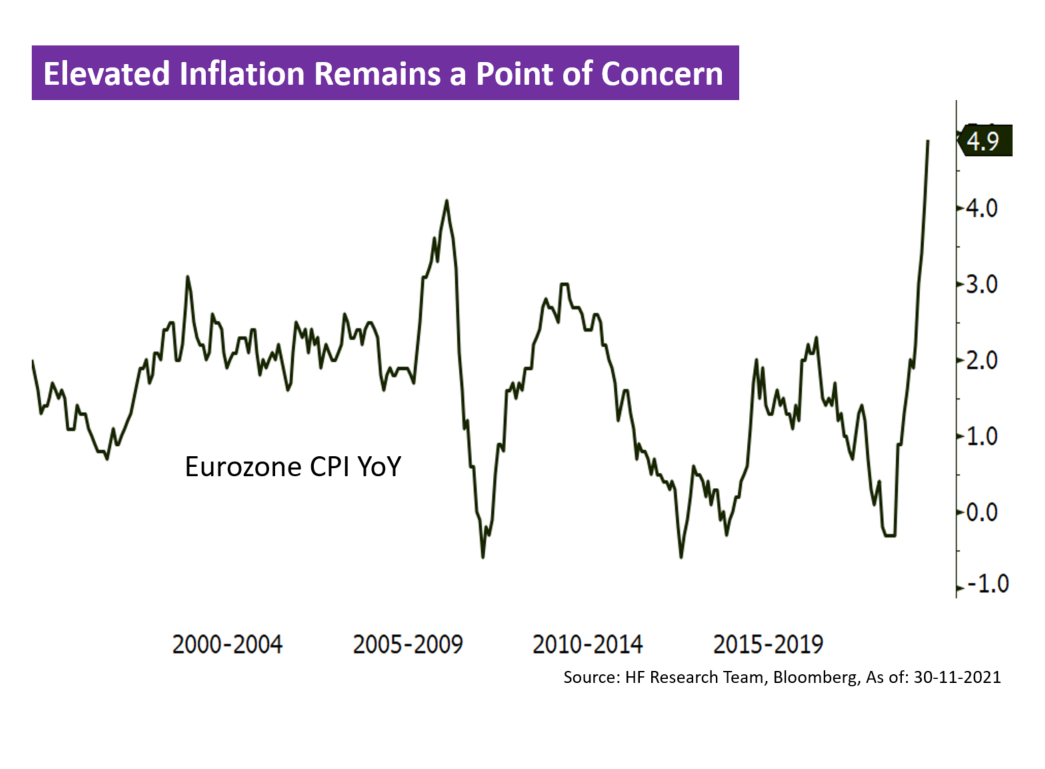

European equities had a better run than the US, with the FTSE 100 up 0.89%, Germany's DAX up 1.05%, and France's CAC up 1.35% in the first four days of 2022. European benchmark gas prices for next month's deliveries rose by 20% at one point due to a reduction in gas deliveries from a key Russian pipeline through Ukraine. In addition to gas prices, markets were also concerned about inflation in Europe, with Germany reporting a 5.3% YoY figure for December CPI, higher than both market expectations and the previous reading. ECB Governing Council member Martins Kazaks said the bank would take action if the inflation outlook worsened. Another member of the Governing Council, Francois Villeroy de Galhau, expects inflation in the Eurozone to be nearing its peak. Next week, the Eurozone unemployment rate and the Sentix investor confidence index will be released.

China

China

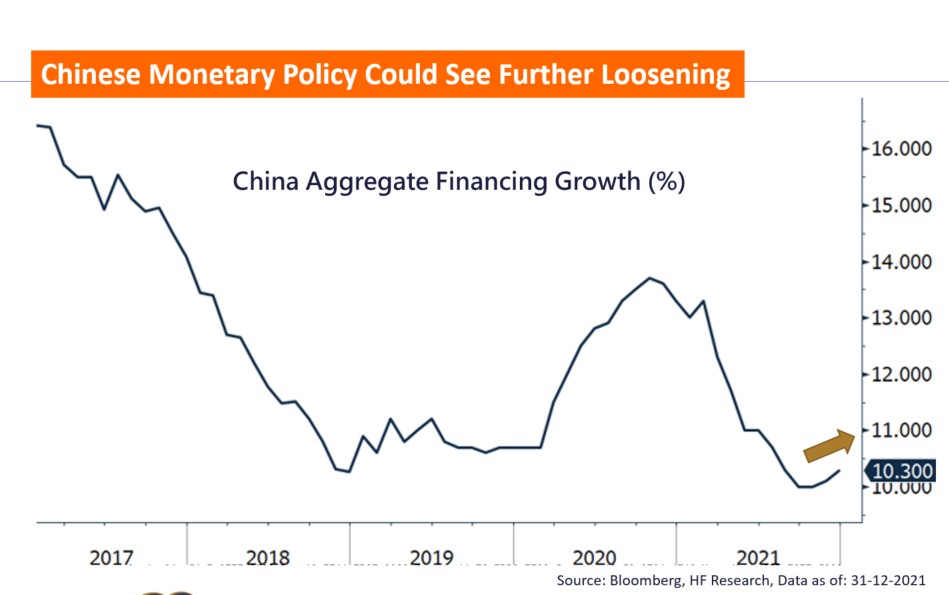

Hong Kong and Mainland equity markets diverged heading into 2022, with the CSI 300 Index falling in recent days, 2.39% lower over the week, whereas the HSI rebounded on Friday, reversing its weekly weakness and rising 0.33% over the week. On the data front, the Caixin China Manufacturing and Services PMIs for December were 50.9 and 53.1 respectively, both improving over the November figures. Premier Li Keqiang called for greater tax and fee cuts, as well as special support for the service sector and other areas severely hit by the epidemic, to ensure steady economic growth in the first quarter. China will release CPI and PPI figures for December.

US

US Europe

Europe China

China

15 January 2022 -

15 January 2022 -  12:00 - 18:00

12:00 - 18:00 銅鑼灣利園3期4樓

銅鑼灣利園3期4樓

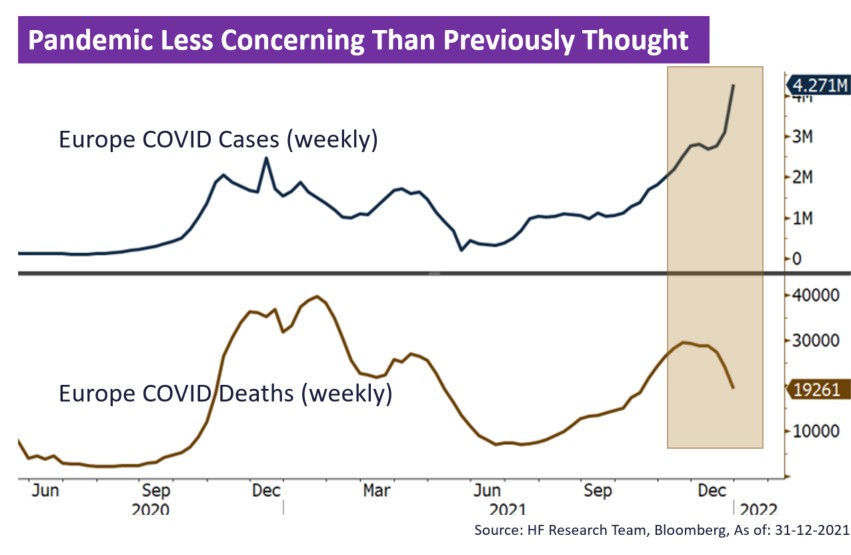

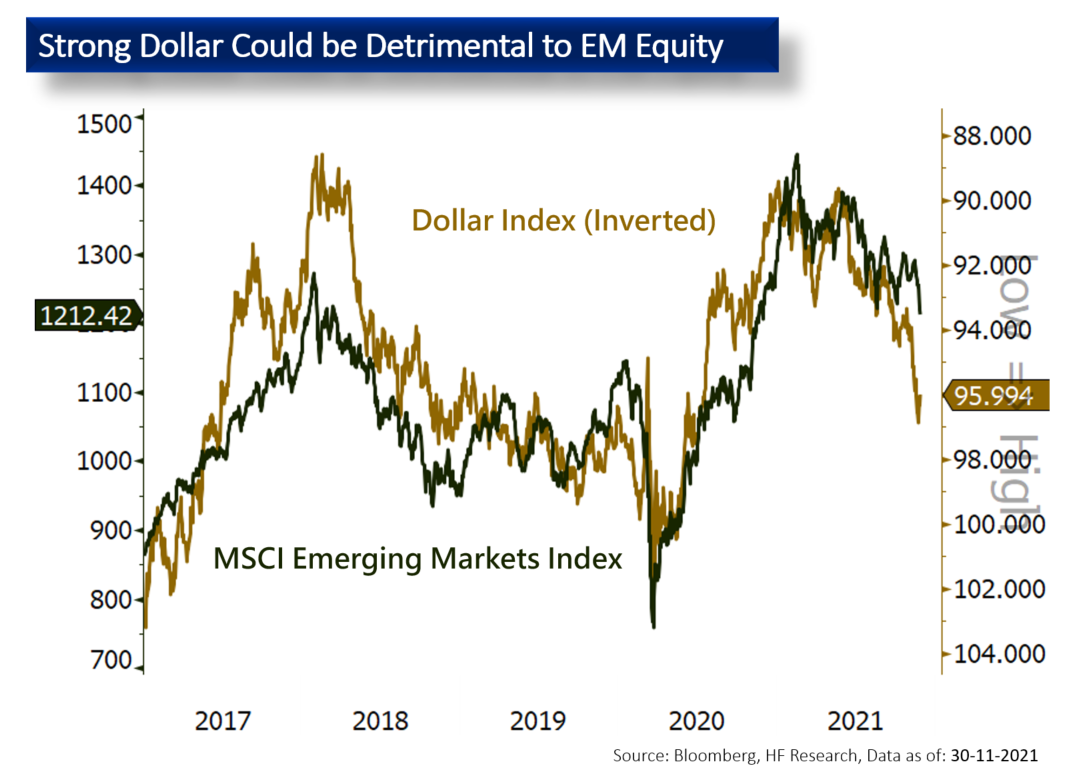

onetary policy in the US materialised, the Dollar is expected to strengthen, and EM economies could see pressure ahead in form of hiking rates and capital outflows. We continue to hold a conservative outlook for EM equities in the short term before the dust over the Omicron variant settles, by then one could consider geographies with better pandemic control, as those markets could possibly see recovery further ahead in the New Year.

onetary policy in the US materialised, the Dollar is expected to strengthen, and EM economies could see pressure ahead in form of hiking rates and capital outflows. We continue to hold a conservative outlook for EM equities in the short term before the dust over the Omicron variant settles, by then one could consider geographies with better pandemic control, as those markets could possibly see recovery further ahead in the New Year.