After the rally in the previous month, Chinese markets retreated in September following global markets. The CSI 300 and the Shanghai Composite Index lost 4.75% (3.94% in US$ terms) and 5.23% (4.43% in US$ terms) respectively, while the Hang Seng Index also fell 6.82% (6.82% in US$ terms).

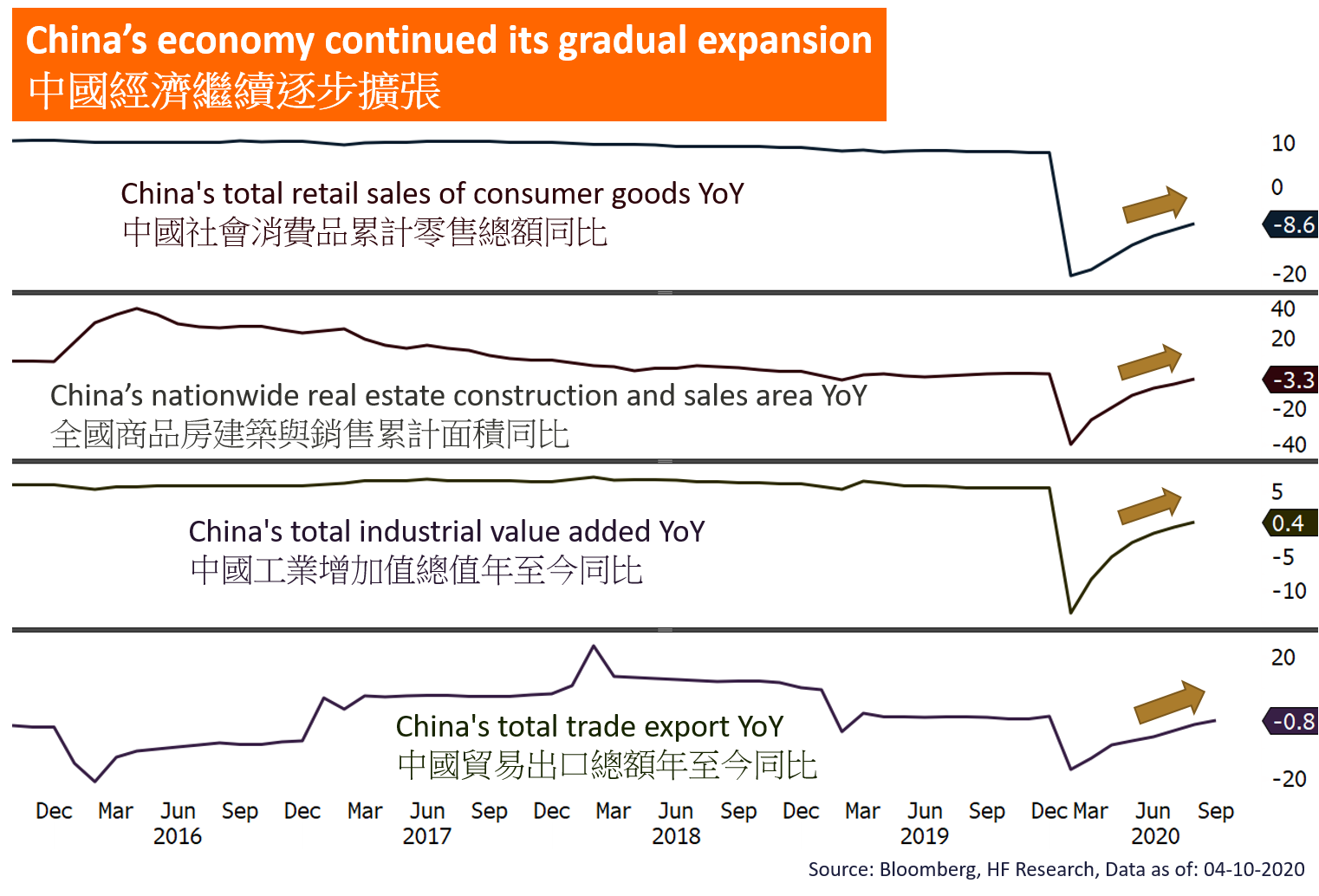

As numerous concurrent and leading indicators showed, Chinese economic fundamentals continued its recent uptrend, industrial production in particular finally achieved a positive growth on a YoY basis, cementing proof that the Chinese economy has hit rock bottom earlier and would continue its recovery with the aid of the government. With the Fifth Plenary Session of the 19th Central Committee scheduled to be held by the end of October, market participants looking for more colour on policy direction should monitor the upcoming 14th Five-Year plan closely.

In the short to mid-term, the “Two circulation” rhetoric should continue, and expect the government to keep its priority on economic stability, these together should continue to support growth in the new economy sectors in the years to come. In addition, the Fifth Plenary Session comes with a potential catalyst for clean energy sectors in particular, as the Chinese government recently mentioned striving for carbon neutrality by 2060, which should signal more policy support in the pipeline. Nevertheless, markets should remain volatile as the US elections close in, investors should stay cautious before the uncertainties are cleared.