US equities went up in November, S&P 500, Dow Jones and NASDAQ rose 3.40%, 3.72%, and 4.50% respectively.

Q3 GDP growth was revised up to 2.1% YoY, which further improved market sentiment with positive news over the trade war. Throughout November, it was reported numerous times that the 1st stage of the Sino-US trade agreement will be signed soon, driving the markets to historic heights.

From the fundamental perspective, the latest Fed Beige Book gave the markets better insight into current market conditions. According to the report, Fed members see the economy expanding moderately and the manufacturing sector has shown signs of improvement with limited inflation pressure. Thus, the Fed is unlikely to change rates in the short to mid-term. Other economic indicators also find that the US economy is showing signs of stabilisation. Apart from the ISM PMI figures, other PMIs regained momentum and rebounded, hinting at a brighter outlook on the US economy.

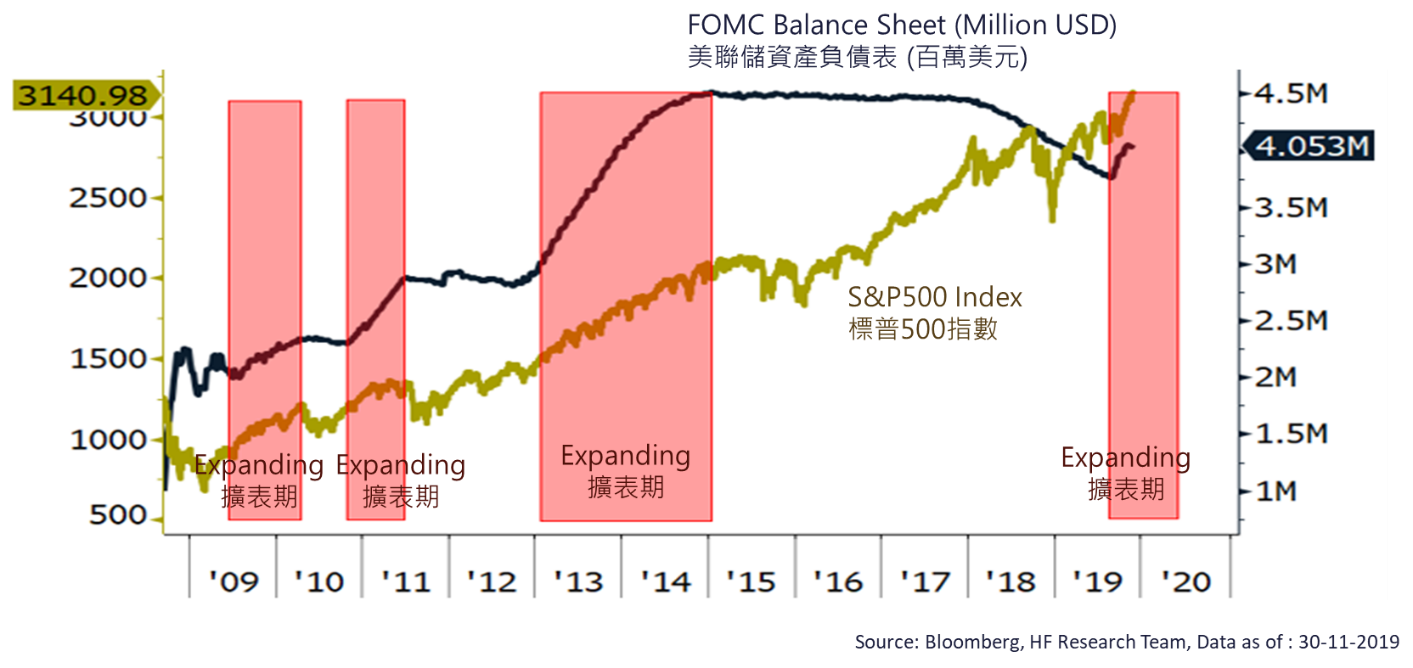

On the monetary side, the Fed is unlikely to cut rates in December. While this might provide less support to the markets, the ongoing Fed balance sheet expansion will likely continue to boost asset prices across the board. In the past, markets tend to perform better with lower volatility during periods of Fed balance sheet expansions, when compared to periods of flat or reduction in the Fed balance sheet. As QE is expected to continue well into 2020 Q2, we could expect a decent equity performance until then, despite the relatively higher current valuation. The US market remains the go-to equity market with the earnings to back its performance, but caution is always needed in volatile markets.