Chinese markets continued the relatively stronger performance against global equities, as the virus has seemingly gotten under control in the country, with confirmed figures growing less by the day. In March, the CSI 300 Index and the Shanghai Composite Index were down by 6.44% (7.64% in USD) and 4.51% (5.73% in USD) respectively, while the Hang Seng Index also went down by 9.67% (9.17% in USD).

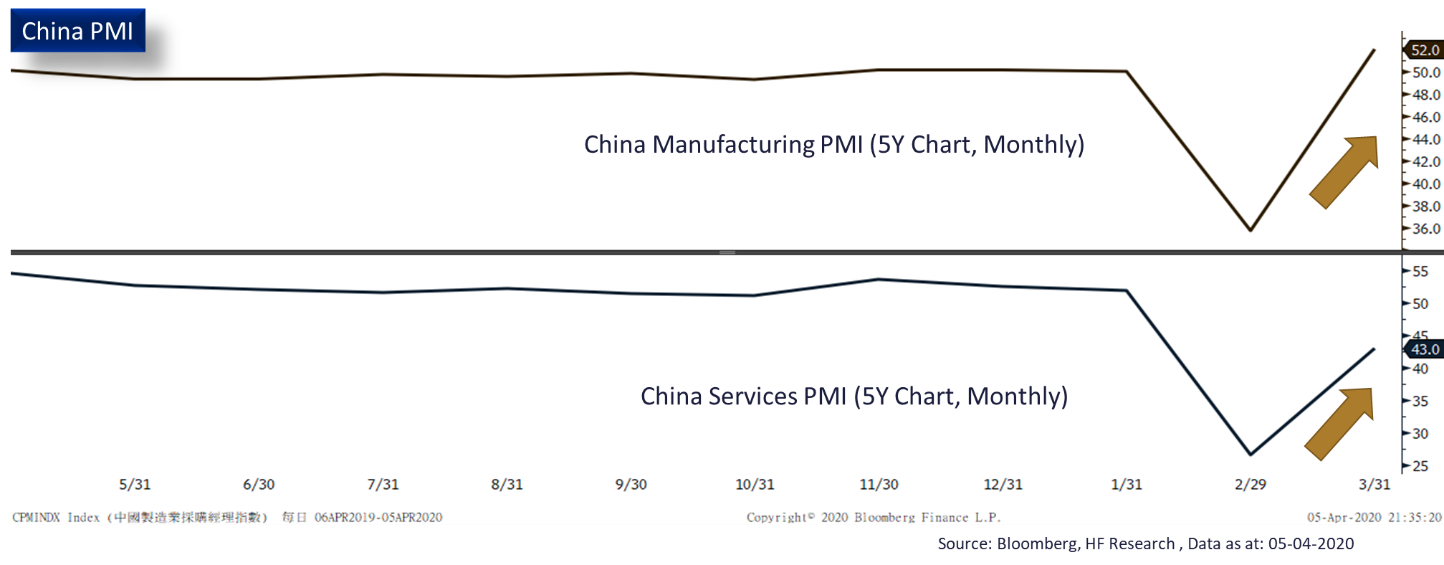

The dramatic recovery in terms of economic indicators in China was the bright spot in the month, manufacturing and non-manufacturing PMIs have recorded strong rebounds from the horrendous February figure, both returning to the expansion zone. Work resumption figures also brought positive vibes to the market. According to official figures, more than 75% of companies have already resumed business, which implies that the virus impact may have passed its peak in China.

However, even as the former epidemic epicentre Wuhan gradually lifts its lockdown orders, it is still too early to be overly complacent, as we await for more economic data such as industrial production and profit figures to further validate the recovery. More importantly, as the epidemic spreads across the world, global demand should further fall, potentially threatening recession recovery. That said, as China is likely first to recover among major markets, with the ongoing fiscal stimulation plans, we could be looking at a v-shaped rebound in the country, we are positive on the Chinese market in 2020.