There are concerns over tapering talks and the Delta variant, but positive corporate earnings together with the dovish Fed standing firm, supported US equities to edge higher over the month of July and stayed close to the historic high, the NASDAQ, S&P 500, and Dow Jones were up by 1.16%, 2.27%, and 1.25% respectively.

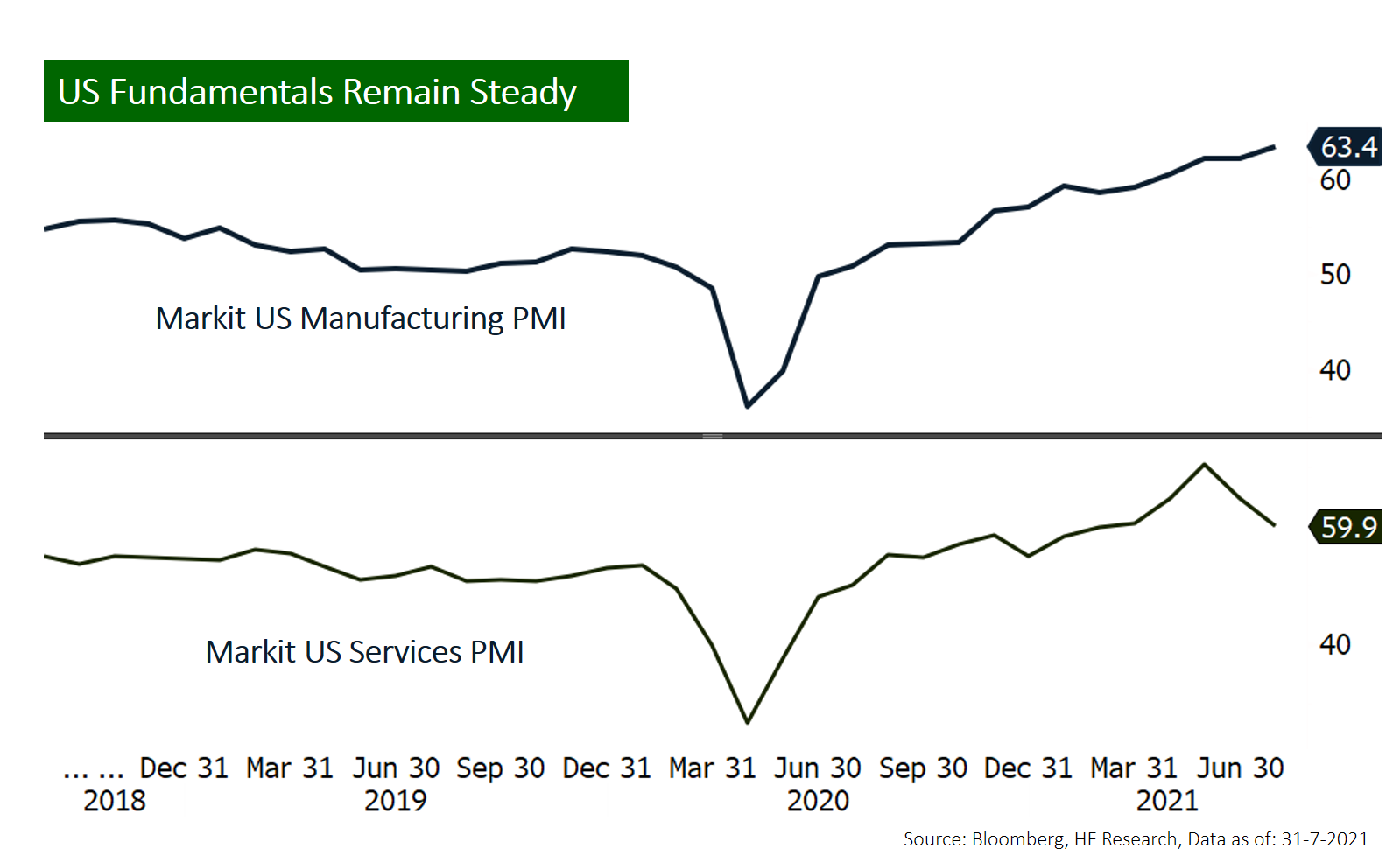

Recent economic data in the US were mixed. While PMIs were decent, and consumer confidence returned to the pre-pandemic level, employment figures were disappointing. Interestingly, the market did not see this necessarily as a bad thing, as an incomplete recovery in the economy could allow the dovish monetary policy to extend. According to the latest Fed interest rate meeting, Chairman Jerome Powell stood unchanged on the monetary policy as the economy is still ‘some distance away from a full recovery’, citing job market figures as his primary rationale.

Another thing to consider is that COVID cases are once again on the rise. With the pace of vaccination rollout in the US slowing down, the rise in the Delta variant combined with the lack of herd immunity could still pose a threat to the economy with potential lockdowns and other restrictive policies. In short, expect more downside risks in the short term arising from epidemic resurgence and tapering talks, investors could consider a gradual shift back to more growth exposure when the market potentially corrects, which should offer a better return potential over the longer term.