Weekly insight March 6

United States

United States

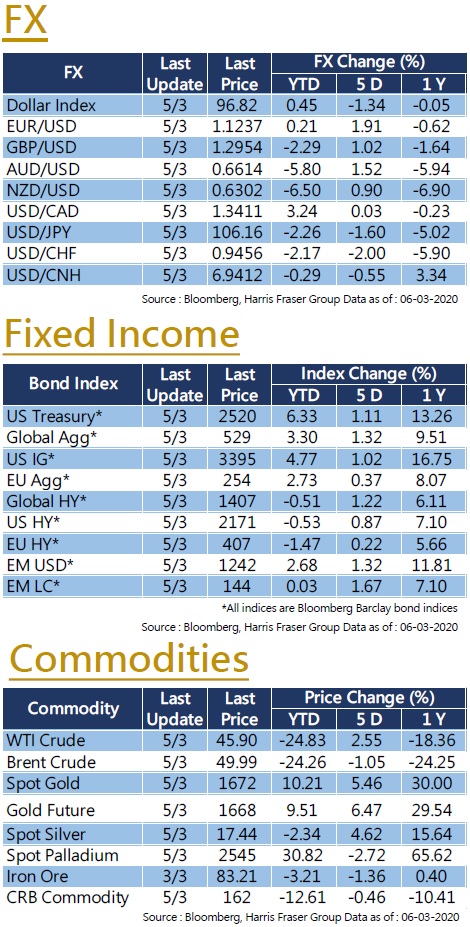

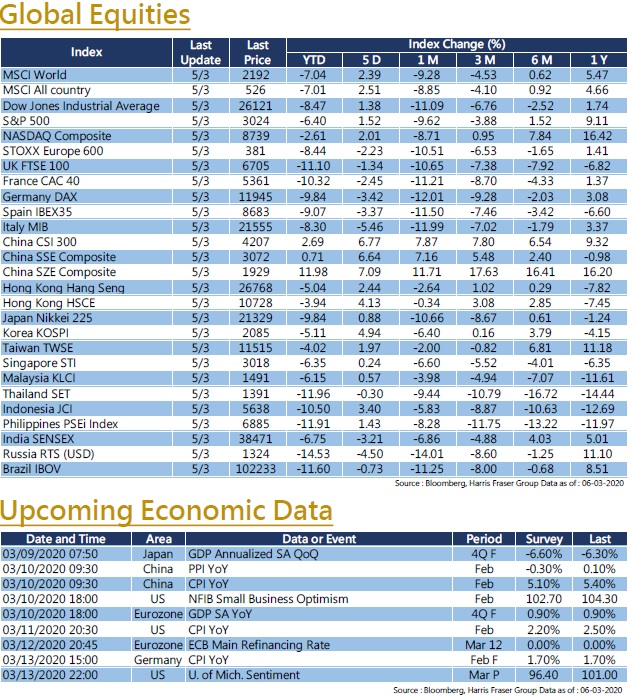

US stocks had abnormally high volatility this week. At the beginning of the week, it was reported that major global central banks would work together to stabilize the market. The news reversed the original pessimism in the market, sending US stocks up for the largest single day percentage gain in 14 months on Monday. However, the subsequent announcement of an emergency 50-basis-point cut in the policy triggered market worries that the financial crisis may recur, US stocks have once again plummeted on that day, and in the two following days saw sharp fluctuations in the market. After the Fed decided to carry out the first emergency rate cut of 50 basis points in more than a decade, the yield on 10-year US Treasury bond yield fell below the 1.00% level, reflecting large fund flows into US debt to reduce risk exposure. Another focus of the market is the ‘Super Tuesday’ of the Democratic Party presidential primaries. As the results came out, former Vice President Biden won 10 states and increased his lead, the news brought positive sentiment to the markets. In addition, some candidates, such as Pete Buttigieg and Mike Bloomberg, announced their withdrawal and voiced support for Biden. It is expected that the future development in the DNC primaries will be clearer. Next week, data on the US CPI, Michigan Consumer Sentiment, and the NFIB Small Business Optimism Index will be announced.

Europe

Europe

Over the past 5 days ending Thursday, the European stock market remained weak, with UK, French, and German stock markets falling by 1.34%, 2.45%, and 3.42% respectively. The rapid spread of the COVID-19 epidemic in Europe worried markets, investors feared countries like France and Italy might enter recession. In response to the development of the epidemic, Italian Prime Minister Conte said that the scale of aid for the epidemic will be increased to 7.5 billion euros, the funds will be used to support families and businesses hit by the epidemic, so as to ensure that no one loses their job due to the virus. As for economic data, the final February Eurozone service PMI rose slightly from 52.5 in January to 52.6, indicating that the February data might have yet to reflect the impacts of the epidemic. The European Central Bank will hold its interest rate meeting next week, the market focus will be on whether the Bank follows the Fed and deepens monetary easing.

China

China

Compared to the global stock market, the Chinese and Hong Kong stock markets have performed well this week, with A-shares being the best performer. As the COVID-19 epidemic continues to spread across the world, market is hoping that more stimulation measures will be introduced in the Mainland, including monetary policies such as interest rate cuts and RRR cuts, China's 10-year government bond yield fell to a new low since 2002. While presided over a meeting of the Central Leadership Working Group on Response to the COVID-19 Epidemic, State Premier Li Keqiang called for careful and effective strengthening of the epidemic prevention and control. On the other hand, under the increasing downward pressure on the Mainland economy, the work resume ratio is also an economic data worthy of attention. The Ministry of Agriculture in China stated that the spring planting is on track, and expects to meet the food production target despite the epidemic. China will announce February CPI and PPI data next week.