Weekly Insight May 22

US

US

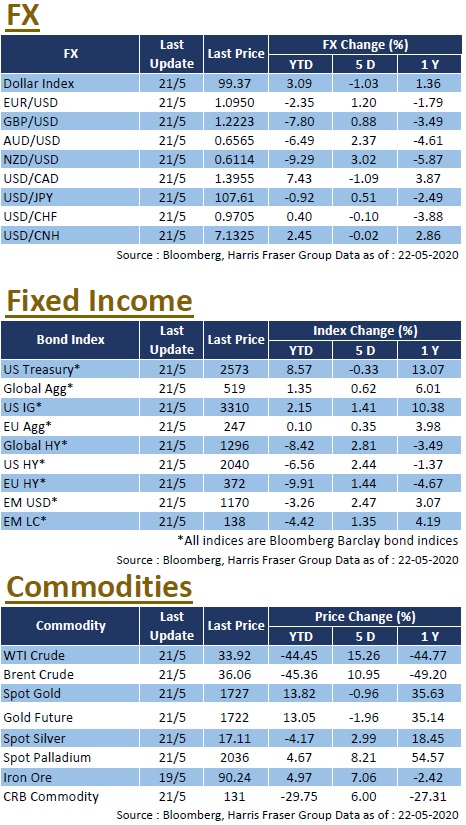

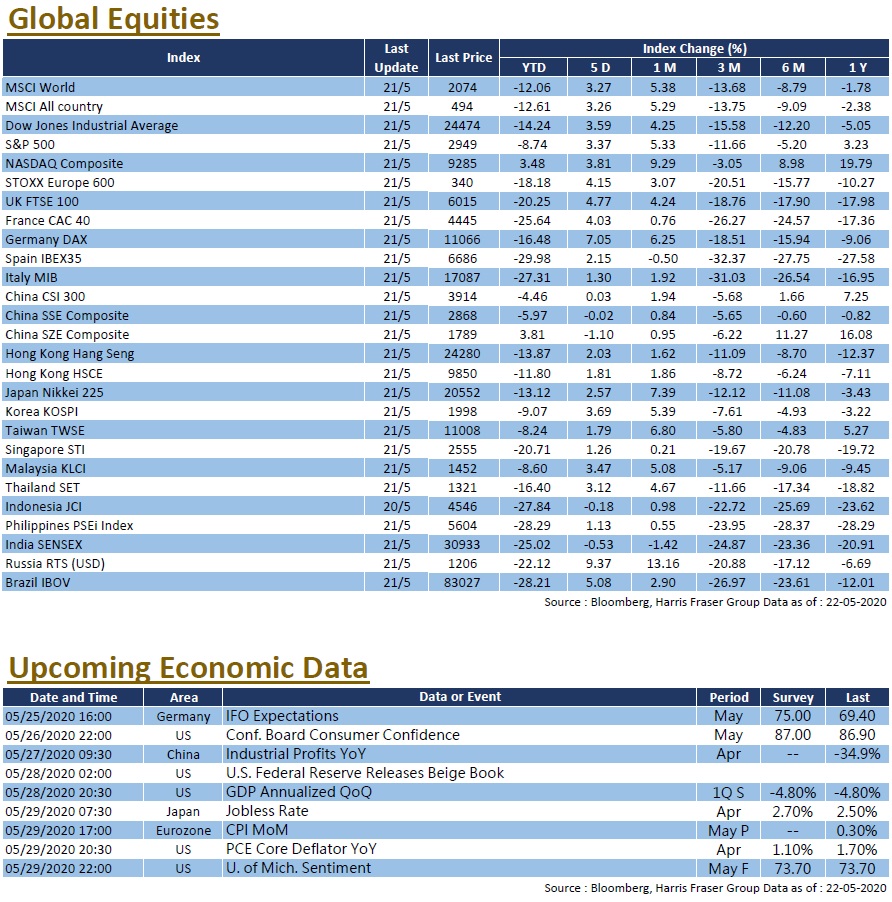

Recently, market has shifted focus from the covid-19 epidemic to the rising Sino-US tesions. The US trade adviser remarked that the virus originated from China, President Trump even threatened to completely withdraw from the World Health Organisation. Moreover, the US Senate passed a bill, which may trigger delisting of some Chinese enterprises. Although the escalation caused concerns, the three major US stock indexes still rose 3.3 - 3.8% over the past 5 days ending Thursday. At the moment, global covid-19 cases has exceeded 5 million, and the latest epicentre has shifted to Brazil and India. US economic data still raised concerns, as the latest initial jobless claims figure of 2.44 million implied that job losses remained on the higher end. Against the backdrop of uncertainties in the economy, US Treasury Mnuchin pointed out that the Congress would need to pass more stimulus bills. The Beige Book will be published next week, alongside the consumer confidence index in May, plus the revised Q1 GDP.

EU

EU

European equities mirrored global stock market gains, the UK, French, and German indexes rose 3.7% to 5.7% over the past 5 days ending Thursday. Under the severe economic setback, European countries announced stimulus plans to counteract the epidemic impacts. The UK has launched the post-Brexit tariff plan, reducing import tariffs for a number of products; Spain on the other hand raised the country’s 2020 net debt target to 130 billion Euros, which is three times higher than the original. In addition, French President Macron and German Chancellor Angela Merkel supported establishing the EU recovery fund of 500 billion Euros, this should relief some of the downward pressures on the economy. Europe will release the initial estimates of the Eurozone CPI in May.

China

China

European equities mirrored global stock market gains, the UK, French, and German indexes rose 3.7% to 5.7% over the past 5 days ending Thursday. Under the severe economic setback, European countries announced stimulus plans to counteract the epidemic impacts. The UK has launched the post-Brexit tariff plan, reducing import tariffs for a number of products; Spain on the other hand raised the country’s 2020 net debt target to 130 billion Euros, which is three times higher than the original. In addition, French President Macron and German Chancellor Angela Merkel supported establishing the EU recovery fund of 500 billion Euros, this should relief some of the downward pressures on the economy. Europe will release the initial estimates of the Eurozone CPI in May.

<Harris Fraser Research Team>