Weekly Market Insight for October 11

United States

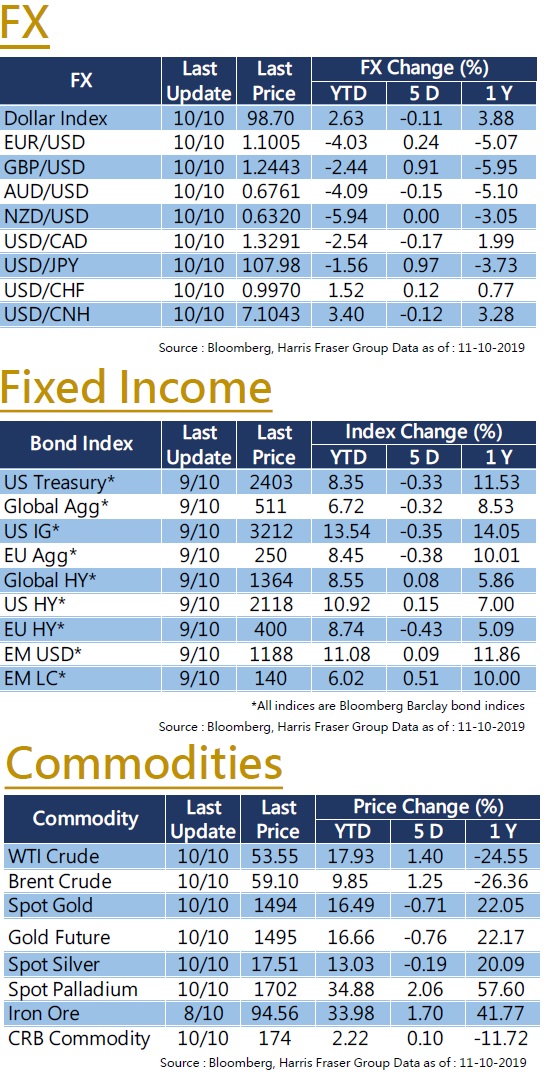

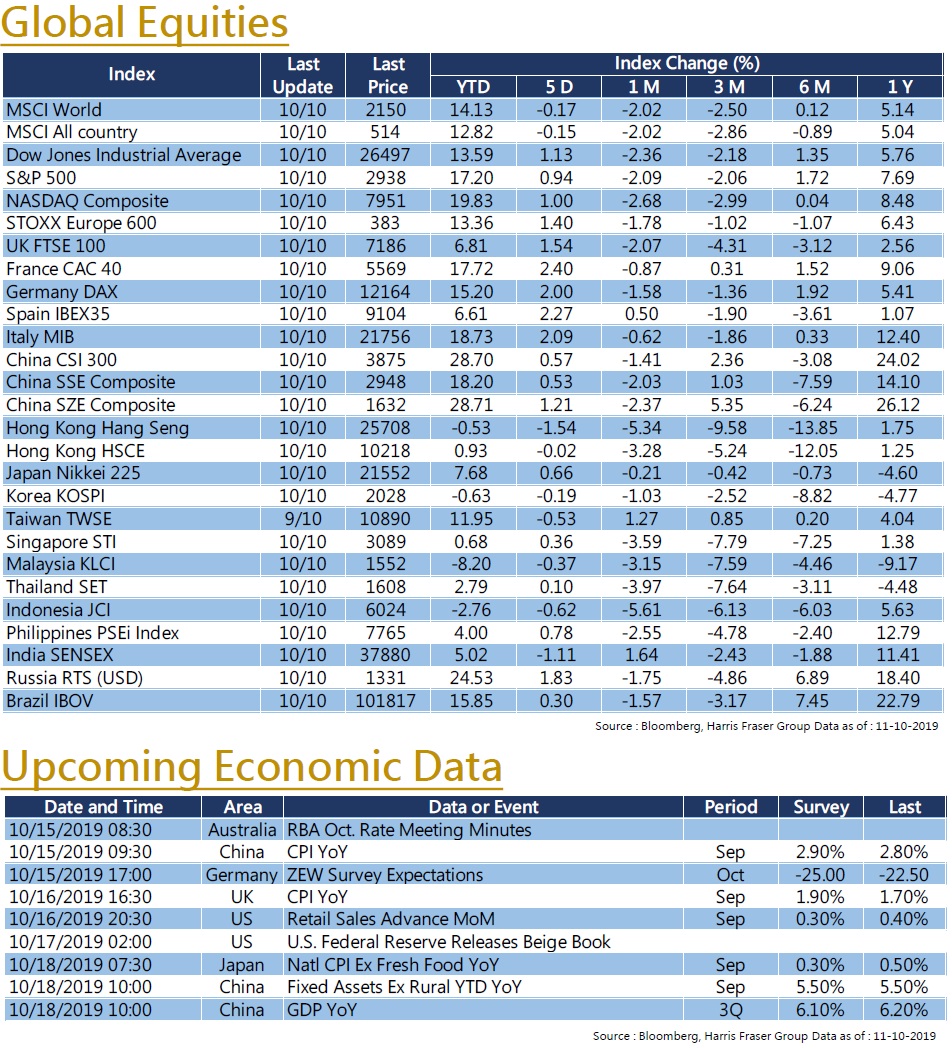

US stocks are still in a correction period, but the three major indices recorded a rise over the past 5 days ending Thursday. The market is focusing on if there are any breakthroughs in the latest round of Sino-US trade talks. Representatives on both sides have showed a cautiously optimistic attitude towards reaching a partial agreement, providing support to the equity markets. The US Federal Reserve Chairman Jerome Powell is another point of focus, as he mentioned that the Fed would resume expanding its balance sheet soon, driving the short-term US Treasury bond prices up, the announcement of the plan also improved equity market sentiment. The US will release the economic Beige Book and September retail sales data next week.

Europe

Trade worries have eased and European stock markets have performed relatively better than global stocks recently. Over the past 5 days ending Thursday, both the French CAC and German DAX recorded cumulative gains of over 2%, while the FTSE 100 also recorded a 1.54% rise. Earlier, the European Central Bank (ECB) announced after the September meeting that it would restart quantitative easing in November. The ECB minutes released last week showed that ECB officials have differing opinions over the composition of the monetary stimulus, about 30% of the 25 members of the management committee actually opposed to the restart of quantitative easing. On the other hand, the Brexit fiasco, which is about to reach the deadline, has took a dramatic turn. The British and Irish leaders issued a statement after the talks, claiming that they have found a way to reach a potential agreement, driving the GBP/USD up sharply from about 1.22 to a level above 1.24.

China

The Chinese stock market resumed on Tuesday after the long holiday, and recorded a good performance. Both the CSI 300, SSE Composite and SZSE Component Indices rose for four consecutive days. On the contrary, the performance of HSI was mixed, with the best performance recorded on Friday. This week, the market has been focusing on the Sino-US economic and trade talks, yet there were still rumors on the eve of the talks. It was reported that the White House is looking into restricting government pension funds from investing in Chinese stocks. However, after the conclusion of the first day of trade talks, both representatives hinted that they were cautiously optimistic on reaching an agreement, and the US President Donald Trump also remarked that the talks went smoothly. The news drove the overall Asian stock market up on Friday. Next week, China will release a number of important economic data, including Q3 GDP, CPI, Fixed Asset Investment, Industrial Production, Retail Sales etc.

Recent activities include : Attend The Private Wealth Asia Forum, Harris Fraser Hong Kong Property Market Outlook and Investment Strategy Seminar and Press Conference, Taiwan Immigration Seminar etc.

Media include : SCMP、imoney、AAStocks、TVB、HKEJ、MingPao、HKET、Metro Broadcast、Commercial Radio Hong Kong etc (including but not limited to the above)

Publishing on newspapers, magazines and online sections : “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos collaborated by Mason Securities limited and Harris Fraser Group.