Weekly Insight February 21

United States

United States

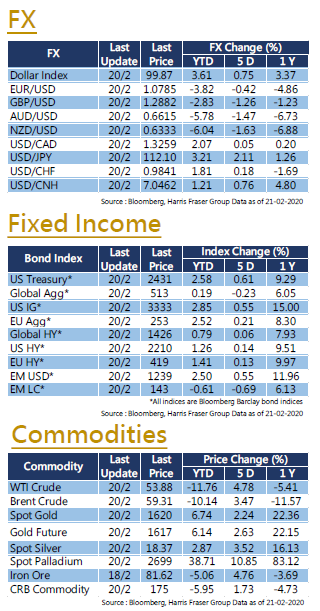

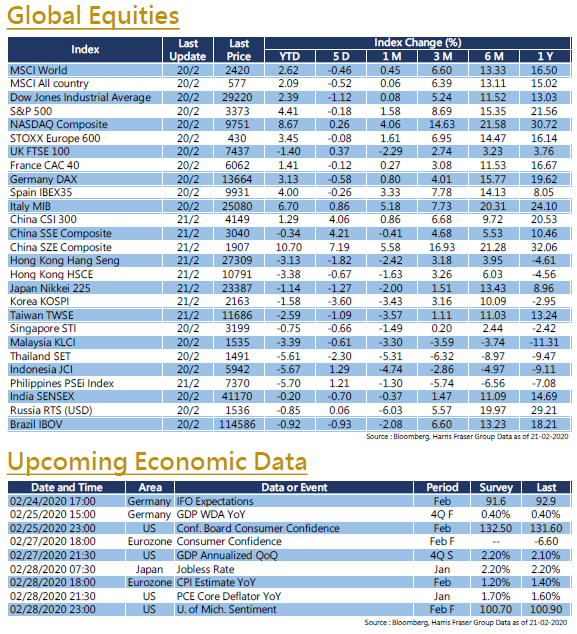

The spread of the COVID-19 epidemic accelerated in Japan and South Korea, while the China National Health Commission announced that as at 20 February, there are 75,400 confirmed cases in China. Market sentiment remained weak due to virus woes, and overall global markets underperformed. Over the past 5 days ending Thursday, the S&P 500 and the Dow fell 0.18% and 1.12% respectively. However, the NASDAQ rose by 0.26%. The January FOMC meeting minutes were released this week, showing that the economy was stronger than expected at the end of January, most officials see the current interest rate policy as appropriate for "quite a period of time." However, opposing views still existed within the committee, and Fed Vice Chairman Clarida emphasised that most economists do not expect rate cuts any time soon. According to the Bloomberg interest rate futures data, market predicts that the Fed will cut interest rates at least once before the end of the year. Next week, the United States will release the revised GDP figures for 2019 Q4, the market expects that the annualised increase will be revised slightly upwards from 2.1% to 2.2%. In addition, the United States will also announce the finalized figures of the January Core PCE, the February Consumer Confidence figures, and the University of Michigan Consumer Sentiment Index in February.

Europe

Europe

European equity performance was unsatisfactory over the week, with the UK FTSE, French CAC, and German DAX falling 0.22%, 0.51%, and 0.59% over the past 5 days ending Thursday. The Vice President of the European Central Bank (ECB) Guindos affirmed that the Eurozone economy is growing moderately, but mentioned that sluggish trade and the COVID-19 epidemic will lead to increased uncertainty in the economic outlook. As for economic data, the February Eurozone ZEW Economic Sentiment fell from 25.6 to 10.4, while the Eurozone Consumer Confidence Index came in at negative 6.6, which improved over the previous value of negative 8.1 and beat market expectations of negative 8.2. The Eurozone will announce the final figures of the February consumer confidence index and the February CPI next week. The market expects the YoY increase in CPI to fall from 1.4% to 1.2%. If inflation data continues to weaken, it may further solidify market expectations for the ECB maintaining a dovish stance.

China

China

China and Hong Kong stock markets had mixed results this week. A-shares continued the rebound with large trading volumes. The Shanghai Composite Index reclaimed the 3,000 level, closing at 3,039 on Friday, up 4.2% over the week. The Hong Kong Hang Seng Index met resistance at the 28,000 level and subsequently fell, closing at 27,308 on Friday. Under the influence of the epidemic, the local economy remains under pressure, it was speculated that the Chinese government may increase market liquidity to support the A-shares. This week, the People's Bank of China and the Ministry of Finance increased their efforts to strengthen monetary and fiscal policy amidst the COVID-19 epidemic. In particular, the central bank cut MLF and LPR interest rates respectively. A-share market sentiment remains positive.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”,“iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”,“OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)