Weekly Insight October 18

United States

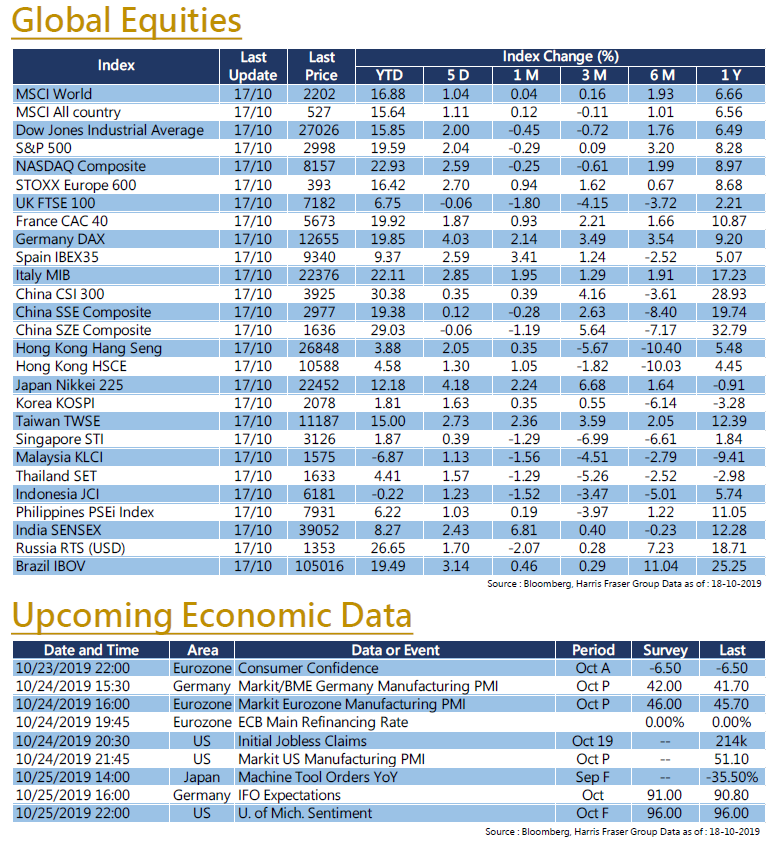

One of the focus in the market this week is the commencement of the US earnings season. Mixed performance is observed for big Wall Street names, JP Morgan’s Q3 net profit is up 8% year-on-year beating expectations; Citi’s earnings also bested market estimates. However, Goldman Sachs' earnings per share fell sharply by 24%, missing the mark by quite a margin; Q3 profit for Wells Fargo also dropped 26% YoY. Among the 66 S&P 500 constituents which have already announced earnings, about 83% recorded an earnings beat, which is outstanding considering the macro environment. Over the past 5 days ending Thursday, all three major US stock indexes rose more than 2%. In terms of economic outlook, after the IMF lowered its forecast for the 2019 global economic growth to a 10-year low, the Beige Book released by the US Federal Reserve also lowered its economic outlook moderately. The US retail sales falling for the first time in seven months also worried markets. Investors should continue to pay close attention to corporate earnings.

Europe

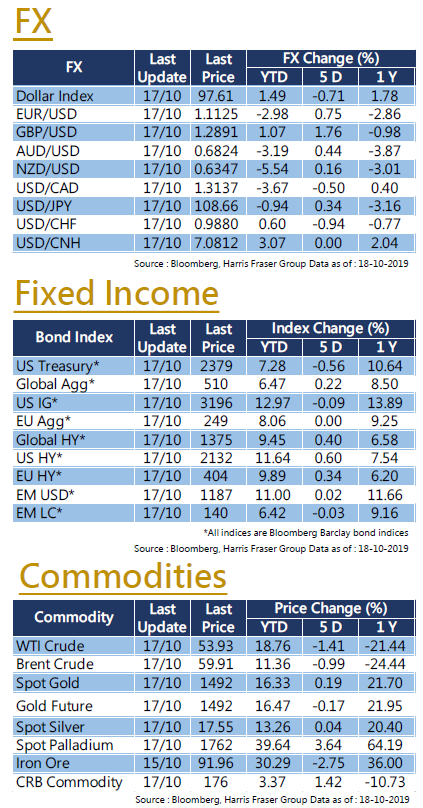

In Europe, Brexit matters continue to take the centre stage, as the whole Brexit process taken a dramatic turn. The EU and the UK announced on Thursday that they have reached a Brexit agreement. After the announcement, the pound rose alongside the European stock market, GBP/USD even closed in the 1.30 level on Thursday. Over the past 5 days ending Thursday, the general European stock markets went positive. Apart from the dampening effect on UK stocks due to a strong pound, the German DAX rose 4% and the French CAC rose nearly 2%. However, the deal is yet to complete, the Northern Irish Democratic Unionist Party (DUP) has expressed that they will not accept the new deal, and the British Parliament will vote on the deal this Saturday. The short-term volatility of the Pound Exchange is expected to be very high.

China

On Friday, mainland China released a number of important economic data on economic growth. While Chinese Q3 GDP growth continued the slide to a new low in 27 years, slowing down to 6% YoY, industrial production growth accelerated, and retail sales remained stable. Premier Li Keqiang has set the economic growth target for this year at 6% to 6.5% in the “Report on the Work of the Government”. As for Sino-US relations, both sides have reached a consensus on the outline of the first phase of the trade agreement. It was reported that China and the US might conduct further negotiations as early as the end of October, they might even formally sign the agreement at the APEC summit in November. The market will continue to follow the progress of the trade negotiations closely.

- Recent activities include : Attend The Private Wealth Asia Forum, Harris Fraser Hong Kong Property Market Outlook and Investment Strategy Seminar and Press Conference, Taiwan Immigration Seminar etc.

- Media include : SCMP、imoney、AAStocks、TVB、HKEJ、MingPao、HKET、Metro Broadcast、Commercial Radio Hong Kong etc (including but not limited to the above)

- Publishing on newspapers, magazines and online sections : “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos collaborated by Mason Securities limited and Harris Fraser Group.