Chinese markets continued to show a strong form as the country continue to lead the world in post-epidemic recovery. Over the month of October, the CSI 300 Index and the Shanghai Composite Index gained 2.35% (3.86% in USD) and 0.20% (1.68% in USD) respectively, while the Hang Seng Index also rose 2.76% (2.71% in USD).

The Fifth Plenary Session of the 19th Central Committee was held in late October, where the policy direction for the short, mid, and long-term are outlined. Analysts have tallied the usage of certain keywords in the official circular, which signalled that China will prioritise domestic economic and technological development over an international political fight for power. Economic stimulus is expected to be limited for the short term, and the recurring theme of “dual circulations” is once again key to the upcoming 5 years, vying to shed external reliance on a multitude of products and services. Henceforth, with the positive support for domestic new economy sectors, relevant themes such as semiconductors, clean energy, electric vehicles, 5G, AI alike should see continued growth in the mid to long-term.

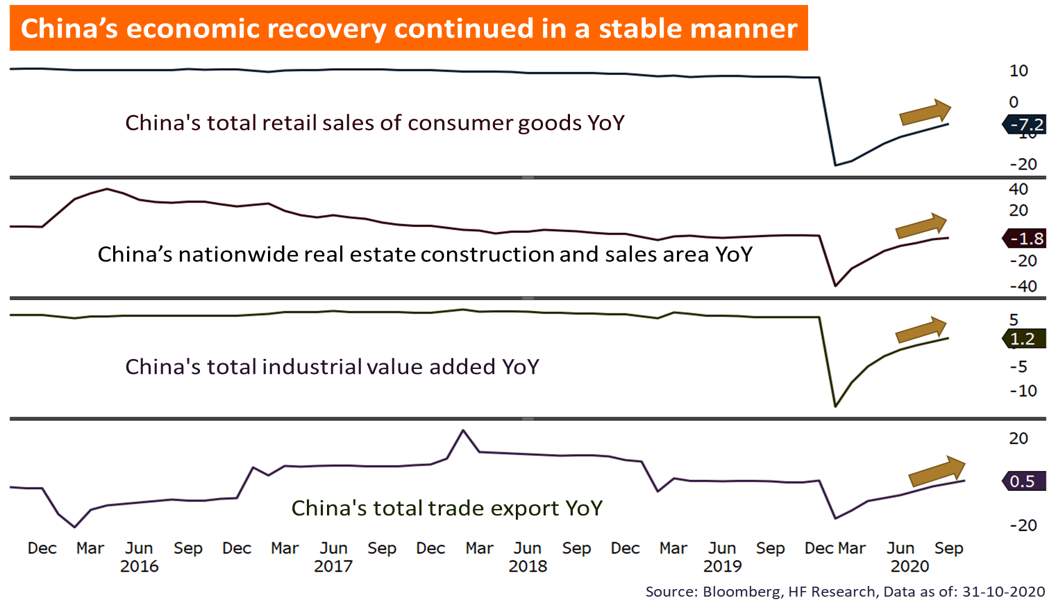

As for fundamentals, the Chinese economy is doing well, the Q3 GDP YoY growth continues to recover, which far outpaces other major economies such as the US and other European peers. Other fundamental indicators such as various PMIs and other investment/consumption indexes continued its steady recovery since the height of covid in China. With the elections in the US concluding soon, we expect there to be more clarity in the 4 years to come, which are expected to be supportive of the Chinese markets as uncertainties fade.