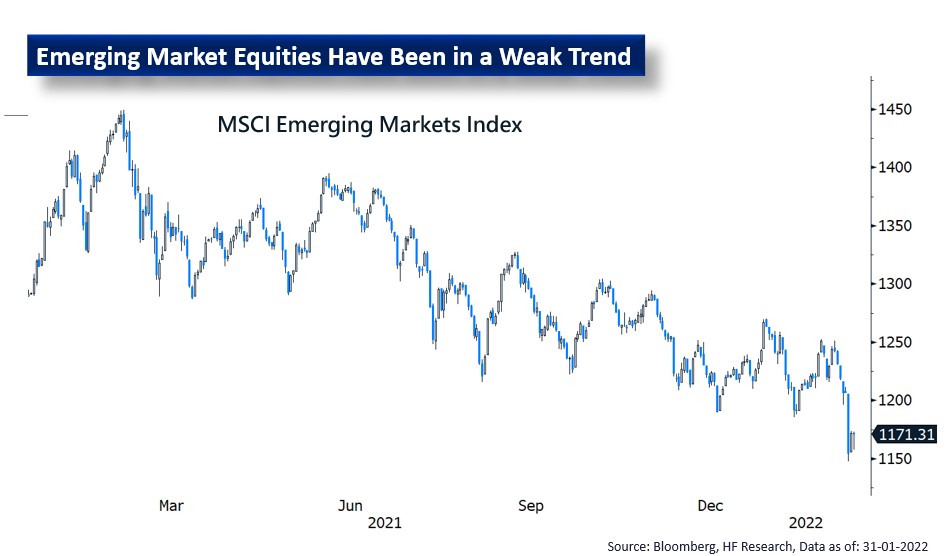

EM equities continued to slide in February. While southern Asian and Latin American equity markets had a decent month, the negative shocks arising from the Russo-Ukraine conflicts rippled across other markets. Russian equities saw an over 30% crash in value as other parties rush to cut their Russian ties. Over the month, MSCI emerging markets index lost 3.06%.

Fears of supply shocks in various commodities drove prices higher, commodities exporters other than Russia were able to post gains amidst the volatility. With sanctions imposed on several key entities, energy supply is facing potential jeopardy. With short term shortfall in supply expected, energy prices could remain at elevated levels in the short to medium term, inflation would linger. This could act as headwinds for the market, as it pushes for a tighter monetary policy from central banks, which in turn likely hurts the economy.

At the moment, we are still cautious on EM equities, as the risk factors remain in place. A less than ideal vaccination level leading to more COVID disruption to the economy; softer economic fundamentals as reflected by the leading indicators; strong US Dollar and inflation leading to capital outflows. These together bundled with the uncertainties surrounding the military conflict paints a rather bleak picture for emerging markets, as capital generally prefer DM equities and fixed income during periods of risk aversion. As of now, we are only selectively positive on China and Southeast Asia markets, mainly due to their relatively healthier economic fundamentals.