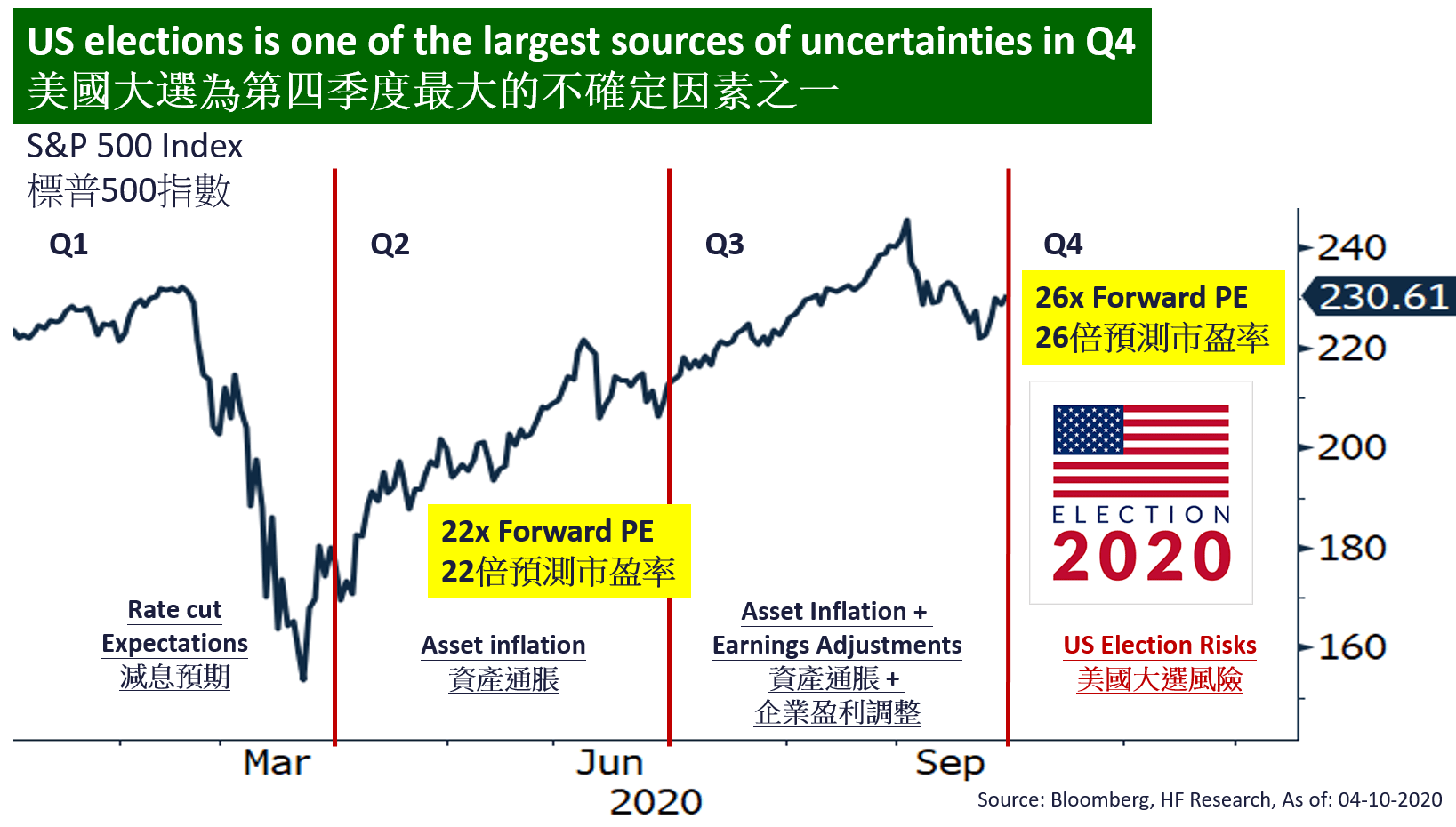

With the impending elections in November, uncertainties in the future policy direction drove the wide market to flight-for-safety. US equities saw some corrections, with the S&P 500, Dow Jones, and NASDAQ losing 3.92%, 2.28%, and 5.16% in September respectively.

Staying wary of the upcoming elections, markets de-risked over the month, which is as expected as we mentioned in the previous issue of Monthly Insight. Together with high valuations and the stalemate in the stimulus bill, the US equity market is exposed to a much larger downside risk compared to its upside potential. As for fundamentals, unemployment remains a big red flag for the economy, suggesting a sluggish growth and recovery in the economy, which should continue to concern investors in the US market with its high dependency on consumption.

With a month to go, election jitters should continue to weigh on markets. While the first debate between the 2 presidential candidates did not provide much insight to their policies, skimming through their campaign promises and public statements, we could conclude that there is a wide rift between both sides on a variety of issues, which likely poses a material risk for anyone who tries to bet on policy winners. Thus, we would prefer to invest in quality growth only after the uncertainties settle.