By executing an arbitrage carry operation with your newly minted capital, you can also create your own "passive income" with bond leveraging.

The two trends that help

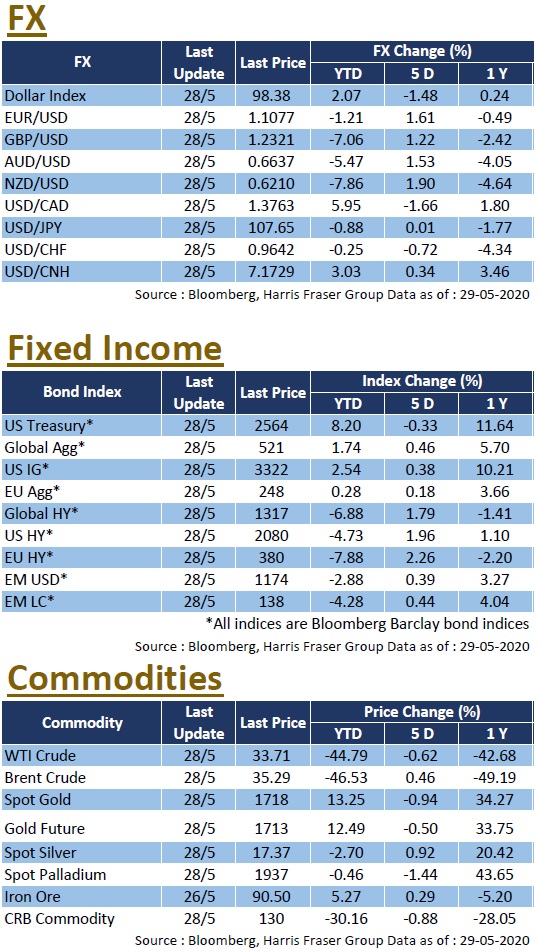

There are two notable trends in the market in recent years: 1) rising global property prices, especially in Hong Kong, and 2) falling global interest rates. This makes arbitrage operations via mortgage financing more favourable, as the higher property prices result in a larger amount of property refinancing available; and the lower interest rates require less interest payments, leaving more room for carry arbitrage.

Releasing your hidden capital

How can we kick-start the engine without much cash on hand? Recently, there has been much talk on "mortgage refinancing". Mortgage refinancing is like magic, releasing your hidden capital that investors may have looked over. Doesn’t matter if we utilize it for investment, or for another property purchases, utilizing them give us more opportunities for wealth growth.

How do we create passive income

So how do we come around creating passive income? With the low cost of financing, we can choose assets that are relatively price-stable, but not necessarily high-yielding, to generate interest income according to your own suitability. By utilizing the low-interest capital from mortgage refinancing, and investing it in higher-yielding assets, we can capture the interest rate differential, leaving us with a net return as our passive income.

Top Investment Choices for Mortgage Refinancing

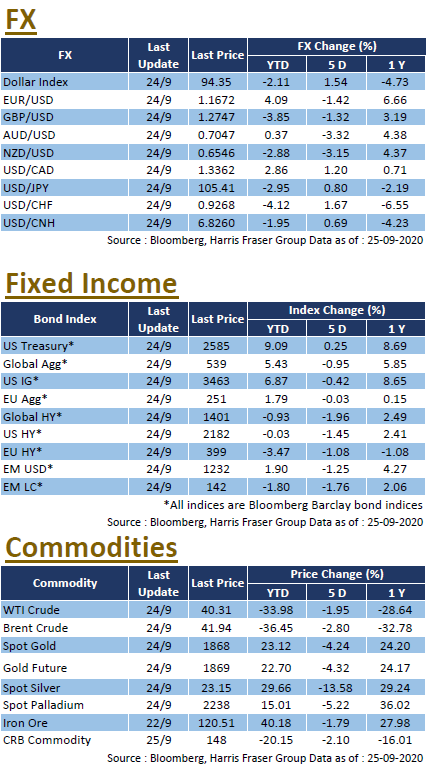

Bonds, bond funds, real estate investment trusts, and high yielding stocks are some of the more popular income generating assets in the market. Among them, bonds and bond funds are more popular because of their bond nature, as they are generally dividend/coupon paying and have a lower price volatility than stocks; these two features fall in line with the requirements of mortgage refinancing, making them the prime choice for such purposes. Of course, when deciding on any investment, one has to consider various risk factors and one's own risk appetite, which might not be fully covered in this article.

Low interest rates makes carry trades with capital appreciation possible

As for the interest rate outlook, none expects the US to raise interest rates in the near future, and the current low interest rate environment is expected to continue. This will create more room for carry, and lower interest rates will also benefit bond prices. If bond prices rise, investment returns could further increase, making capital appreciation possible even in the carry trade.

All in all, with the low interest rate environment resulting in less opportunities in the fixed income sphere, utilising carry arbitrage via mortgage financing, we can generate passive income to improve wealth appreciation, which is one of the strategies we can opt for in the current environment.

US

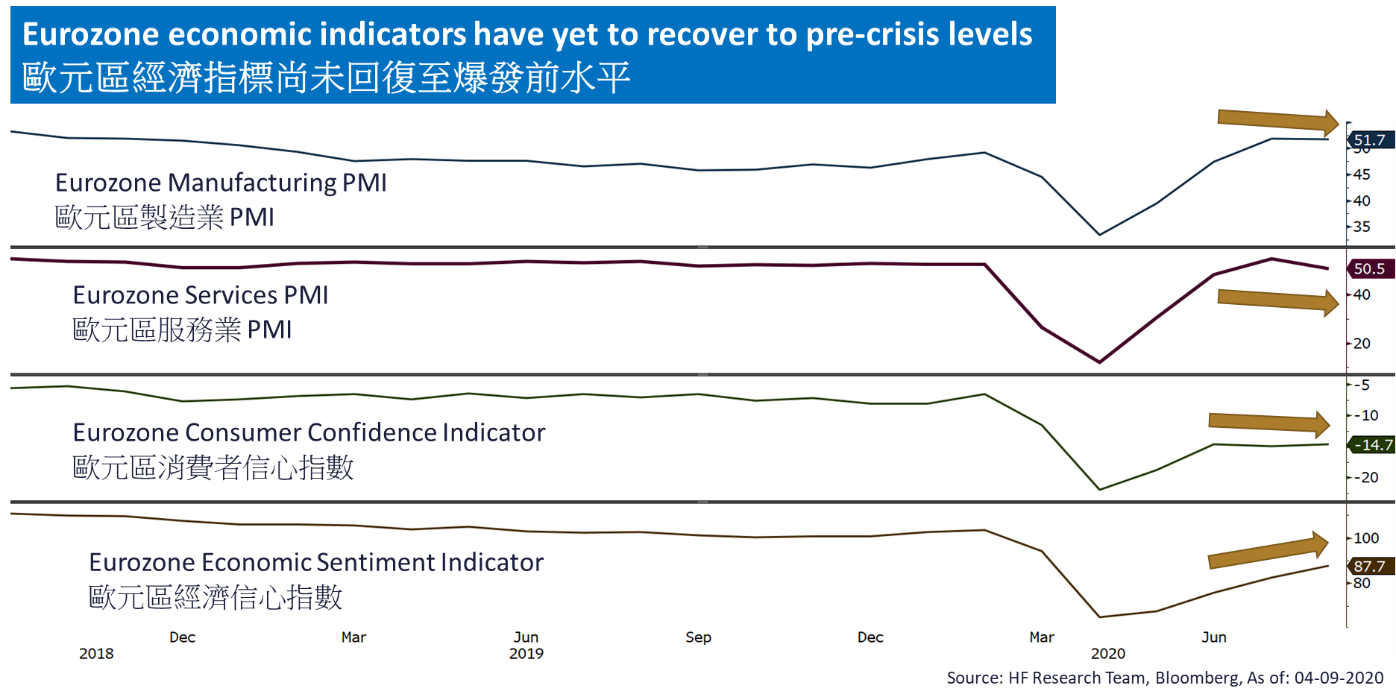

US EU

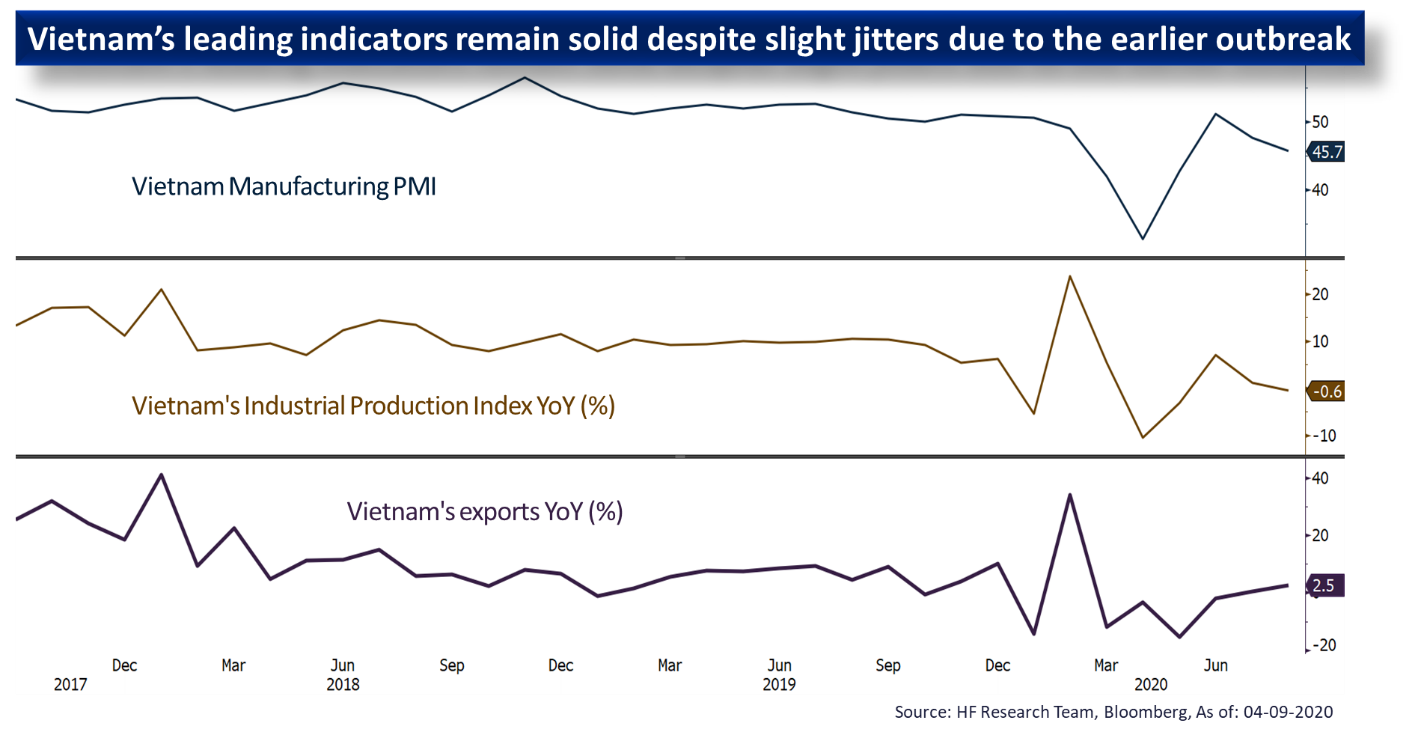

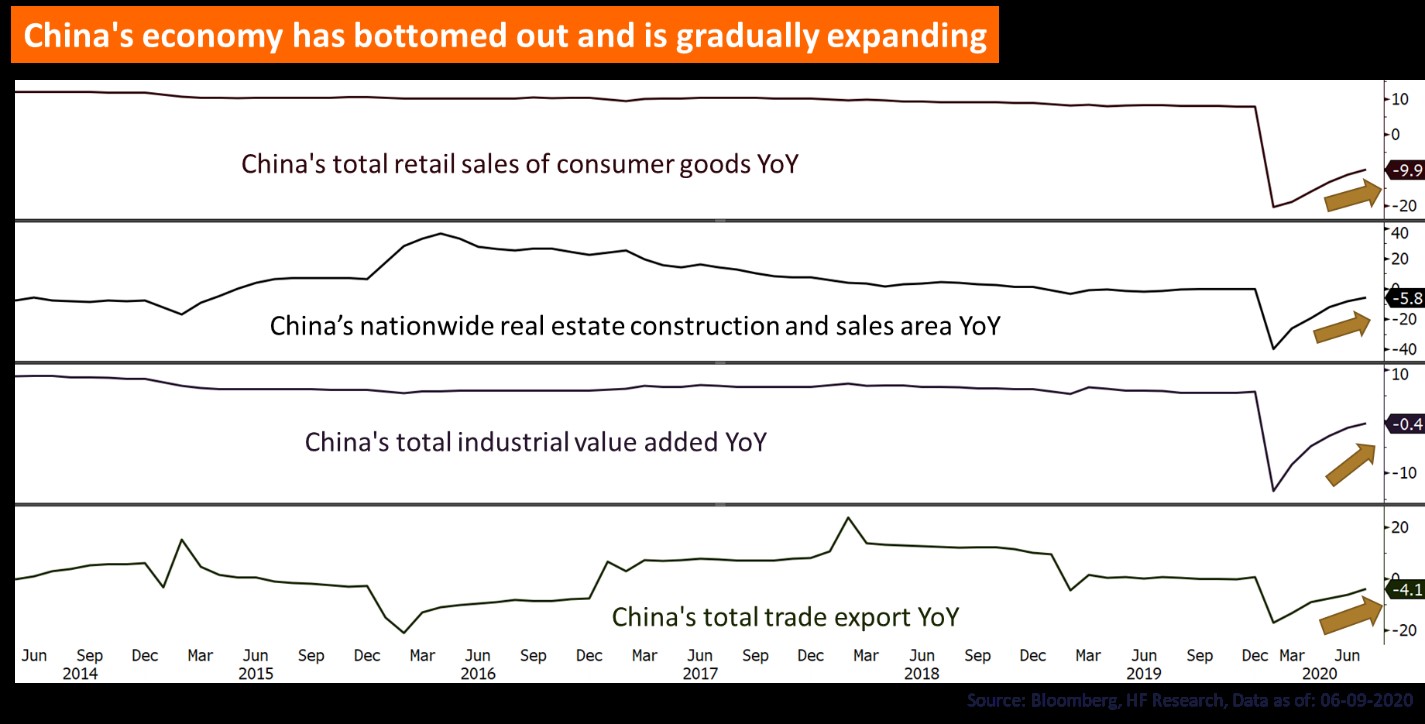

EU CHINA

CHINA