Weekly Insight July 10

USA

USA

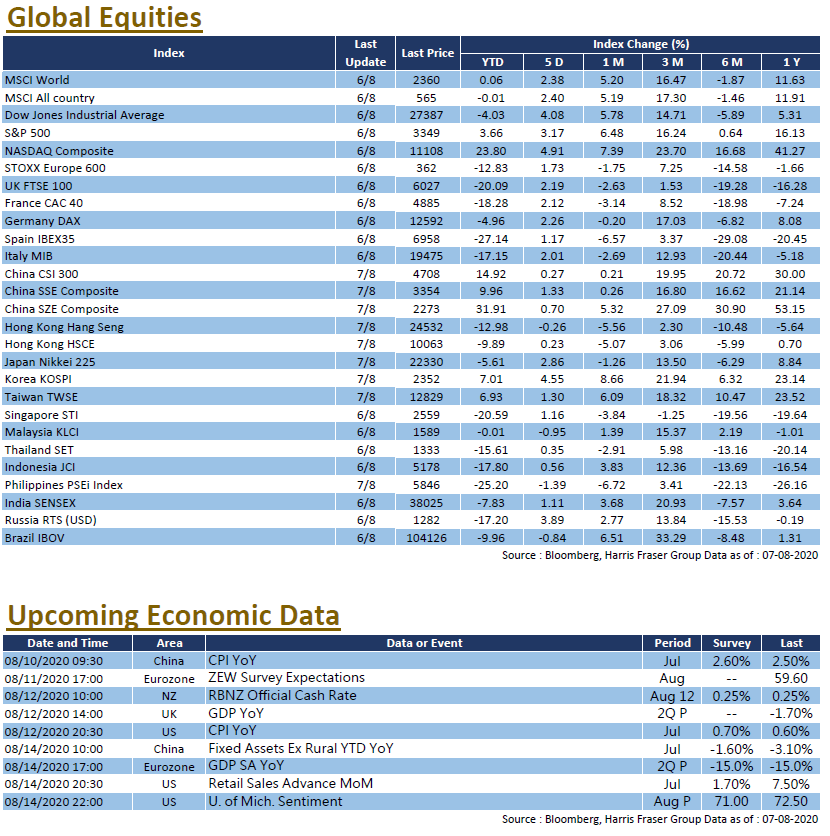

The United States reported more than 62,000 new Covid-19 cases on Wednesday, setting a new record high. Global covid-19 cases continue to rise, yet US president Donald Trump threatened to withhold federal funds unless schools reopen. As markets continued to be concerned over the second wave infections, the Dow and the S&P 500 fell 1.39% and 0.56% respectively on Thursday, while the NASDAQ gained 0.53%. Earlier, Federal Reserve Vice Chairman Richard Clarida said the fed is ready to adopt clearer forward guidance and increase asset purchases if the situation calls for it. The US will release the core CPI, initial jobless claims, and the Federal budget next week.

Europe

Europe

European stocks retreated, the UK, French, and German equity indexes fell 0.94% - 3.06% over the past five days ending Thursday. Most European countries have restarted their economies, the UK also announced a new stimulus plan of 30 billion pounds. Against the background of the gradual recovery of economic activities, the market focus has shifted back to the Brexit trade talks. The EU Brexit negotiators said that there are still key differences between both sides, and they also pointed out that the whole Brexit fiasco will bring greater damage to companies than the covid epidemic; Still, the UK Prime Minister Boris Johnson claimed they are well prepared for a “No deal Brexit”. The European Central Bank will hold an interest rate meeting next week, President Lagarde hinted on Wednesday that the policy rates will remain unchanged.

China

China

Since the start of the third quarter, the Chinese and Hong Kong stock markets saw heated trading. The turnover of the Shanghai and Shenzhen stock markets broke through the one trillion yuan mark, and the total margin balance also exceeded 1.3 trillion, reaching a 5 year record high. The CSI 300 Index soared 14.15% since the start of July and gained over 7.55% this week. Although the Hang Seng Index did not perform as well as A-shares did, it has also accumulated a gain of 5.32% MTD and 1.40% over the week. China announced that its foreign exchange reserves increased to 3.112 trillion USD in June, aggregate financing figures also increased in June. As for Hong Kong stocks, on the one hand, the HKMA continues to inject capital into the banking system. On the other hand, it was reported that the HSI will launch the "Hong Kong version of the Nasdaq", driving market speculation on new economy stocks such as ATMX. Next week, China will announce its 2020 Q2 GDP growth, market expects the YoY figure recover to 2.5%.