Weekly Insight September 25

Weekly Insight September 25

US

US

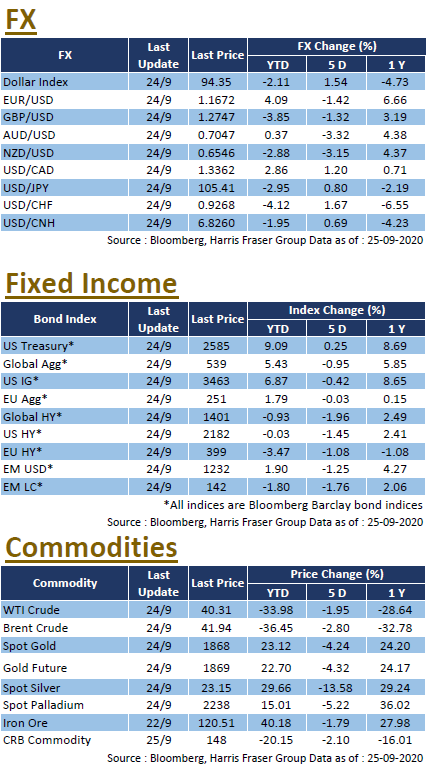

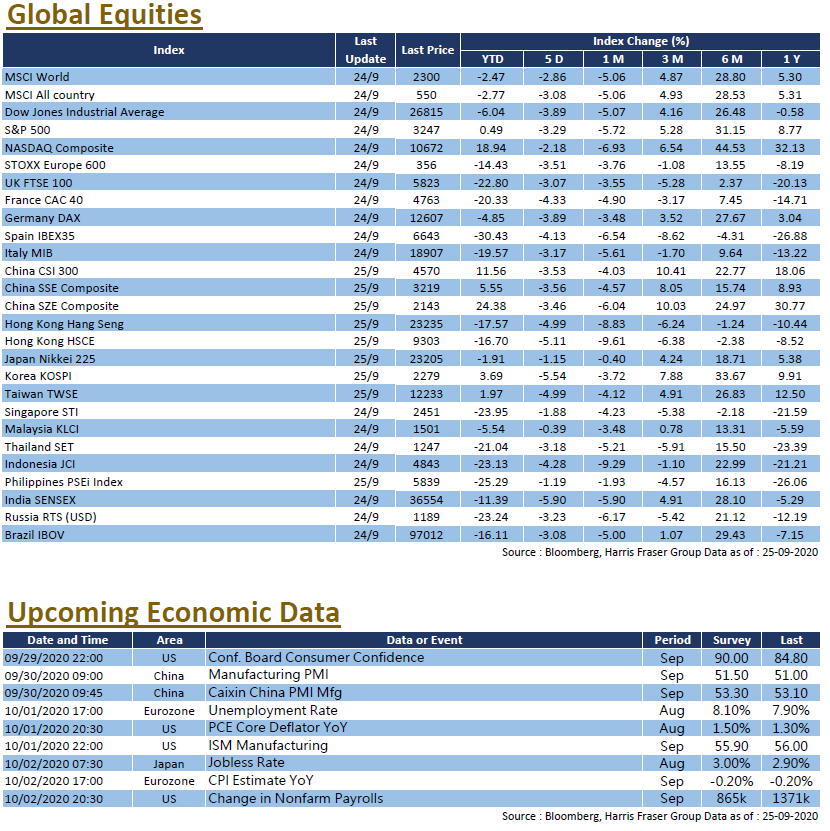

With no signs of improvement in the global epidemic, and US officials expressing worries over the progress of economic recovery, the US stock market continued its downtrend. The Dow, the S&P 500 and the NASDAQ were down between 2.18% and 3.89% over the past 5 days ending Thursday. US Federal Reserve Chairman Jerome Powell said that the progress of the economic recovery remains "highly uncertain", as evidenced by the elevated number of unemployment claims. In addition, several officials continued to call for additional fiscal stimulus. It was reported that the White House and Congress are planning to restart the stimulus talks, and the Democratic Party is ready to draft a $2.4 trillion stimulus package, but the new downsized package is still far above what the Republican Party would accept. Next week, figures on unemployment rate, ISM manufacturing index and consumer confidence index will be released.

EU

EU

Europe equities continued to fall, with the UK, French, and German indexes losing 3.75% - 5.49% over the past five days ending Thursday, amid worries over the reintroduction of lockdown measures due to the worsening epidemic in Europe. In the UK and France, both governments announced new restrictions in response to the new daily infection record highs. In addition, the European Central Bank President Christine Lagarde states that it will increase the monetary policy stimulus if necessary. Earlier, the Bank of England (BoE) stated that a negative interest rate policy in the future is being considered. The announcement put the Pound under pressure, but the BoE Governor Andrew Bailey explained that market participants should not read too much between the lines, stabilizing the Pound in the short term. Next week, the Eurozone will release CPI and unemployment figures.

CHINA

CHINA

Weighed down by the HSBC-led banking sector, Hong Kong stocks continued to fall over the week, with the Hang Seng Index losing nearly 5% over the week; China A-shares also fell, the CSI 300 Index was down 3.53% over the same period. The market expressed concern over the Evergrande Group, as documents and screenshots related to its rumoured restructuring were circulated on the Internet recently. The Group subsequently issued a statement saying that the information was fabricated and defamatory, and had reported the case to the authorities. On the other hand, FTSE Russell announced the inclusion of Chinese government bonds into its flagship index, starting from October next year, which is expected to result in an inflow of hundreds of billions of US dollars into the Chinese onshore bond market. Next week, China will release various data including the official manufacturing PMI.