Weekly Insight October 16

US

US

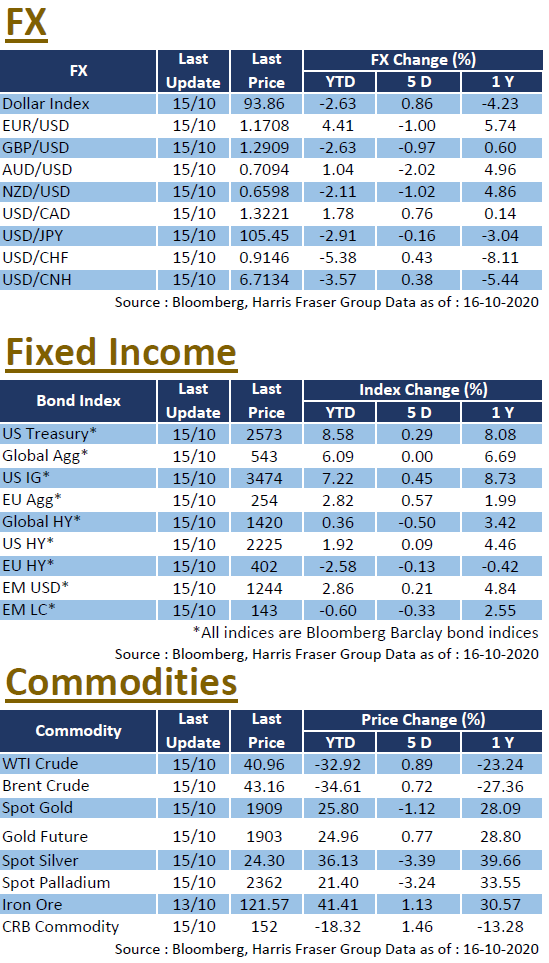

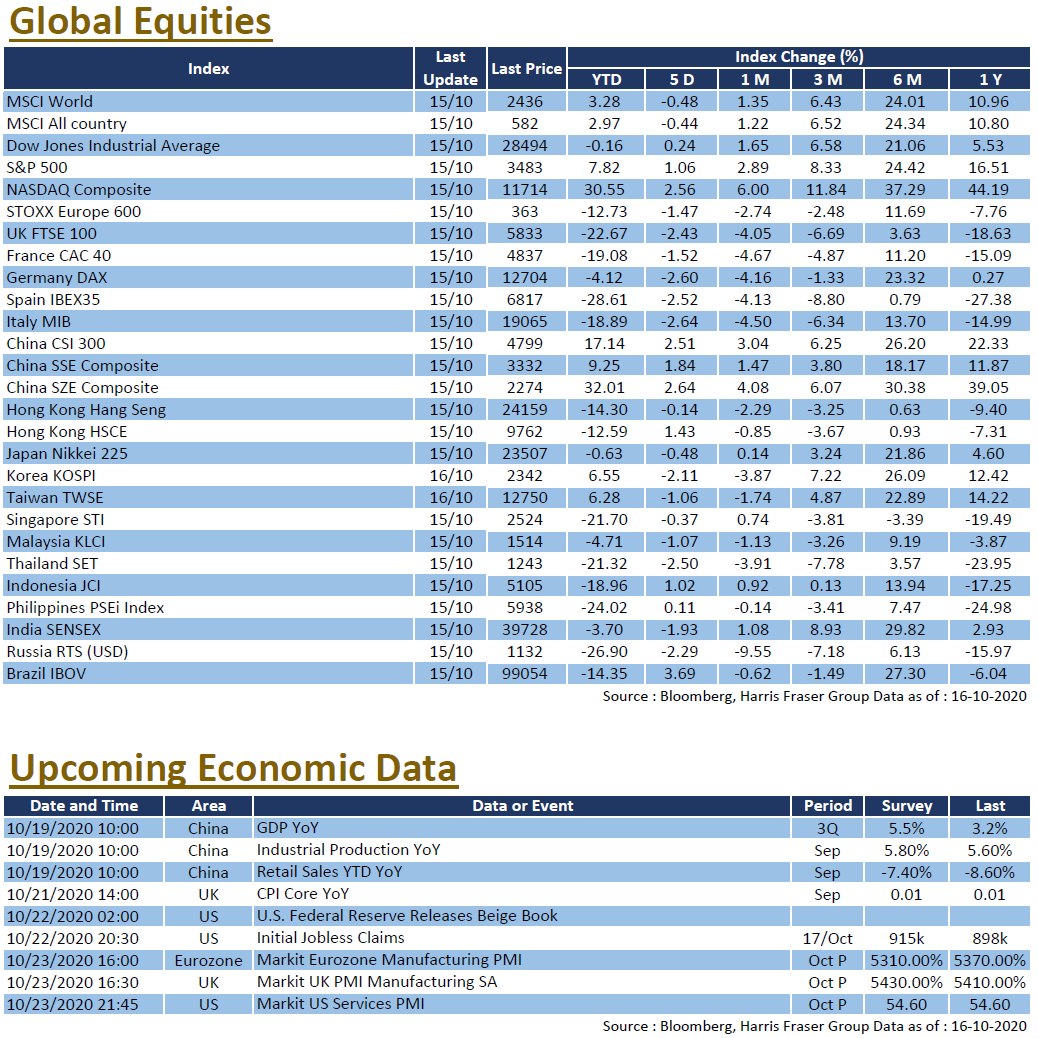

Anticipating the fresh round of stimulus bills to be passed at an earlier date, over the past 5 days ending Thursday, the S&P 500, the Dow, and the NASDAQ gained 1.06%, 0.24%, and 2.56% respectively. We expect the US markets to remain focused on the trifecta for the coming weeks: Elections, covid, and the stimulus bill. With little less than 3 weeks to go, election matters should take the centre stage in the near future. Polls continue to show former VP Joe Biden leading the incumbent President Donald Trump by a fair margin, but one can never be fully sure under the Electoral College system. As for covid, the latest daily infection figures continue to rise, crossing the 60,000 daily mark for the first time since August, expect more volatility in equities in line with the anticipated reintroduction of lockdown measures. As for the stimulus bills, US Treasury Secretary Steven Mnuchin shared his optimism on the bill with House Speaker Nancy Pelosi, citing common ground in seeing the need for relief bills, President Trump also voiced support over a 1.8 trillion stimulus package. However the divergent views between the Senate and the House remains an obstacle. Next week, the US Fed will publish the Beige Book, and various PMI figures will be released.

Europe

Europe

Covid continued to take the centre stage, it was reported that the German Chancellor Angela Merkel stated that the European economy cannot afford a second wave of covid epidemic. Worries grew stronger as multiple countries like the UK, France, and Spain began to adopt more stringent lockdown measures. As a result, European markets trended down over the week, the UK, French, and German stock indexes lost 2.43%, 1.52%, and 2.6% respectively over the past 5 days ending Thursday. Brexit talks stalled and are expected to cross the negotiation deadline this week. However, both sides are likely to continue the talks. EU chief negotiator Michel Barnier hoped to reach a deal by the end of October, asking the UK to make “necessary moves” needed for the deal. On the other side, UK Chief Negotiator Lord David Frost fired back, stating that it is unreasonable for the EU to expect the UK to make “all necessary moves” for the talks to progress. With both sides at odds and awaiting the other side to compromise on key issues, the Brexit trade talks are expected to remain in deadlock for the coming weeks. Next week, various CPIs and PMIs for both the Eurozone and the UK will be released.

China

China

Chinese markets remained strong over the week, the CSI 300 and Shanghai Composite rose 2.36% and 1.96% respectively, while the Hang Seng Index were volatile, slightly rising 1.11% over the same period. Chairman Xi briefly visited Shenzhen and several other Guangdong cities earlier in the week to celebrate the 40th anniversary of the Shenzhen Special Economic Zone, driving market optimism in anticipation of favourable policies in the future. Looking forward, markets should pay attention to the upcoming Fifth Plenary Session of the 19th Central Committee, the details on the 14th Five-Year plan should give investors a better idea of the upcoming policy direction. It was reported that due to strong demand, Ant Holdings has raised its IPO valuation to US$280 billion (i.e. HK$2,178.4 billion) and will raise more than HK$270 billion in the IPO. Next week, GDP, fixed investment, industrial production, and retails sales figures will be released. PBOC will also announce the latest loan prime rate (LPR), market expects that to stay unchanged.