While developed economies barring the US saw infection figures fall, epidemic situation in emerging economies continued to worsen.

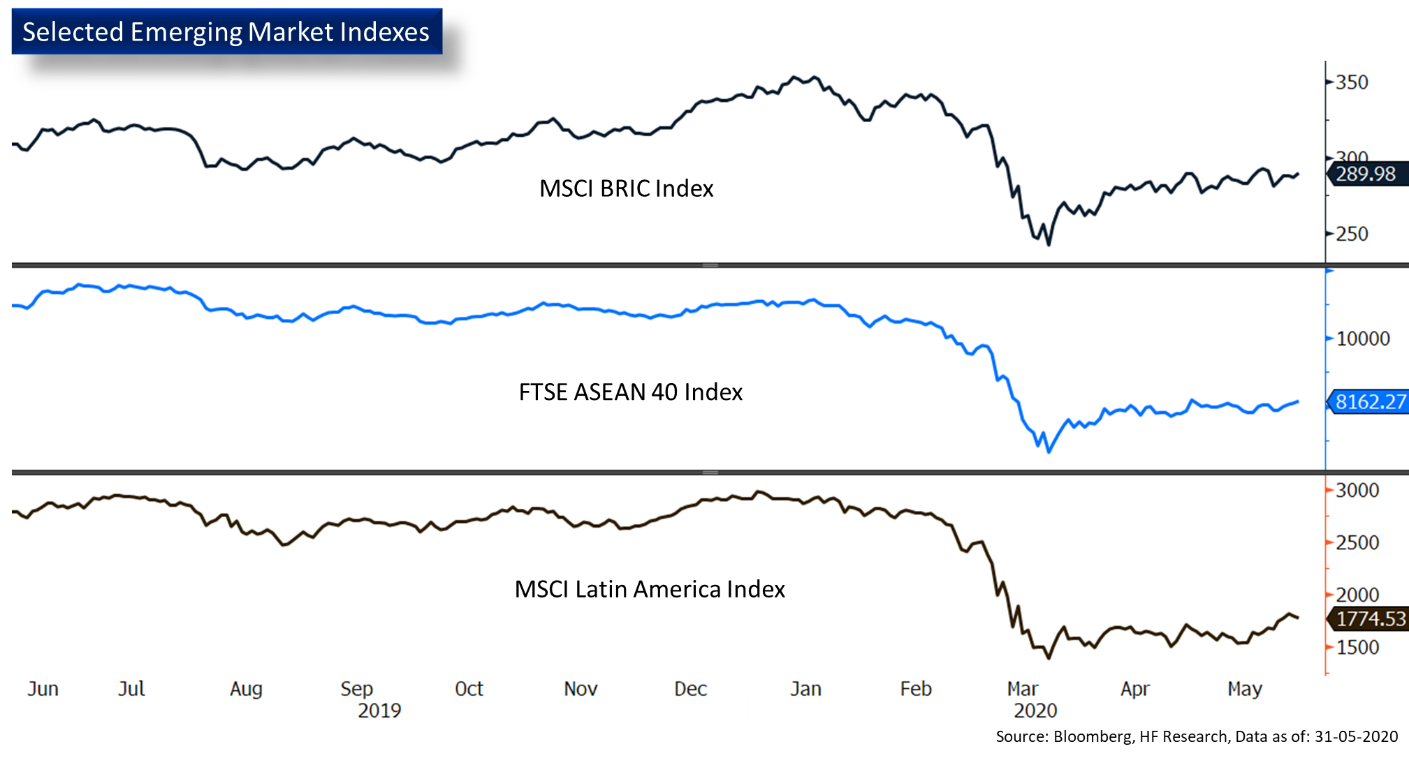

While developed economies barring the US saw infection figures fall, epidemic situation in emerging economies continued to worsen. Emerging markets went sideways after the strong performance in the previous month, rising 0.58% in May.

The latest ex-US epicentres of infection have now officially shifted from Europe to emerging countries like India, Brazil, and Russia alike, with new infection figures on the continued rise. Emerging economies are hit by the double whammy of recession and the rapidly advancing covid-19 epidemic, especially with falling global demand amidst the epidemic induced recession in developed markets. If forward looking economic indicators reflect anything, emerging markets are likely deep in recession, business confidence remain low, and there is still a long way away from a full recovery.

Marred with the array of risks in form of weaker economy recovery, ongoing epidemic, and rising Sino-US tensions, we expect emerging markets to remain under pressure in the short to mid-term. That said, we could see potential opportunities in ASEAN markets and possibly Latin American markets in the longer horizon, as these are expected beneficiaries in rising trade tensions and relocating production lines. We do note Vietnam as one of the prime candidates with its controlled epidemic situation, high growth and lower valuation, thus, viability as a China alternative. Hence, a positive outlook for the frontier market over the year.