Chinese markets underperformed global markets in the month of May, the CSI 300 and the Shanghai Composite Index were down 1.16% (2.18% in USD) and 0.27% (1.29% in USD) respectively, while the Hang Seng Index also fell 6.83% (6.85% in USD).

As the pandemic ended its ravage in the country, the “Two Sessions” were finally held in Beijing. During the meetings, key points to note for the year include no GDP growth target, a much higher M2 money supply target, and setting a higher budget deficit target. These are expected to outline the Chinese government’s developmental directions for the year: a further consolidation of the economy with no growth targets, more focus on the physical economy with increased budget deficit, plus a looser monetary policy with the increased money supply, we could potentially see RRR cuts or even falling interest rates in the year.

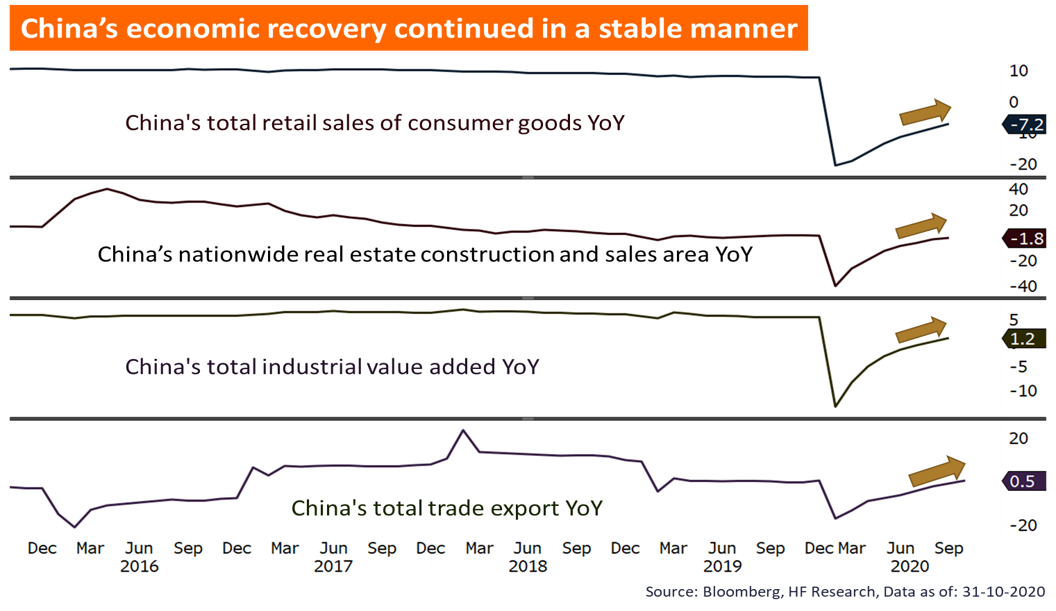

Economic indicators seemed to agree that the Chinese economy is essentially back to normal, PMIs have recovered, all returning into the expansion territory, potentially marking an end to the pandemic induced recession. That said, external risks remain with Sino-US tensions running back to trade war levels, which does dampen the optimism after the recovery. Although external risks remain, which could pressure the equity markets in the short to mid-term, we still expect the Chinese economy to further stabilize as economic activities pick up.