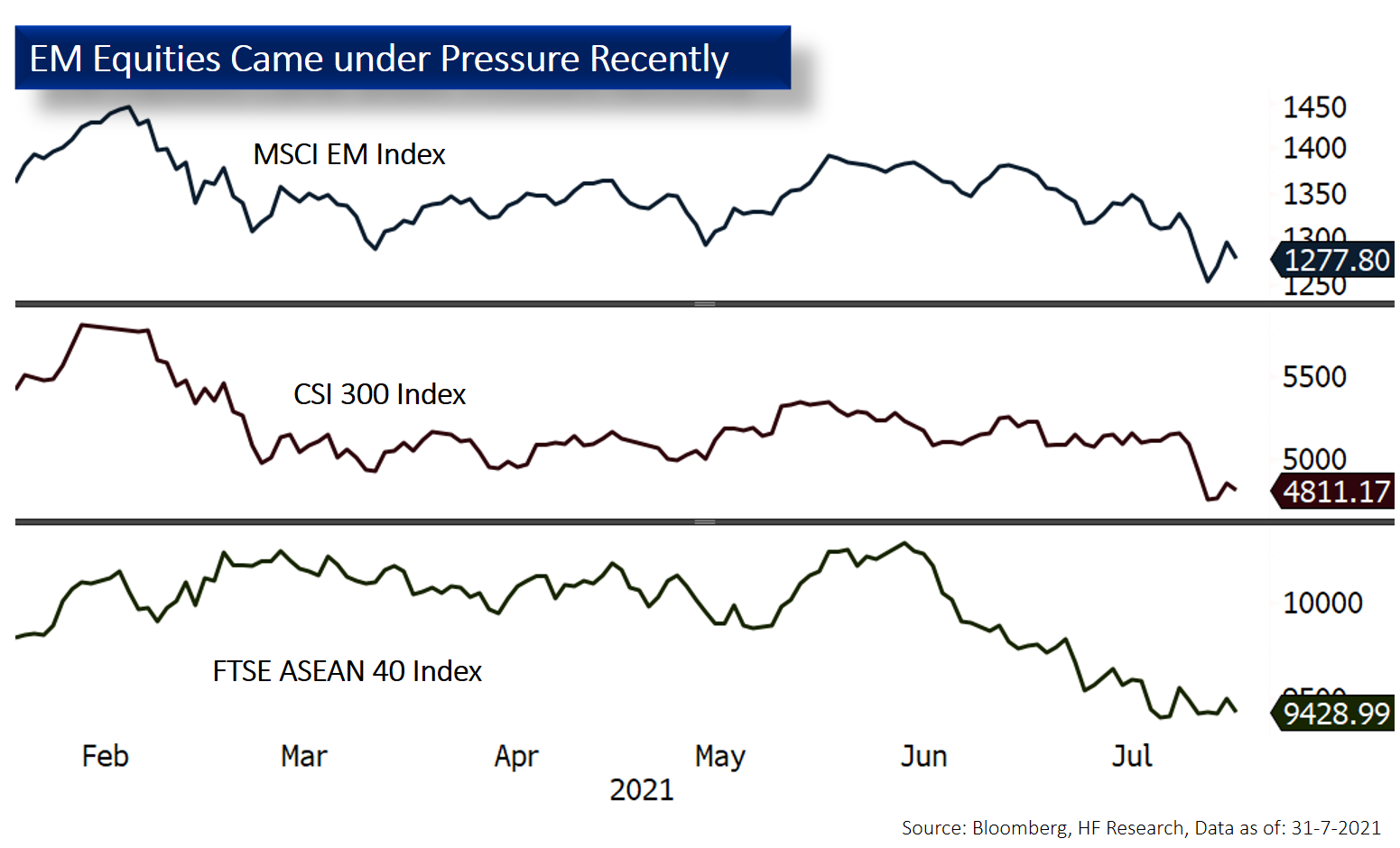

Dragged down by the weak investment landscape, emerging markets further slid in July. The biggest detractor was the Chinese market, which saw a large correction due to policy uncertainty, other emerging markets also fell with a weakening economic outlook due to resurgence of the Delta variant. Over the month, the MSCI emerging markets index lost 7.04%, while the FTSE ASEAN 40 Index fell 3.54%.

While the macro environment has slightly shifted, we still think developed markets should outperform emerging markets in the near term, as several factors contribute to the divergence in performance. The resurgence of the Delta variant could potentially derail the economic recovery, as countries have started to re-impose epidemic restrictions in order to control the situation.

Vaccinations in emerging economies continue to lag behind developed countries due to logistic and supply constraints, which could further amplify the lockdown impact as economic activities gets more limited.

Likewise, inflation also poses as a threat to the emerging market equity performance. The relatively elevated figure across EM countries could force local central banks to tighten up their monetary policy. As a matter of fact, numerous emerging market central banks including Russia and Brazil have already hiked their rates recently, the tightening in liquidity puts a cap on the valuation level. Given no material changes to the macro environment, we will still prefer DM equities in the shorter term, and would avoid taking in more EM exposure.