Fixed income products performed well in October.

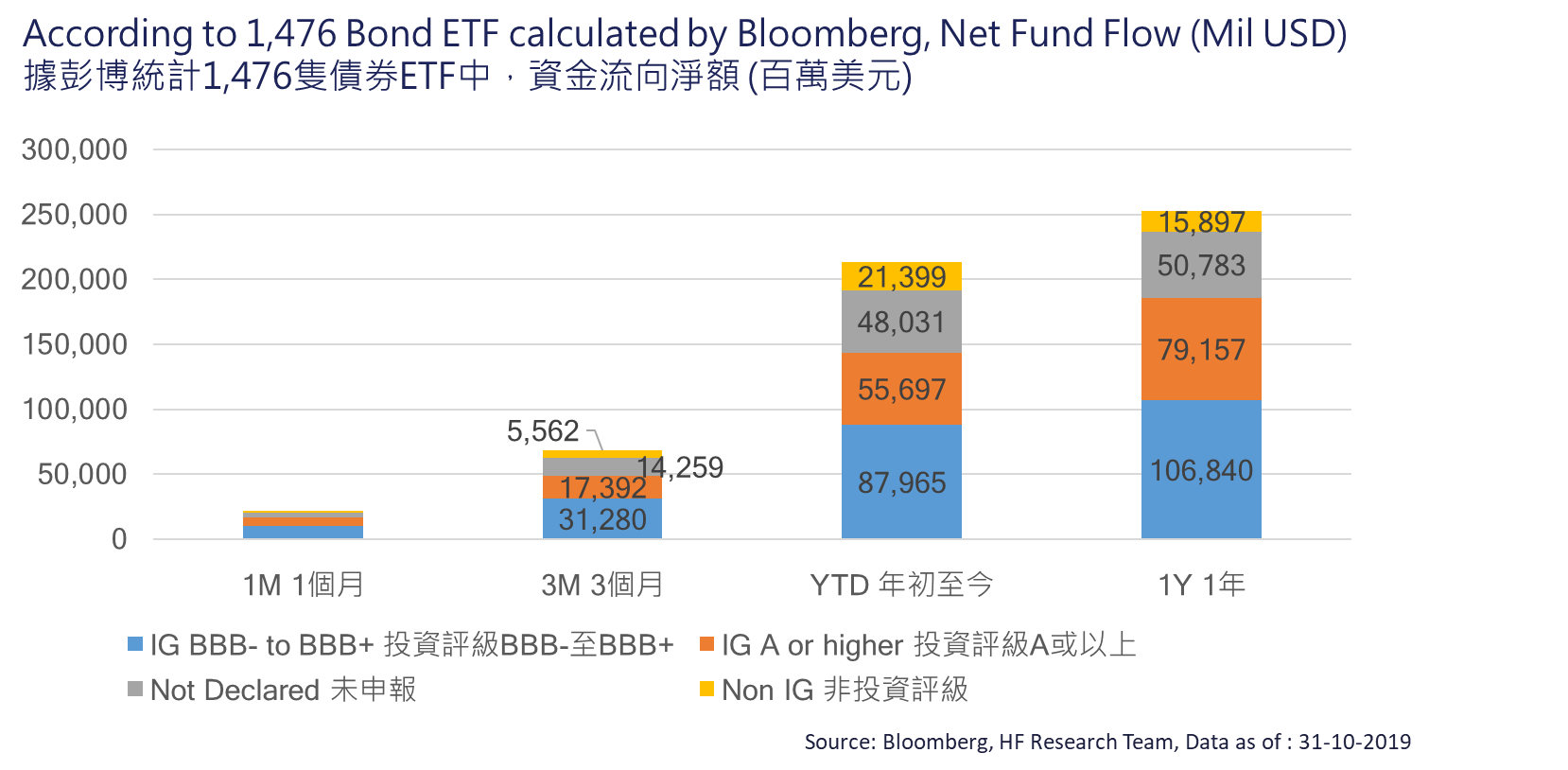

The Bloomberg Barclays Global Aggregate Bond Index rose 0.67%, while US Investment Grade, Emerging Markets US dollar Bonds, and US High-yield bonds rose 0.61%, 0.53%, and 0.81% respectively. Although global trade tensions continued to ease over the month, there is still net positive inflow into the fixed income markets, pushing bond prices up.

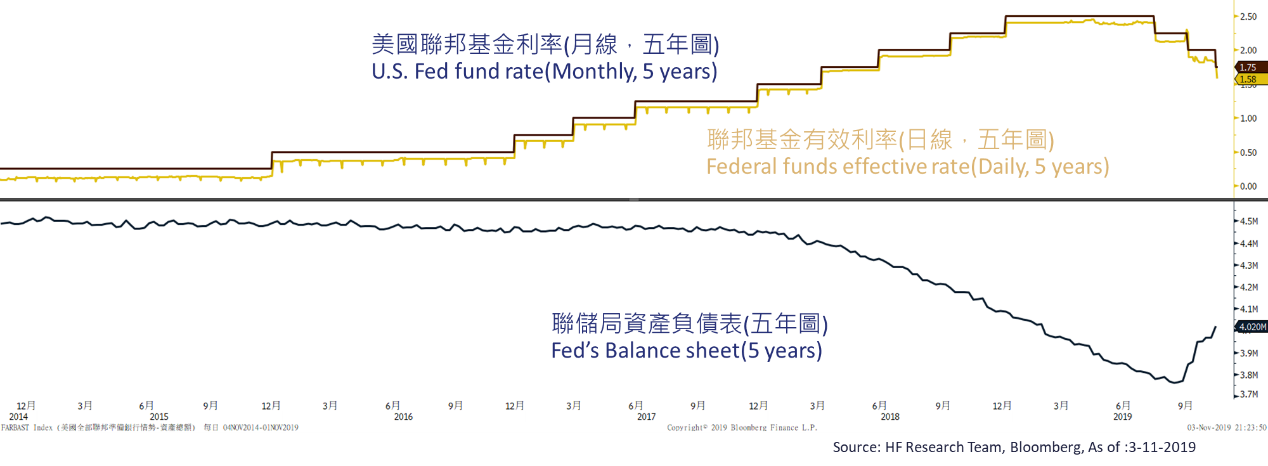

The Fed rate cut in October continue to drive the bond market movement. Right after the FOMC meeting and announcement, Fed Chair Powell’s address was surprisingly hawkish, as he claimed that the current interest rate is appropriate, mentioning reduction in external shocks (possibly referring to trade war and Brexit), and referred to economic indicators as acceptable. Given that the Fed describes the current economy as solid and rising in a strong pace, the market speculates that the October rate cut will be the last cut in year 2019.

Although interest rates are expected to hold constant for the remaining portion of the year, dovish policies could still provide additional support to the fixed income markets. Given that the latest round of quantitative easing policies, both the 20B EUR plan for ECB in Europe and the 60B USD plan for Fed in US, will at least continue until mid-2020, we still see upside potential in the fixed income markets. Heightened volatility and greater downside risk in the equity markets are still expected even though there are more positive news coming from Europe on Brexit and the trade war. With the continuing rate cuts across the globe, high quality debt continue to provide an opportunity to reduce volatility in the portfolio while enhancing the yield via interest income and capital appreciation.