The fixed income products started the New Year on a positive note. The Bloomberg Barclays Global Aggregate Bond Index was up 1.28%, US Investment Grade, Emerging Markets US dollar Bonds, and US High-yield bonds rose 2.34%, 1.54%, and 0.03% respectively.

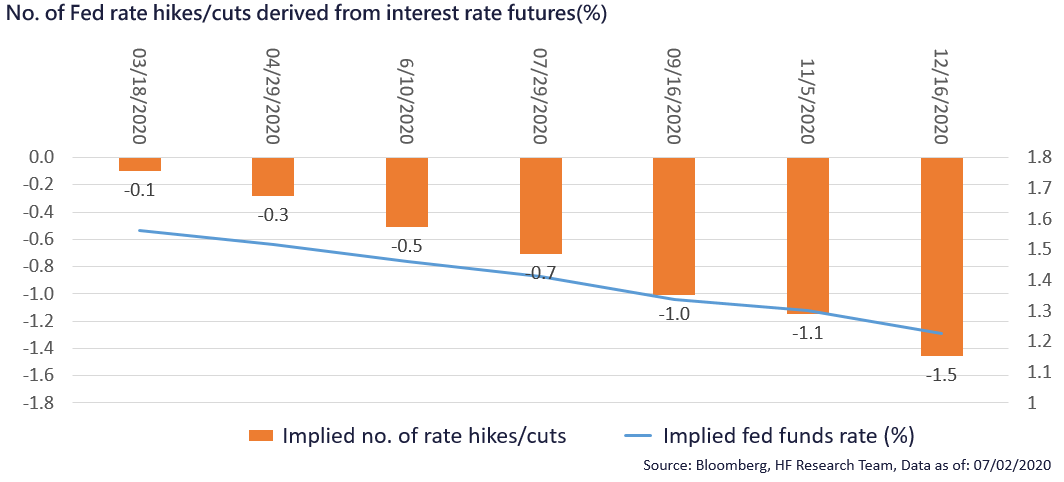

We retain our positive view on fixed income in 2020. Although central banks across the globe did not slash rates in the first rate decision of the year, this leaves ample headroom for future rate cuts later in the year. As always, the ongoing quantitative easing offers upside potential with downside protection. The latest fed meeting further confirmed that the QE programme will extend at least until April, which solidifies the short-term positive outlook for bonds.

We highlighted the volatility and downside risk for equity markets in 2020, which tensions in the Middle East, Brexit in Europe, impeachment in US, COVID-19 in China, and of course the unresolved trade war all contribute to the increasing risk profile of global equity markets. As the 2020 uncertainties remain, we continue to suggest allocating a portion of the investment in bonds to limit volatility and diversify risk in the portfolio, introducing bond exposure in the investment portfolio could provide a better risk adjusted return.