The fixed income products had mixed performance in November.

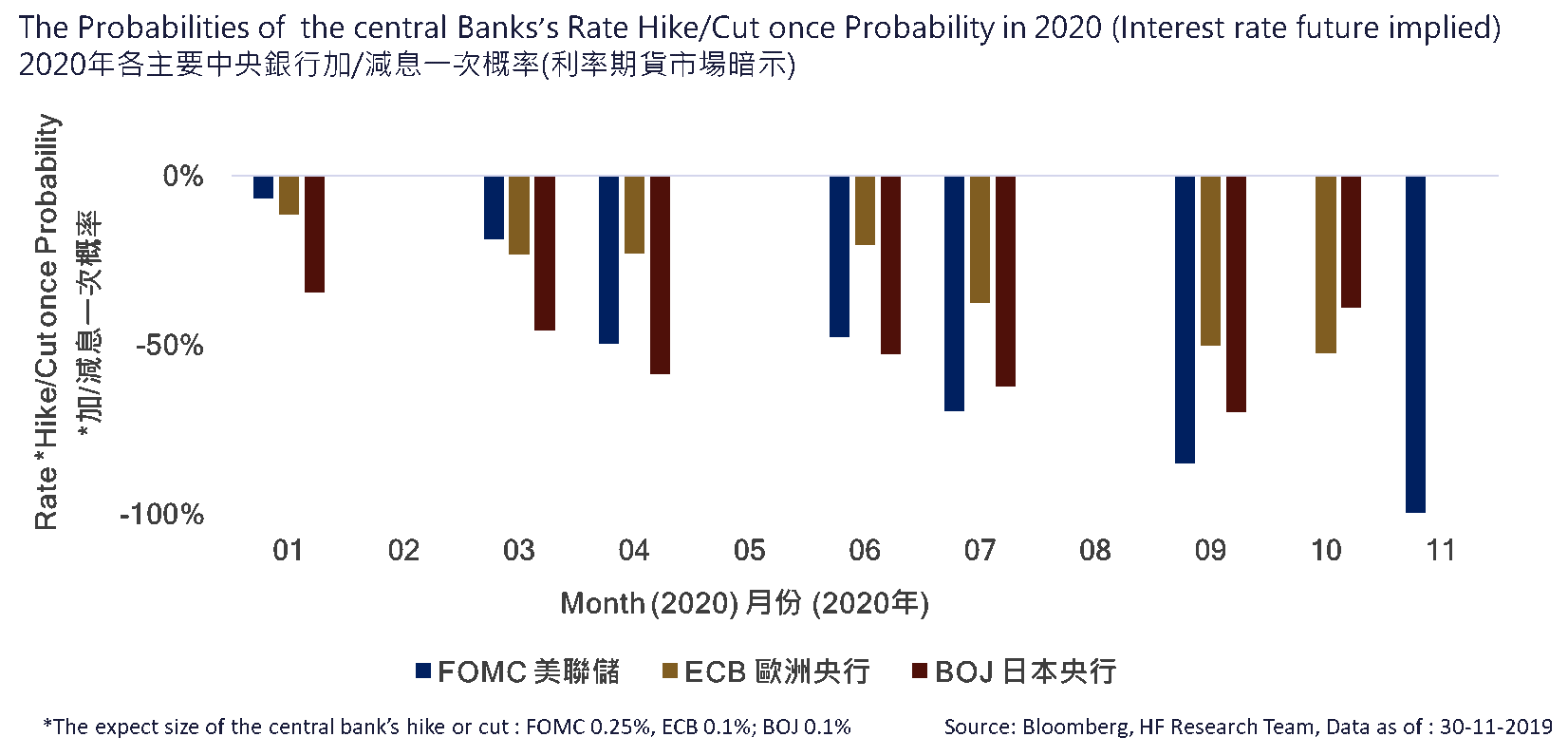

The Bloomberg Barclays Global Aggregate Bond Index fell 0.76%, while US Investment Grade, Emerging Markets US dollar, and US High-yield bond indexes rose 0.25%, 0.03%, and 0.33% respectively. As trade tensions continue to lighten over the month, capital returned to equity markets, bringing about the mixed performance. Although according to the recently published Fed Beige Book, the economy is still doing well, lowering the chances of further rate cuts in the short to mid-term, the ongoing quantitative easing in form of the Asset Purchasing Programme and balance sheet expansion should continue to provide support to bond prices.

Equity markets remain volatile and news sensitive. Although the US trade representatives on multiple occasions claimed that the first stage Sino-US trade deal will be signed before the end of the year, but there has been a lack of concrete evidence of that happening. Via the state media, the Chinese government has repeatedly requested for a complete uplift of existing tariffs as a prerequisite for signing the partial deal, which could prove to be an obstacle to signing off the trade deal in the short term. Thus, as we close in the end of the year, we expect that trading volume to thin out and volatility to increase. Taking high quality debt in the portfolio could reduce volatility while enhancing the yield. Investors who want to avoid the temporary market turbulence should consider increasing their bond exposure in their portfolio to improve their risk adjusted returns.