Global markets bounced back in the month of October, US equities rose in line. Market sentiment improved with positive corporate earnings, outweighing concerns over the economic slowdown, the NASDAQ, S&P 500, and Dow Jones rose 7.27%, 6.91%, and 5.84% respectively.

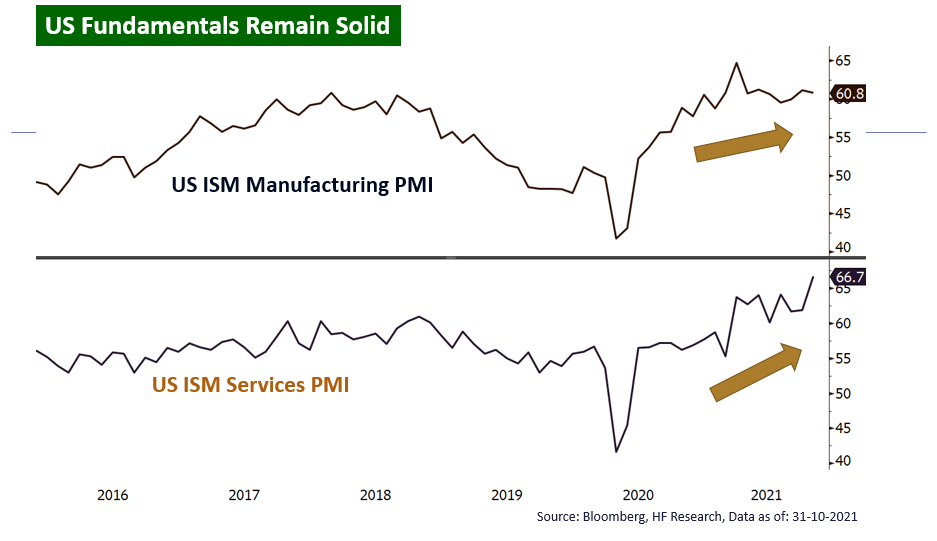

Fundamentals remained solid, most leading indicators including PMIs and employment figures came out positive. This is further supported by the strong corporate earnings, with a majority of reporting companies managed to beat market expectations. Overall, market outlook remains positive, while the biggest source of risk originates from extended periods of inflation. The global energy crisis continued throughout the month, pushing inflation higher, as reflected by the elevated US CPI, which has remained above 5% YoY for 4 consecutive months.

Partly as a response to the higher and more persistent inflation, US Fed President Jerome Powell announced the decision to taper bond purchases, by US$15 billion per month, marking a formal end to the COVID related monetary stimuli by mid-2022, and opening the path for future rate hikes. While there are no surprises in the policy, downside risks remain in form of supply chain disruptions, lingering inflation, and the impending debt ceiling. The reduction on liquidity could reduce the equity upside, but fundamentals remains solid, slowing monetary stimulus should be offset by materialising fiscal expenditure and strong consumption, we still see the US market to perform in line with the global market for the remaining portion of the year, with the room to edge higher.