Weekly Insight November 12

US

US

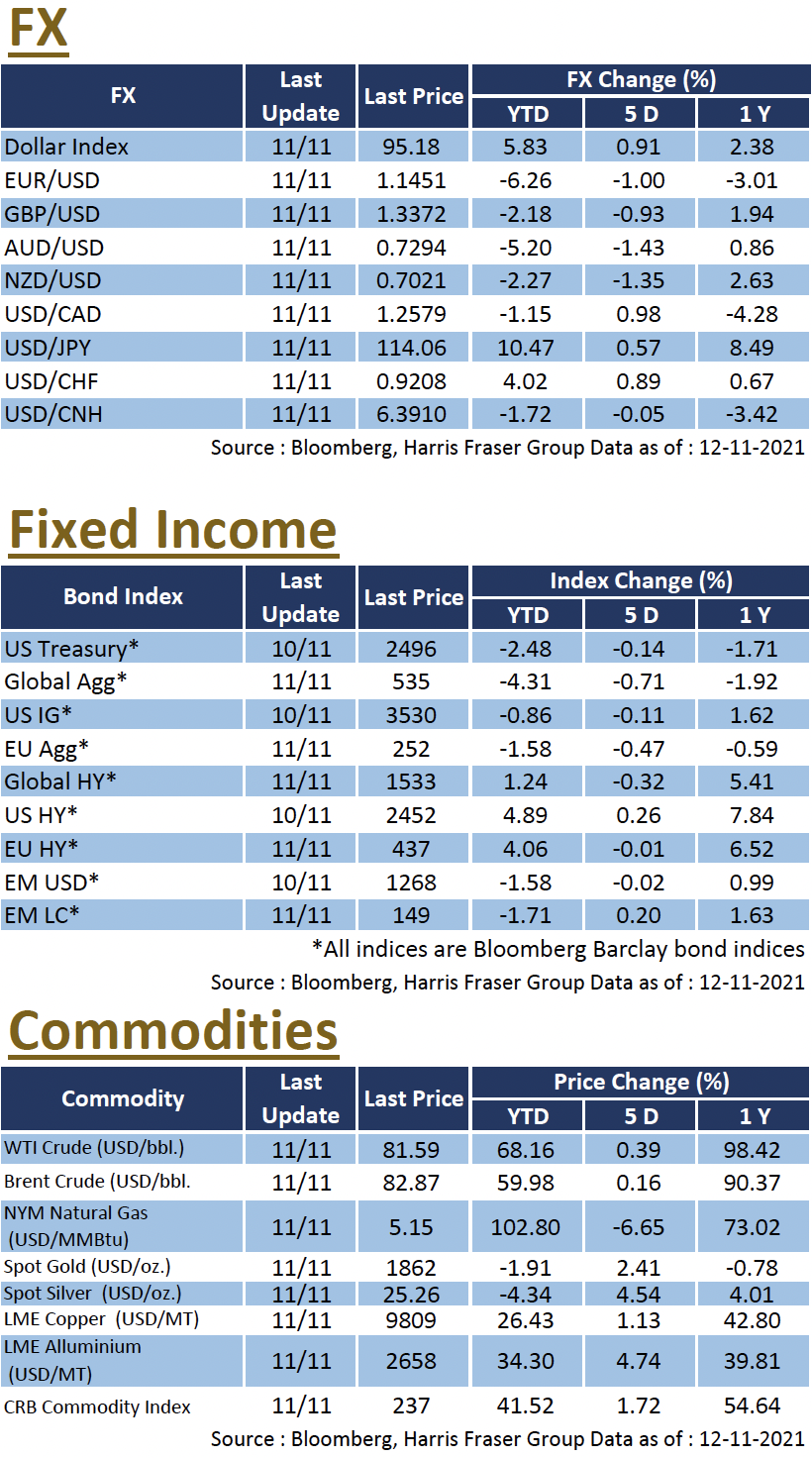

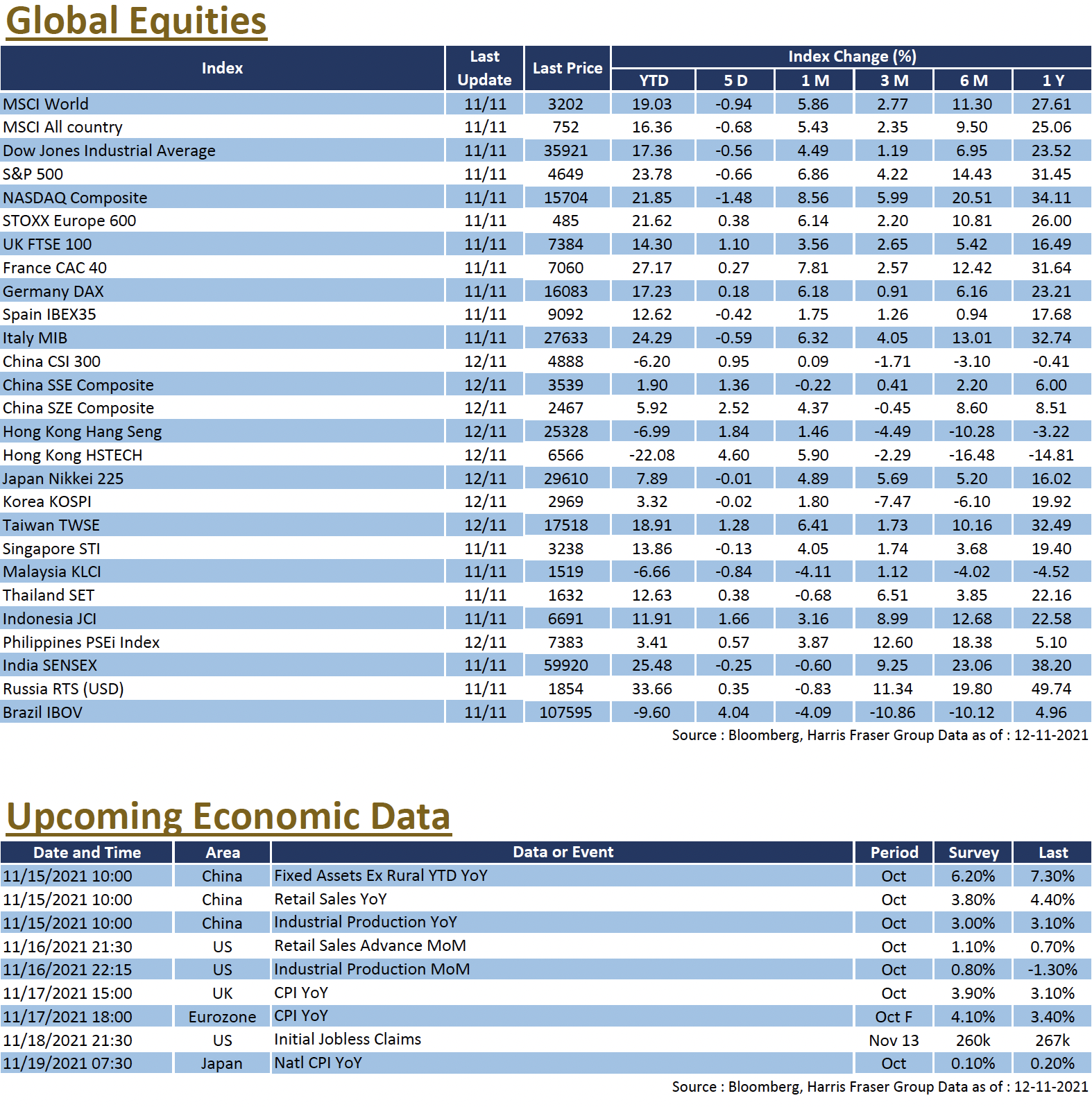

Inflation was more serious than expected, market sentiment was hit. Over the past 5 days ending Thursday, the Dow, S&P 500, and NASDAQ fell 0.56%, 0.66%, and 1.48% respectively. Inflation stayed as a forefront issue, as the latest CPI figure for October hit 6.2% YoY, which topped forecasts, and was the highest reading since November 1990. With inflation remaining at elevated levels, markets are pricing in the potential impacts. Treasury notes saw a larger selloff with shorter term treasury yields rising more, the 2Y treasury yield jumped from 0.42% to 0.51% on Wednesday, which was the largest single day gain since early 2020, narrowing the yields spread between the 2 and 10 year treasuries. Investors are also rebasing their inflation expectations, as the 5 year breakeven inflation rate hit 3.1%. Although Fed members have tried to delink tapering and rate hikes, citing that labour market conditions have not fully recovered as suggested by the miss in initial jobless claims, Bloomberg interest rate futures showed that markets are moving their rate hike expectations forward. At the time of writing, markets are currently pricing in an 82% chance of the first rate hike happening in June 2022. On other news, crude oil prices briefly rebounded, hitting the US$84 level during the week but retreated afterwards. Next week, the US will release several key data including retail sales and industrial production.

Europe

Europe

COVID have seemingly started its resurgence in Europe, investors are watching how the latest wave will unfold. Over the past 5 days ending Thursday, the UK, French, and German equity indices gained between 0.33% - 1.43%. ECB board member Frank Elderson reassured that the ECB have recognised the high level of near term inflation, and suggested that inflation expectations on the medium term have come closer to the Bank’s target of 2%, but refused to speculate on the fate of the PEPP once it expires in March 2022. COVID have returned in certain parts of Europe, Germany in particular hit a record number of daily cases this week, other less vaccinated European countries are also experiencing the same resurgence. Markets will be on the lookout for any policy tightening in response. For economic data, the German ZEW economic sentiment index surpassed market estimates by a fair margin, while the UK Q3 GDP of 1.3% QoQ was disappointing as it fell short of the market expectation of 1.5%. Next week, Europe will release its finalised CPI for October, while UK will release its CPI and retail sales figures.

China

China

Global inflationary pressures intensified as China's October PPI YoY rose at the fastest rate in 26 years, while CPI YoY also rose at the fastest rate since September 2020. A wave of selloff in China's real estate sector took place, even higher rated USD bonds such as Country Garden were hit. Foreign investors are worried about the risks, the US Federal Reserve issued warning about China's real estate sector, the Hong Kong Monetary Authority reportedly asked banks to report details on their exposures to the sectir, and Credit Suisse and UBS rumoured to have stopped accepting Chinese developers’ issued USD bonds as collateral for loans. However, later in the week, reports of a gradual loosening of the financing conditions for the real estate sector boosted sentiment, the debt-ridden Evergrande also managed to avoid default again and paid its outstanding interest before the end of the grace period, the market believes that the Chinese government would take concrete steps to help resolve the economic crisis caused by the rout in the property sector, lifting equity indices. The CSI 300 Index rose 0.95% over the week, while the Hang Seng Index also closed 1.84% higher. Next week, China will release data on retail sales, industrial production and fixed asset investment.