Weekly Insight December 10

US

US

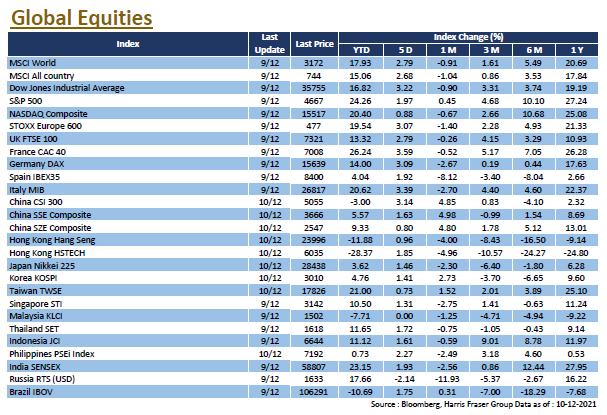

US stocks rebounded sharply as market sentiment was boosted by easing concerns over the Omicron variant, with the Dow, S&P 500 and NASDAQ rising between 0.88% and 3.22% over the past five days ending Thursday. Data showed that US online retail prices rose by 3.5% YoY in November, the highest since 2014. As for employment data, the initial jobless claims figure also fell to a 52-year low. US Commerce Secretary Gina Raimondo said that inflation would ease when the supply chain and labour market disruptions caused by the epidemic dissipate. That said, there are still concerns that the pandemic countermeasures could negatively impact the economic outlook, neutralising the positive impacts of the vaccine. Next week, US will release retail sales for November and the Markit US Manufacturing PMI for December, while the US Federal Reserve will hold its last interest rate meeting of the year, markets are focused on whether the Fed will accelerate the tapering of bond purchases.

Europe

Europe

As fears of the epidemic subside, European stocks rebounded in line with global markets, with the UK, French, and German indices gaining between 2.79% and 3.59% over the past five days ending Thursday. There are reports that the European Central Bank (ECB) is studying the possibility of changing its PEPP reinvestment to help its member states cope with the future circumstances. On the monetary policy front, ECB Executive Board member Isabel Schnabel said the bank should not change the sequence of monetary policy tightening, and must only raise interest rates after the end of bond purchase programmes. As for economic data, German exports improved, with a higher-than-expected 0.9% rise in seasonally adjusted exports, to 4.1% MoM in October, suggesting that Germany's recovery may be improving. Next week, the Bank of England and the ECB will hold their December interest rate meetings, while the UK will also release CPI data for November.

China

China

The market sentiment was boosted by the news of the RRR cut, with Hong Kong and China stocks rising in tandem, the HSI was up 0.96% and the CSI 300 was 3.14% higher for the week. The People's Bank of China (PBoC) announced a 0.5% RRR cut early in the week, which is expected to release about RMB1.2 trillion in long-term funds. Subsequently, PBoC also lowered the refinancing rate for agricultural and small loans by 0.25%. On the economic front, China's CPI rose by 2.3% YoY in November, a 15-month high, while foreign exchange reserves stood at US$3.2224 trillion at the end of November, up from US$3.2176 trillion in the previous month. Next week, China will release key data on fixed investment, retail sales and production in November.