Weekly Insight December 17

US

US

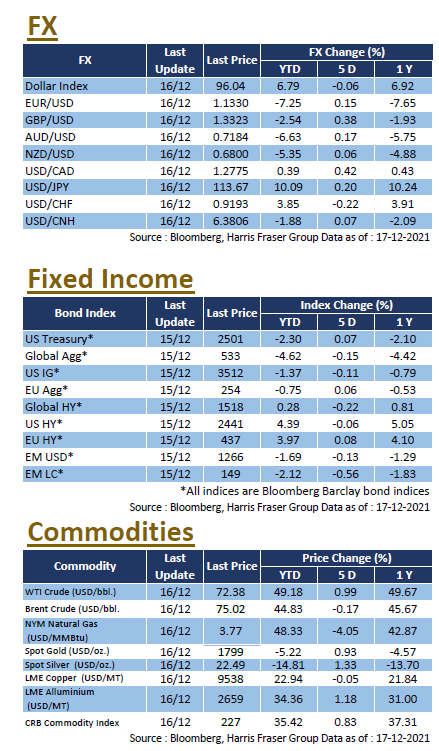

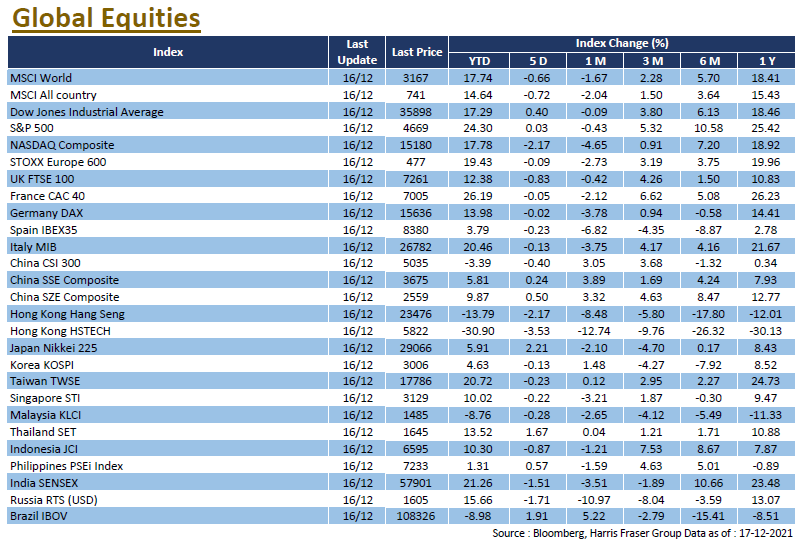

Short term volatility increased in the US equity market, as the Fed announced a ramp up in the pace of tapering. The S&P 500 and Dow saw little movement over the past 5 days ending Thursday, while the NASDAQ was down 2.17%. The US Federal Reserve announced a doubling of the tapering of bond purchases to US$30 billion per month after its interest rate meeting, and markets expect the programme to end in March next year. According to the Fed dot plot, officials are anticipating three interest rate hikes next year and three in the year after. Chairman Powell said he would not rule out raising interest rates before full employment is achieved.

The US Senate's latest bill to raise the debt ceiling by US$2.5 trillion has now been sent to the House of Representatives for voting. The Bill is expected to extend the US government's ability to raise debt until early 2023. The Omicron variant has emerged in 33 US states, with hospitalisations in New York State rising by 70% since Thanksgiving, raising concerns about the spread of the new variant. Next week, the US will release the Conference Board Consumer Confidence index and the University of Michigan Consumer Sentiment for December.

Europe

Europe

The European stock market saw little movement over the past five days ending Thursday, but the UK market was affected by the Bank of England's unexpected interest rate hike, sending the FTSE 100 index 0.43% lower over the same period. The Bank of England unexpectedly raised interest rates by 15 basis points to 0.25% after the interest rate meeting. The Bank stated that with inflation rising and likely to peak at around 6% by April next year, the Bank might need 'modest tightening’ down the road. The ECB kept its policy rate unchanged, and announced that it would temporarily increase the size of its regular bond-buying operations from the second quarter next year onwards, in order to hedge against the impact of the end of the Pandemic Emergency Purchase Programme (PEPP). ECB President Christine Lagarde said that the central bank will unlikely raise interest rates next year. Next week, Germany will release the GfK consumer confidence index for January.

China

China

Fears over the faster pace of global monetary policy tightening continued, with the Hang Seng Index under pressure, down 3.35% over the week, while the CSI 300 index was also 1.99% lower. The latest YTD growth rates for fixed investment, retail sales, and industrial production in China for November were 5.2%, 13.7% and 10.1% respectively, all lower than the previous month. The market will be on the lookout for more accommodative measures from the Chinese government to support the economy. On the other hand, the market is still watching the development of the property market, as both hare and bond prices of Chinese real estate companies have fallen amidst the resurgence of risks in the sector. Next week, China will announce the one year LPR rate.