Weekly Insight January 14

US

US

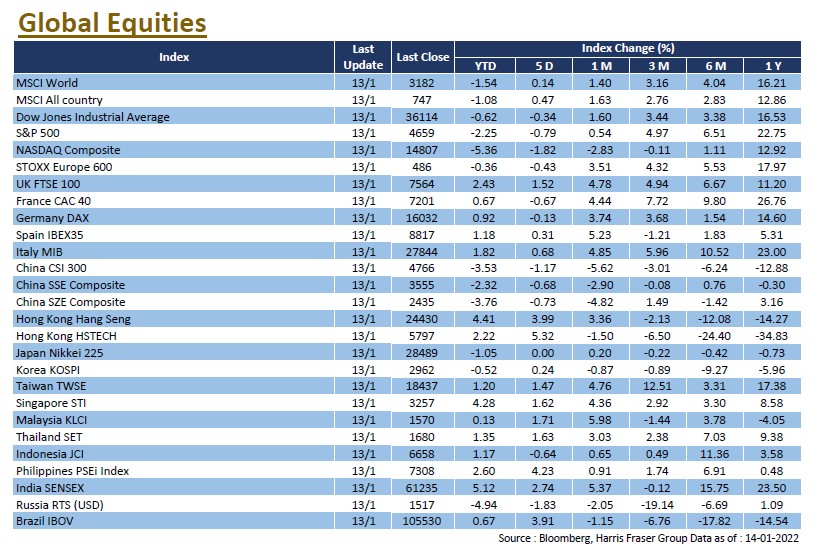

The US inflation rate hit a near 40-year high and the hawkish comments by Federal Reserve Chairman Jerome Powell have heightened market concerns about accelerating interest rate hikes. Uncertainty has weighed on US stocks, with the S&P and Dow down 0.79% and 0.34% respectively over the past five days ending Thursday. The US CPI rose 7% YoY in December last year, the highest jump in 39 years. This has increased market expectations for a rate hike in March, with the probability of a rate hike in March rising to 90%, according to Bloomberg interest rate futures data. Earlier, Chairman Powell said that in order to curb the worsening inflation, the Fed could raise interest rates more often if necessary, and that the tapering would be carried out faster and earlier than it did in previous cycles.

On the pandemic front, studies have shown that T-cells produced after a common cold can also fight off the coronavirus. Despite this, the spread of the new Omicron variant continues to accelerate. According to the World Health Organisation, half of the European population will be infected with the Omicron variant in the next few weeks. In the face of the rapid spread of the pandemic, the World Bank has lowered its global growth forecast for 2022 from 4.3% to 4.1%. Subsequently, the Managing Director of the International Monetary Fund (IMF) said that the world would face more uncertainty this year in light of the slowing recovery, inflation, and supply chain issues. Next week, all eyes will be on the Federal Reserve's interest rate meeting on 26 January and the latest developments of the global pandemic.

Europe

Europe

European equities had a mixed week, with the UK FTSE 100 index gaining 1.52% over the past five days ending Thursday, while Germany's DAX and France's CAC fell by 0.13% and 0.67% respectively. The Eurozone CPI rose 5% YoY in December last year, a record high since 1991. The market is concerned about inflation in the region, with Bundesbank President Joachim Nagel saying that the current inflation outlook is still highly uncertain, and that the central bank may need to adjust the monetary policy if inflation exceeds expectations. As for the policy rates, the ECB's chief economist said it was very unlikely that the bank would raise interest rates in 2022. Next week, the Eurozone will release its ZEW survey expectations for January, while the UK will release its CPI for December.

China

China

The A-share and Hong Kong stock markets moved in opposite directions this week, with the CSI 300 Index fell 1.98% over the week, while the Hang Seng Index rose 3.79%. Inflation data in China eased, with the PPI and CPI up by 10.3% and 1.5% YoY in December, down from 12.9% and 2.3% respectively. As for aggregate financing and new RMB loans in December, both recorded declines from the previous values to RMB2.37 trillion and RMB1.13 trillion respectively. RMB-denominated exports improved, the December figure rose 17.3% YoY, up from last month’s 16.6%. Next week, China will release GDP figures for both 2021 Q4 and the full year, as well as fixed investment, industrial production, and retail sales data.