Weekly Insight January 21

US

US

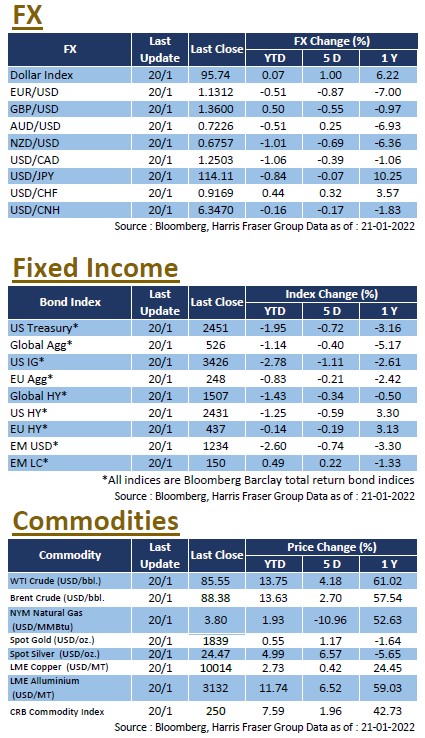

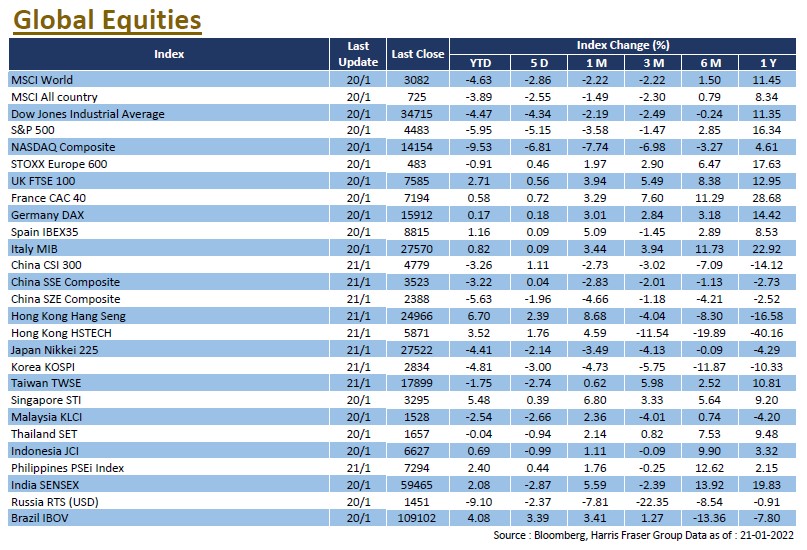

The market is worried that the Fed will take a more aggressive path in hiking interest rates, leading to worsening sentiment and a sharp fall in the US stock market. The Dow was down 4.34%, the S&P 500 5.15% lower and the NASDAQ fell 6.81% over the past five days ending Thursday. The NASDAQ in particular is down by almost 10% this year. Earlier, William Ackman, a famous US hedge fund founder, said that the Fed should raise interest rates by 50 basis points at the March meeting, market is worried about a faster rate hike, which also increased selling pressure in the market. According to Bloomberg interest rate futures, the odds of the Fed raising rates by 25 basis points in March this year have risen to 100%. Although the market is not expecting a 50 basis points hike, but it is still pushing its rate hike expectations gradually higher.

Another event in the spotlight is the US earnings season. Goldman Sachs reported a 13% drop in earnings last quarter, which was weaker than expected and weighed on the banking sector. Of the 61 reporting companies, 77% reported earnings beats. 73% of the 26 financials that reported earnings were better than expected, while all six reporting technology companies managed to beat earnings forecasts, though the most important technology giants such as FAAMG have yet to report their results. It is worth mentioning that crude oil prices surged to a seven-year high, with WTI futures reaching a high of US$87.91 per barrel, before retreating to around US$83. The Organization of the Petroleum Exporting Countries (OPEC) said it expects the global crude oil market to be supported by strong demand this year. Next week, the US will release its interest rate meeting statement in the early hours of 27 January, and markets will be focusing on tapering details. The US will also release its GDP for 2021 Q4 in the evening of the same day.

Europe

Europe

While US stocks fell sharply, European stocks were not significantly dragged down, perhaps reflecting the market's confidence in the ECB to maintain its accommodative policy. Over the past five days ending Thursday, UK equities rose by 0.56%, French by 0.72% and German by 0.18%. The ECB released the minutes of its December meeting, which showed that policymakers suggest that inflation in the Eurozone may easily remain above the bank's target, so the central bank should keep its options open. Central Bank President Christine Lagarde said that inflation was expected to fall this year and that there were reasons not to follow the Fed's swift and vigorous response. Next week, the Eurozone will release its manufacturing PMI for January.

China

China

Hong Kong stocks reversed last year's weakness as the Hang Seng Index continued to rebound this year, gaining 2.39% this week and up 6.7% YTD, which is among the best globally. China A-shares also performed well, with the CSI 300 Index gaining 1.11% over the week. In the face of economic pressure, the People's Bank of China (PBoC) lowered its LPR rate by 5 basis points for 5 years or above and by 10 basis points for the 1 year rates, which is the first in more than a year and half. The PBoC said that the economy is now under three-pronged pressure, and more policies supporting stable growth will be introduced before the downward pressure eases. Next week, China will announce industrial profits for December last year.