Weekly Insight January 3

United States

United States

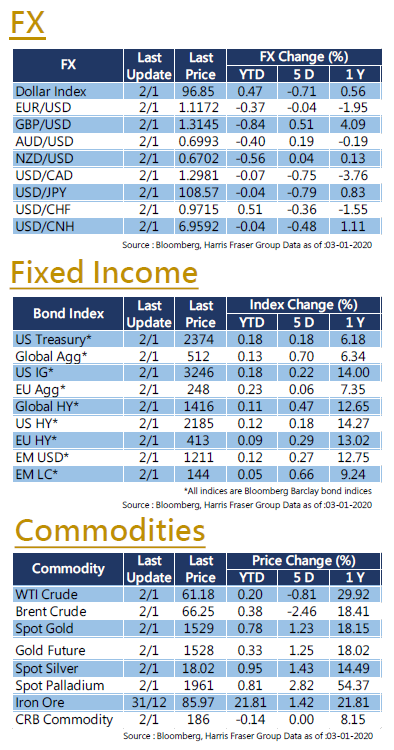

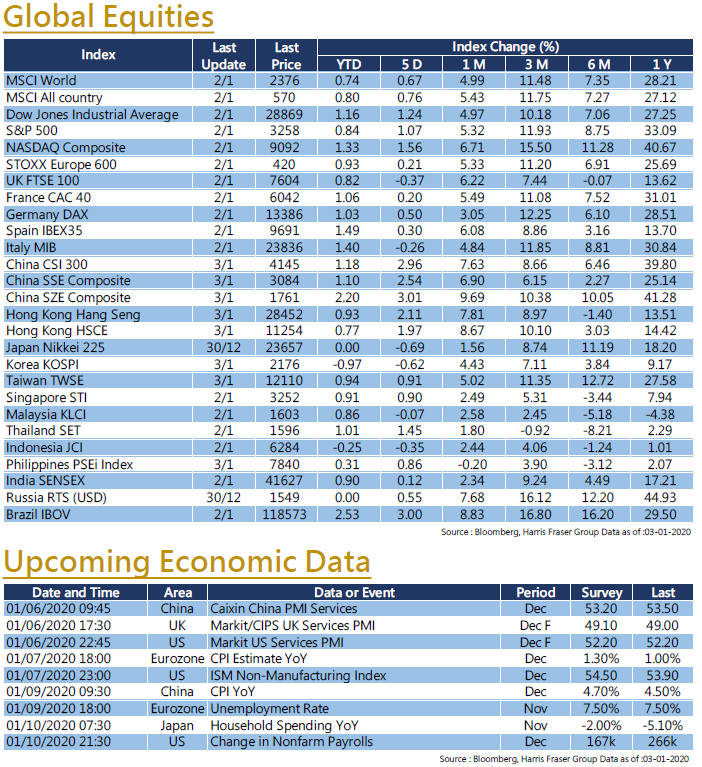

Looking back on 2019, almost all global stock market indexes have recorded gains. Among them, the U.S. equity market ranked nearly at the forefront, with the Dow Jones, S&P500 and the Nasdaq indices rising 22.34%, 28.88% and 35.23% respectively. Sino-US trade dispute is one of the important events of 2019. Entering 2020, trade issues are still expected to dominate the market performance. According to the latest news, the White House's trade adviser says the US-China Phase 1 trade deal would likely be signed in the next week. In terms of recent economic data, the Conference Board Consumer Confidence Index was 126.5, which was lower than the previous data and also the market's survey of 128.5. The Fed will announce the minutes of the December meeting this Friday night, and the market is concerned about the repurchase plan and its interest rate policy outlook. Next week, the United States will announce the December ISM non-manufacturing index and the employment data.

Europe

Europe

The performance of European stock markets was mid-range among the peers in 2019. The European STOXX600 index rose by 23.16%, and the UK, French and German stock markets rose by 16.65%, 26.37%, and 25.48%, respectively. In terms of recent economic data, the Eurozone Markit Manufacturing Index fell slightly from 45.9 to 46.3 in December, which is also the 11th consecutive month below the 50 level, with output and orders falling. As for the exchange rate of the British pound, it recorded the best performance in the past 10 years in the fourth quarter of last year, rising about 8%, the largest increase since 2009. The main reason is that after the latest election in Britain, the risk of a no-deal Brexit has dropped significantly. However, the market is still concerned about the transition period at the end of 2020. The Eurozone will release data on consumer prices and unemployment rate next week.

China

China

2019 is a year when the performance of China and Hong Kong stock markets is quite different. The Shanghai and Shenzhen 300 Index rose by 36.07%, while the Hang Seng Index rose by only 9.07%. The market generally interprets the Hong Kong stock market as having a large ratio of overseas allocations, so it is more vulnerable to the impact of Sino-US trade frictions. However, the latest news indicates that the Chinese Deputy Prime Minister will lead a delegation to visit the United States this Saturday, and the market is expected to sign a trade agreement. In addition, supported by news that the People's Bank of China has cut interest rates, China and Hong Kong stock markets rose sharply on the first trading day of 2020. Earlier, the People's Bank of China (PBOC) announced it will cut banks' reserve requirement ratio (RRR) by 50 basis points, effective Jan. 6, releasing about 800 billion yuan of liquidity into the financial system. The Mainland will release data such as the consumer price index and the service PMI next week.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”,“iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)