Weekly Insight February 28

United States

United States

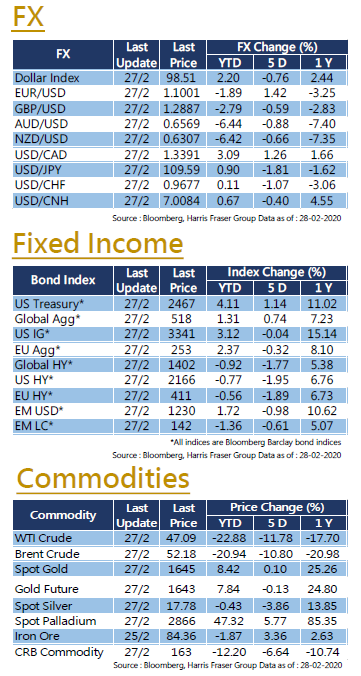

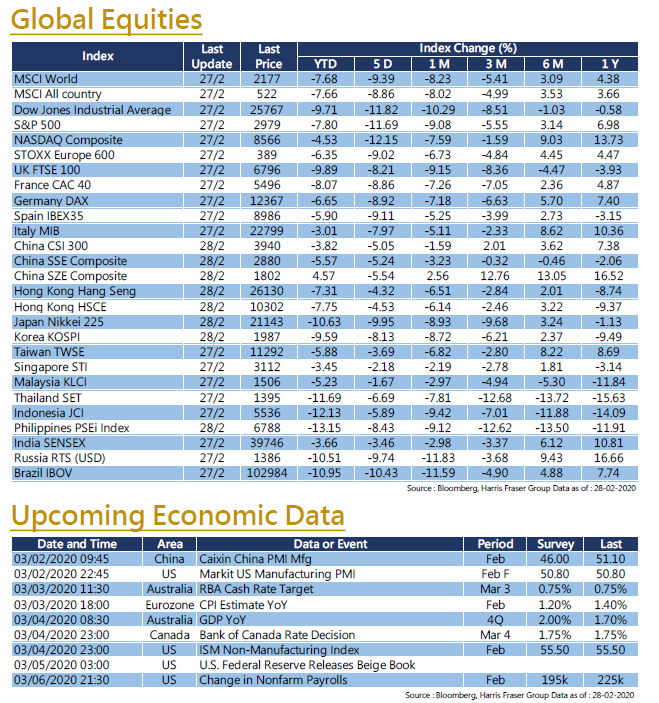

COVID-19 cases across the globe further increased over the week, with situations in South Korea, Japan, Italy, and Iran significantly worsening. In particular, South Korea reported more than 500 new cases on Friday, bringing the total confirmed cases up to 2,337, the largest number of cases outside China. Back in the US, the CDC reported a possible case of ‘community spread’ of the virus in home soil, spreading fear in the market throughout the week. Over the past 5 days ending Thursday, S&P 500, Dow Jones, and NASDAQ fell 11.69%, 11.82%, and 12.15% respectively, which was the worst 5-day-rolling-return since the Financial Crisis back in 2008. Economic data released this week were mixed. The important consumer confidence index came in at 130.7, missing market expectations of 132.0, but still managed to record a slight increase over the January figure. The final 2019 Q4 GDP came in line with expectations, and durable goods were better than expected. Overall, we have yet to see the actual impact of the virus on the real economy and the extent of supply chain disruption. In light of the uncertainty, investors could pay more attention to upcoming data hinting at the virus impacts. Next week, various PMI data, non-farm payrolls, unemployment, and hourly earnings data will be released.

Europe

Europe

The COVID-19 epidemic spread like wildfire across the globe, confirmed cases in Italy and Iran skyrocketed over the week, triggering panic selling in the market. The UK FTSE, French CAC, and German DAX fell 8.21%, 8.86%, and 8.92% over the past 5 days ending Thursday. However, ECB president Lagarde downplayed the economic impact of the COVID-19 epidemic, claiming that the long term impacts on the economy are yet to be seen. That said, confirmed cases in Italy has exceeded 600, neighboring countries of France and Germany warned their citizens of the potential outbreak, given the close ties between EU members. Economic data showed surprisingly strong numbers from the German IFO Business Climate Index and the Eurozone business and consumer survey, both topping market expectations despite the looming COVID-19 outbreak on the continent. Next week, more data on various PMIs, CPIs and retail sales will be released.

China

China

Risk off due to the global spread of COVID-19 epidemic eventually affected market sentiment in the China and Hong Kong stock markets. Over the week, the CSI 300 Index and the HSI fell 5.05% and 4.32% respectively. As the COVID-19 outbreak initially started in the region, the Chinese and Hong Kong stock markets fell first. Thus, during this downturn, the respective markets suffered less loss than global markets. However, the Shanghai Composite Index still fell below the 100-day and 200-day-moving-average this week. During the week, the net sell via Stock Connect set a record high, and the combined stock market turnover has exceeded one trillion yuan for eight consecutive trading days, matching the previous record in 2015. As China has started to resume economic activities, whether there will be any further large scale outbreak could be answered over the next two weeks, investors could closely monitor the relevant data in the weeks to come. As for Hong Kong stocks, as it is expected that the Chinese government will increase infrastructure spending to stimulate the economy, capital inflow to relevant sectors can be worth noting.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”,“iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)