Weekly Insight June 12

United States

United States

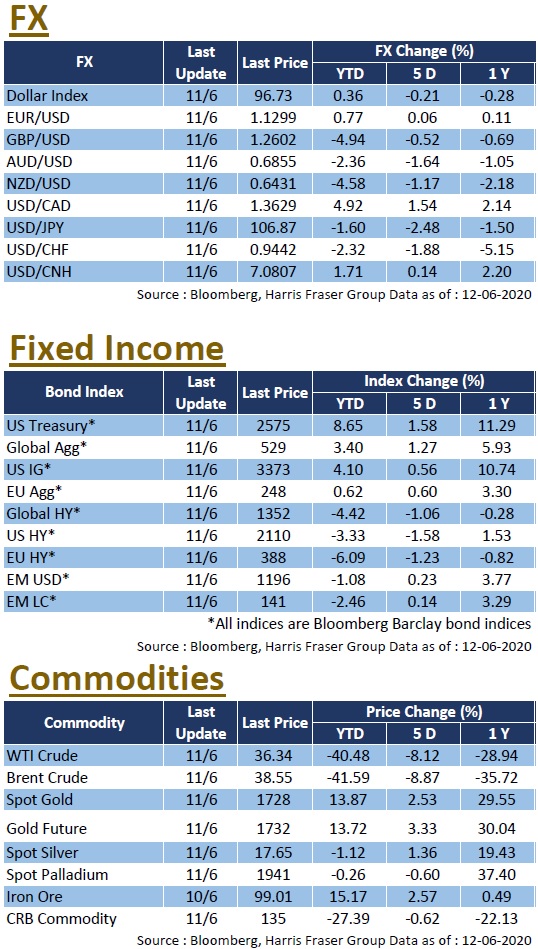

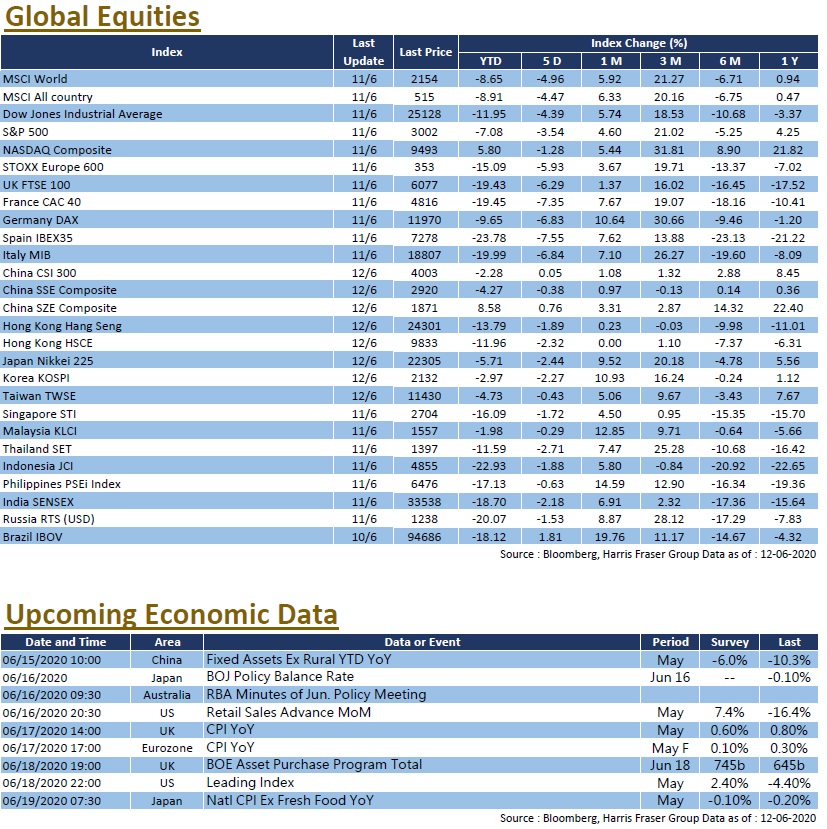

There are early signs of a second wave covid-19 infections across multiple geographies in the United States, raising market concerns over potential delays in restarting the economy, pushing the Dow down by 1861 points or nearly 7% on Thursday, while the S&P 500 and the NASDAQ also fell more than 5% that day. At the moment, the total covid-19 cases in the US exceeded 2 million, and we saw new cases accelerate, States like Florida saw new cases grow at a higher rate than the 7-day average. However, US Treasury Steven Mnuchin stated that even if there is a second wave outbreak, the United States can’t shut down the economy again. The uncertainty in the US economic outlook is reflected in the Fed’s statement this week, Fed Chairman Jerome Powell said the Fed will maintain near zero interest rates in the coming few years, while also maintaining the current rate of balance sheet expansion. The US non-farm payrolls data released earlier were encouraging, market expects the upcoming May retail sales data and the Conference Board Leading Economic Index will show a reverse to the April downtrend.

Europe

Europe

European stocks mirrored the global stock market's decline on Thursday, the UK, French, and German equity indexes fell 3.7% - 4.2% over the past 5 days ending Thursday. New information came in regarding the UK-EU trade agreement, British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen are expected to meet on 15th June, it was also reported that both sides will initiate a weekly trade deal negotiation, for a total of 5 times starting from late June. It was also rumoured that the extension of the Brexit transition period was officially taken off the table on Friday. Market expects both the UK and the EU to speed up post-Brexit trade negotiations in order to break the deadlock over the past few years. Next week, the United Kingdom will release the May CPI figures, and the Bank of England will also hold an interest rate meeting, market expects interest rates to remain unchanged, but an increase in the scale of asset purchase plans is likely.

China

China

The Chinese and Hong Kong stock markets had relatively stable performances this week. The CSI 300 Index slightly rose 0.5% over the week, while the Hang Seng Index fell 1.89%, outperforming their European and American counterparts. In terms of Sino-US trade relations, although both sides have yet to reach consensus on the issue, the first phase trade agreement is still observed, as China continued her purchase of soybeans from the United States. China's May export data was better than expected, falling only 3.3% YoY in US dollar terms, which was a notch higher than the market consensus of a 6.5% drop. Inflation data also showed benign development, the May CPI saw a 2.4% YoY increase, which was milder than both the expected 2.7% and the prior value of 3.3%. China will release May data on fixed investment, industrial production and retail sales next week, market expects most data to improve.

<Harris Fraser Research Team>