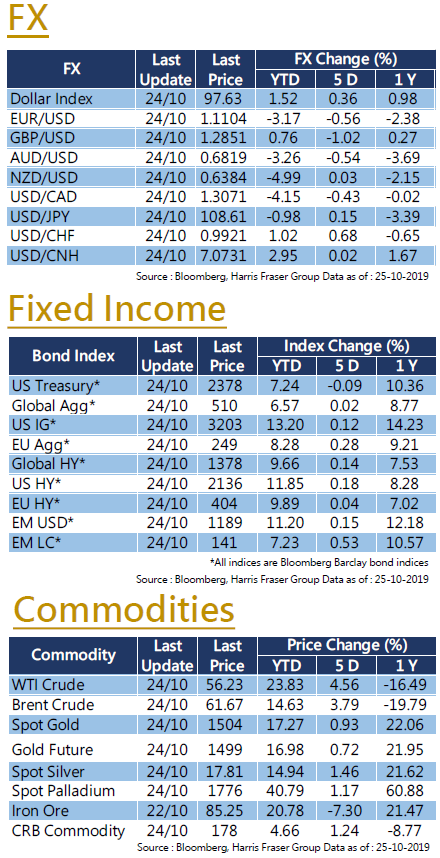

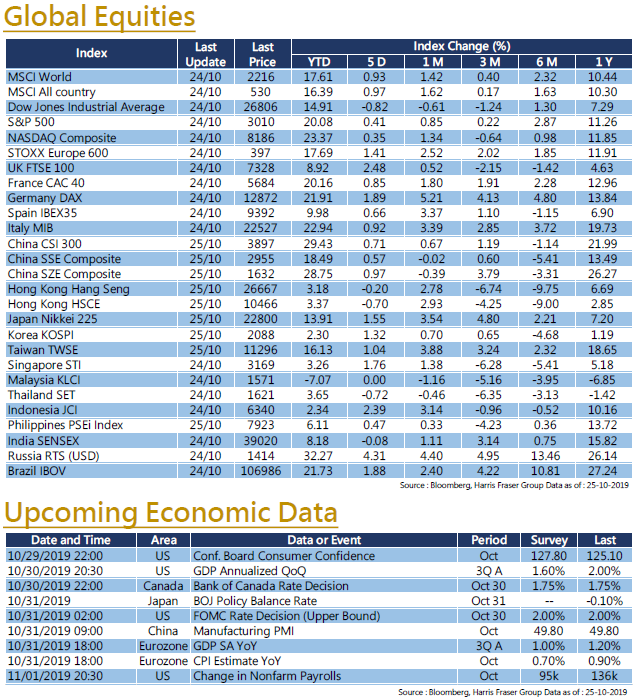

US

US stocks lagged behind global equities this week, the S&P 500 and NASDAQ were only up around 0.4% over the past 5 days ending Thursday, while the Dow recorded a 0.8% decline. US corporate earnings season continued, among the 192 index companies that have announced earnings, more than 80% companies posted positive earnings surprises, although the overall corporate earnings growth is down 0.4% year-on-year. This implies that although profits surpassed expectations, there is still non-existent growth. The market will focus on the upcoming “Super Data Week”: In addition to the preliminary Q3 GDP, non-farm payrolls, various PMI, and consumer confidence figures, the US Federal Reserve will announce the latest interest rate decision. According to the Bloomberg interest rate futures data, there is almost a 90% chance of a rate cut in October.

Europe

With declining chances of a “hard Brexit”, UK stocks rebounded for three consecutive days. Over the past 5 days ending Thursday, British stocks rose more than 2%, while the DAX also rose about 1.7%. Earlier, the House of Commons agreed to delay voting on Brexit arrangements, after which Prime Minister Boris Johnson’s second attempt on a Brexit agreement was voted down in the Commons. While sources reported that the EU will approve postponing the Brexit deadline, Johnson said that if Brexit is delayed until 31st January, the UK will hold a general election. On the monetary side, the European Central Bank maintained its monetary policy unchanged at this week's meeting. President Draghi painted a pessimistic outlook of the Eurozone economy. Claiming that the growth momentum of the Eurozone has weakened and the overall inflation remains sluggish, it is necessary to keep the monetary policy dovish for a longer period. After the ECB meeting, the Euro slightly weakened against the Dollar. Next week, the Eurozone Q3 GDP, CPI and unemployment figures will shed more light on the European economic health.

China

The market sentiment on the Sino-US trade negotiations has improved. Earlier in the week, US President Donald Trump expressed hopes of signing relevant agreements with China in November, the White House economic adviser Kudlow also pointed out that it is possible to cancel the scheduled tariff plans in December. Later, it was reported that China is willing to purchase US$20 billion of US agricultural products within one year after signing the partial agreement, and will consider increasing further purchases. As the easing trade tensions boosted market confidence, mainland stocks performed better this week. The official Chinese PMI and Caixin PMI data will be released next week.

- Recent activities include : Attended The Private Wealth Asia Forum, Harris Fraser Hong Kong Property Market Outlook andInvestment Strategy Seminar and Press Conference, Taiwan Immigration Seminar etc.

- Media include : SCMP、imoney、AAStocks、TVB、HKEJ、MingPao、HKET、Metro Broadcast、Commercial Radio Hong Kong etc (including but not limited to the above)

- Publishing on newspapers, magazines and online sections : “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos collaborated by Mason Securities limited and Harris Fraser Group.

Investment Research - Harris Fraser Group