Weekly Insight November 22

United States

United States

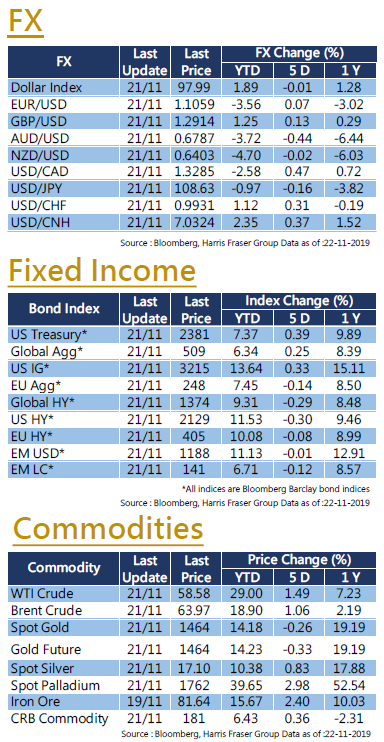

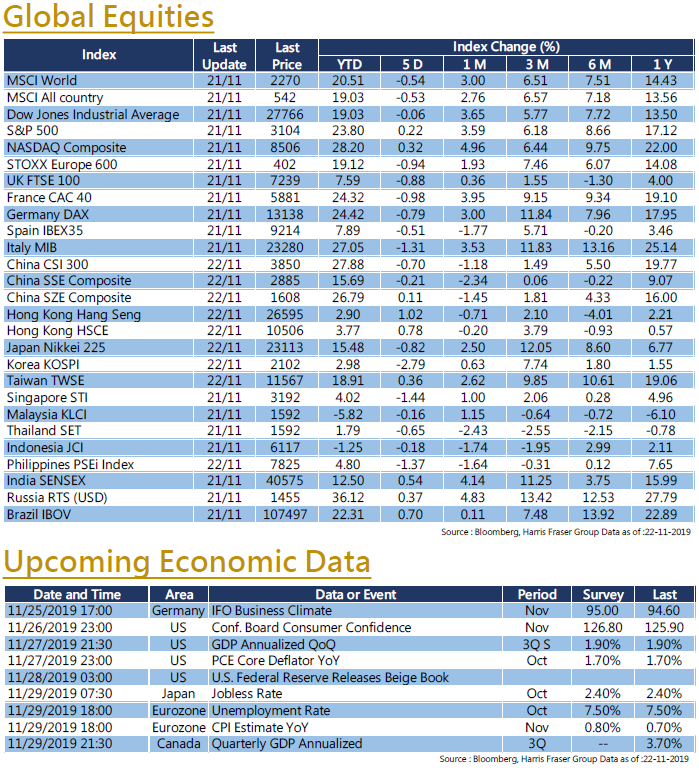

Despite the recent decline, US equities remained close to the all-time high. During the week, news on the Sino-US trade negotiation dominated the US stock market sentiment. Over the past 5 days ending Thursday, the S&P 500 and the NASDAQ rose around 0.2% to 0.3%, while the Dow fell slightly by 0.06%. It was reported that the Sino-US trade negotiations was on the verge of breaking in the middle of the week, sparking the largest single day fall for S&P 500 index over the month on Wednesday. US President Trump signed a four-week temporary spending bill to prevent a government shutdown once again, delaying it till December 20. On the monetary side, the US Federal Reserve just released the minutes of the meeting, which showed that the authorities believe that the economic outlook is at great risk. Later, Minneapolis Fed President Kashkari pointed out that he did not believe that a recession would occur, and he expected the economy to continue growing. According to Bloomberg interest rate futures data, the chance of an interest rate cut before the end of the year is zero. Next week, the US will release data on consumer confidence, core PCE and final GDP. In addition, the Fed will also announce the latest economic Beige Book.

Europe

Europe

European stocks underperformed global markets. . Over the past 5 days ending Thursday, the UK, French, and German stock markets all fell around 0.3% to 0.7%. For the ECB's policy, the bank's chief economist Lane claims that the Bank is yet to reach the end of the road. The general market also expects the central bank to have room to loosening monetary policies in the future. As for economic data, the Eurozone Consumer Confidence Index released this week was -7.2, which was a positive surprise over the -7.3 market expectation and an improvement over the -7.6 last month. There will be more unemployment and inflation data for the Eurozone next week.

China

China

The performance of the Hong Kong stock market this week was mixed, but the Hang Send Index still recorded a slight increase. Chinese and Hong Kong equity investors focused on the Sino-US trade negotiation development over the week. Although State Council Vice Premier Liu He expressed his cautiously optimistic attitude towards reaching the first phase of the trade agreement, the news indicated that the US has not accepted his invitation to China for further talks, market participants remained cautious as a result. However, it was also reported that if the two sides failed to reach an agreement, the United States might postpone the new tariffs scheduled for 15th December. As for economic policies, Premier Li Keqiang agreed that the Chinese economy is inevitably affected by the slowdown in global economic growth, but emphasised that the government will not deploy in strong stimulus. The market should continue focusing on government economic policy directions.

- Recent activities include : Attended iFAST’s annual symposium 2019 in Berlin Germany, visit Mason Privatbank Liechtenstein office in Liechtenstein, joined The Private Wealth Asia Forum in Hong Kong.

- Media include : SCMP、imoney、AAStocks、TVB、HKEJ、MingPao、HKET、Metro Broadcast、Commercial Radio Hong Kong etc (including but not limited to the above)

- Publishing on newspapers, magazines and online sections : “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos collaborated by Mason Securities limited and Harris Fraser Group.