Weekly Insight December 13

United States

United States

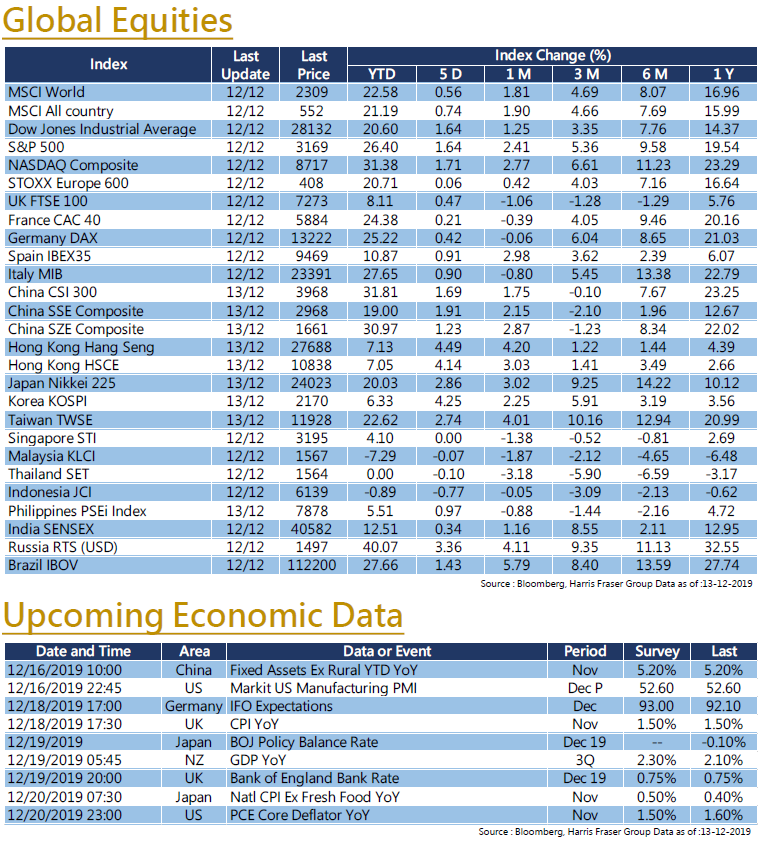

Driven by news that China and the US could possibly reach the first-phase trade agreement soon, the global stock market performed well over the week, US stocks continue to hit new historic highs. Over the past 5 days ending Thursday, the three major US stock indexes rose 1.2 - 1.7 %. According to the latest report, Trump has signed the phase one trade deal, avoidd applying the new 15 Dec tariffs on China, further boosting market sentiment. On the other hand, the Federal Reserve just held its last FOMC meeting this year and the interest rate was kept unchanged as expected. The Fed’s Dot Plot after the meeting also showed that members generally believed that the interest rate will be kept unchanged throughout. Fed Chairman Powell said that he is open to the idea of expanding the scope of Fed Balance Sheet expansion, but thinks that this is not the time. The market expects the current easing policy to continue into next year, which could further support equity markets. As for presidential impeachment, the Democratic Party announced two impeachment allegations against Trump, including abuse of power and obstruction of Congressional investigations. Key data to watch next week include core PCE figures.

Europe

Europe

European stock markets followed global equities and surged. The major stock markets in UK, France, and Germany rose by 1.3 - 1.9% over the past 5 days ending Thursday. The UK elections stayed under the spotlight. At the time of writing, 379 of the 650 seats were announced. The Conservative Party has the absolute upper hand and has secured 202 seats (48 net new gains). The main opposition in Labor only took 128 seats. The latest exit polls have predicted a Conservative victory with 368 out of 650 seats in the House of Commons won, which translates to a parliamentary majority. The other market focus was the first European Central Bank meeting after Lagarde took office, who was quoted saying that there is more ways of inflation measurement, and policymakers should consider a wider range of economic indicators. The market will continue to follow the latest developments in the European Central Bank's monetary policy.

China

China

The performance of China and Hong Kong stock markets this week were rather mixed. Hong Kong equities benefitted from external market conditions and rebounded, while the A-shares performance were muted. It was reported that Trump has approved the first phase trade agreement, coupled with the Central Economic Working Conference’s emphasis on steady growth, drove HK equities up sharply, and briefly challenged the 200-day moving average at the 27600 level. Apart from news of ratifying the agreement, there were also rumours that some US negotiators' proposed to reduce the existing US$ 360 billion tariffs on in Chinese goods by as much as 50%. The Central Economic Work Conference ended on Thursday, demanding improvement in quality and effectiveness in next year's fiscal policy, while the keeping flexibility and appropriateness in a stable monetary policy. The news raised market expectations for positive policy measures next year. Data on fixed investment, production and retail will be released next week.

- Recent activities include : Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019, Attended iFAST’s annual symposium 2019 in Berlin Germany

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”, “iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)