Emerging markets had a stellar performance in the month of November, as vaccine hopes drove anticipation of an earlier return to normal. Over the month, MSCI Emerging Markets Index rose 9.21%, FTSE ASEAN 40 even went up by an astonishing 19.26%.

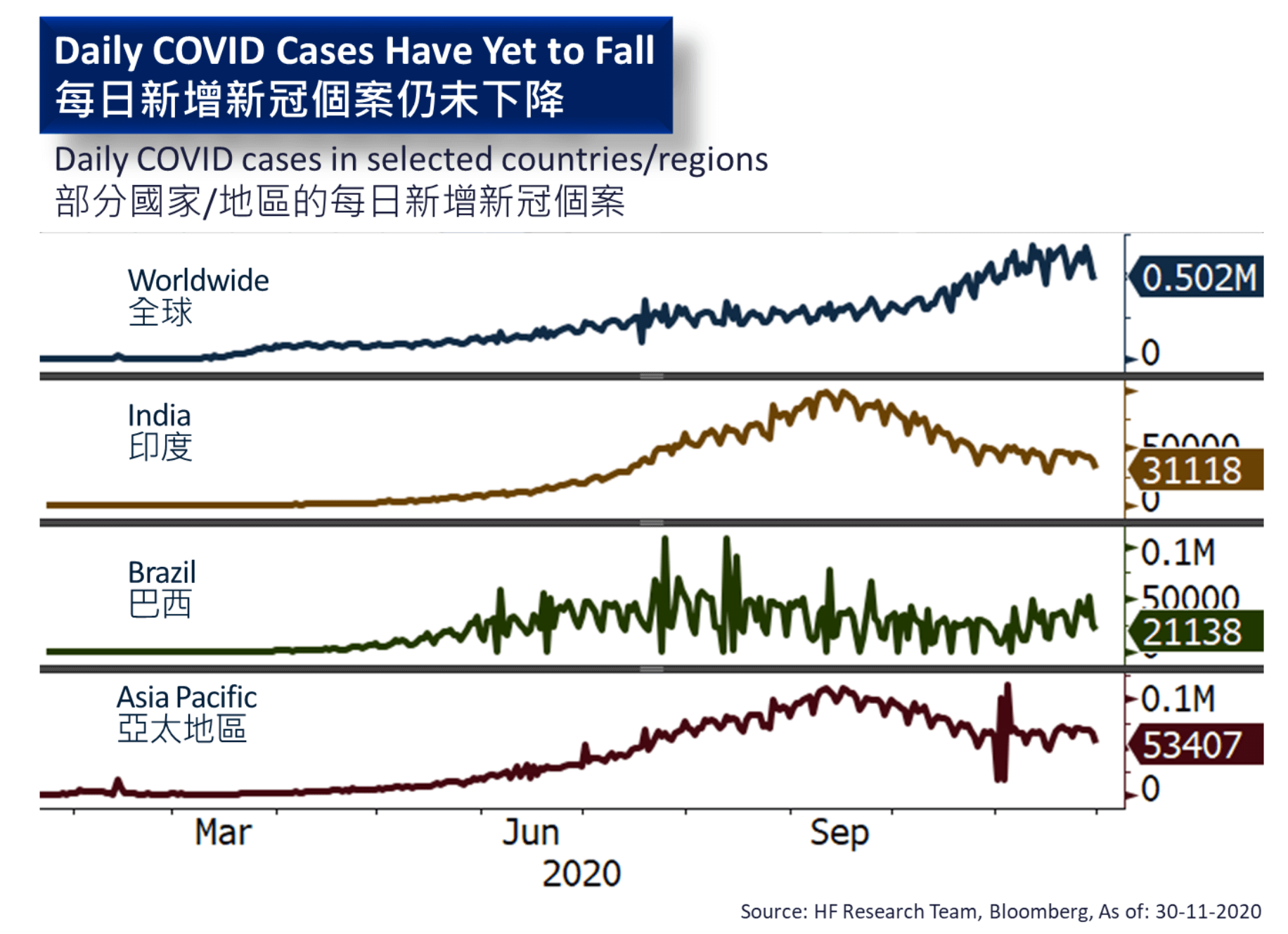

Although daily COVID cases in certain countries remain elevated, markets have already looked past the current situation and decided to price in a longer-term performance. In particular, some of the more prominent equity laggards such ASEAN markets, Russia, and Brazil saw double digit gains in the month. The gains were largely fuelled by the market’s shift to cyclicals and value stocks as optimism runs high, this is accompanied by the Biden victory in the US elections, hinting at policy direction reverting back to the pre-Trump era, which would likely favour emerging markets in terms of political risk.

With the economy entering a faster rebound starting from 2021 onwards, structural growth in EM should likely outpace developed markets. The recent fundamental economic indicators also reflect the recovery in emerging markets, as leading indicators remain in the expansionary zone. Although the market remains at risk of a short-term correction due to the rapid surge in the indexes, we should reasonably expect EM equities to perform in 2021 with the improved base scenario.