Continued headwinds are present in the Chinese market, market sentiment is still affected by the policy uncertainty. The market had limited reaction to the rise of the new variant, allowing the Shanghai Composite to record a gain of 0.47% (1.12% in US$ terms) over the month of November, the CSI 300 index lost 1.56% (0.93% in US$ terms), while the Hang Seng Index saw large losses of 7.49% (7.71% in US$ terms) dragged down by the Chinese tech giants.

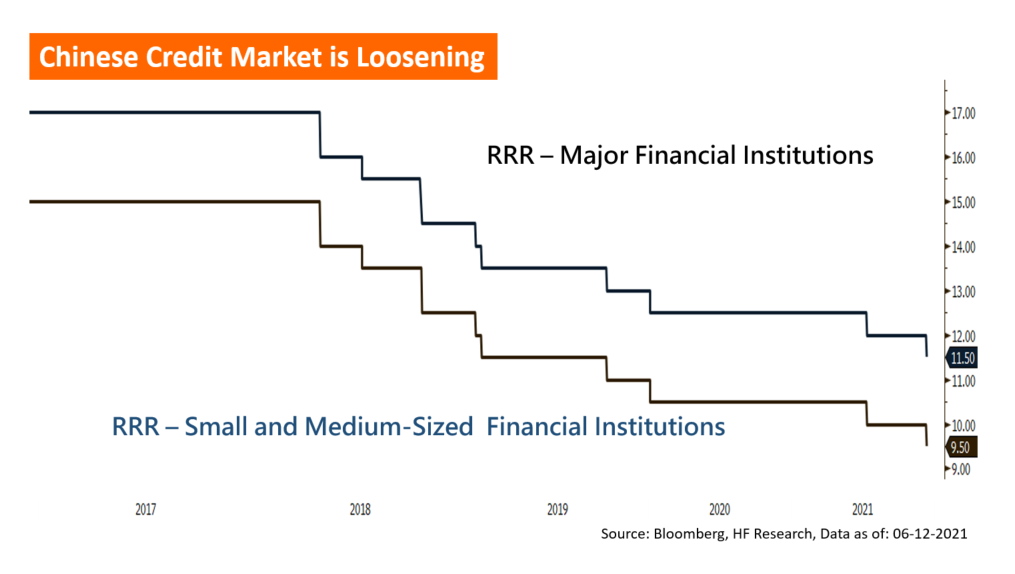

The Chinese economy has remained weaker, with the Caixin manufacturing PMI missing expectations and falling into the contraction zone. More importantly, policy uncertainty is still a wildcard for investors. The real estate market had borne the brunt of the regulatory action, with a continued stream of defaults in the market. Referencing the latest statements from relevant authorities, we expect incremental loosening in the credit market for the real estate sector, which could hopefully signal recovery for one of the most important pillars of economy in China.

On the other hand, tech giants in China continued to see regulatory upheaval surrounding the sector and the stock price suffered. Considering that previous regulatory cycles tend to be over in a year, markets are likely watching closely if this would be the case, as the cheaper valuation in the sector could be a market entry opportunity. Overall, the China market is blessed with its insulation from the global pandemic, with the normalisation of the monetary and fiscal landscape, we expect an orderly recovery in the Chinese economy, which should be positive for the equity market outlook in the New Year.